Part 3 in our series: How Investment Capital Can Enable Profitable Regenerative Agriculture

(This was originally published by RFSI News in June 2022 and updated May 25, 2023)

Regenerative food systems start with regenerative farms. Investment in farmland as an asset is one of the oldest types of agricultural investment, driven by strong underlying fundamentals, including consistent land appreciation, historically strong returns with an attractive risk return ratio, while serving as a hedge against inflation. However, investment without consideration of the long-term impacts of asset management practices, can lead to degraded land assets. Over decades, this has become the status quo and the ecological and financial externalities associated with industrial farm management practices have gone largely unaccounted for. The past 5-10 years, however, have brought a new set of strategies and farmland real asset investors leading the way to regenerative transition. These companies and funds are building farmland portfolios that restore and build soil health, while producing strong financial and ESG returns.

Farmland Investment Offers Strong Fundamentals

Retail and institutional equity investment in farmland began in the 1980s as result of increasing farmland values in the 1970s that piqued traditional investor interest. But the past 15 years, especially, have seen a significant increase in farmland investing among private equity investors and institutions driven by the recognition of strong fundamentals. These include:

Farmland is a stable value, appreciates over time:

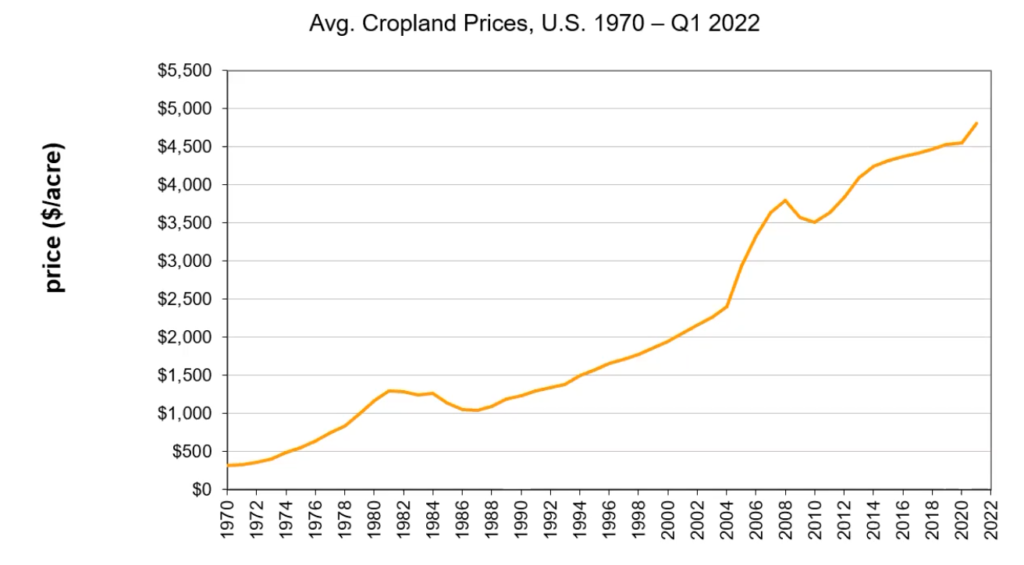

With the exception of only two events in the past 50 years (the farm crisis of the 1980s and the recession of the early 2000s) average farmland prices have continued to increase.

Historically strong returns and attractive risk return ratios:

Specifically, agricultural land, measured by the U.S.-only NCREIF Farmland Index, has outperformed both domestic stocks and bonds on an annualized basis over the last 48 years, providing both consistent income and capital appreciation. In addition, when measured on a risk-return basis, farmland compares favorably to other asset classes, demonstrating strong returns per unit of risk.

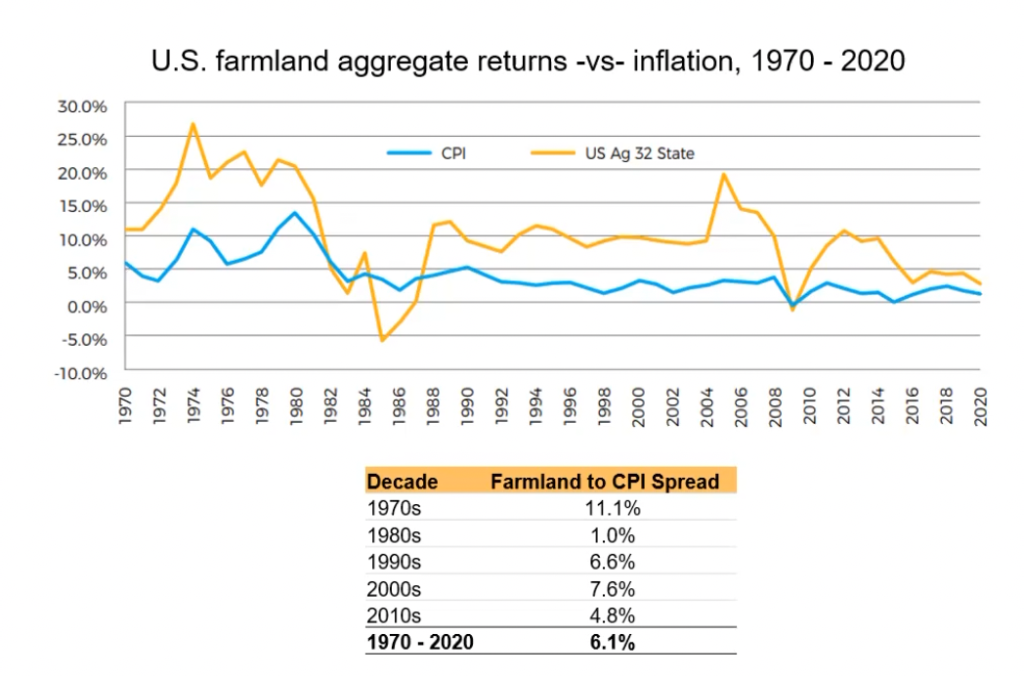

Farmland provides a hedge against inflation:

Food prices are closely linked to inflationary trends. Because of this, owners of farmland assets and those exposed to agricultural businesses are likely to have a hedge against inflation.

Risks of Conventional Farming

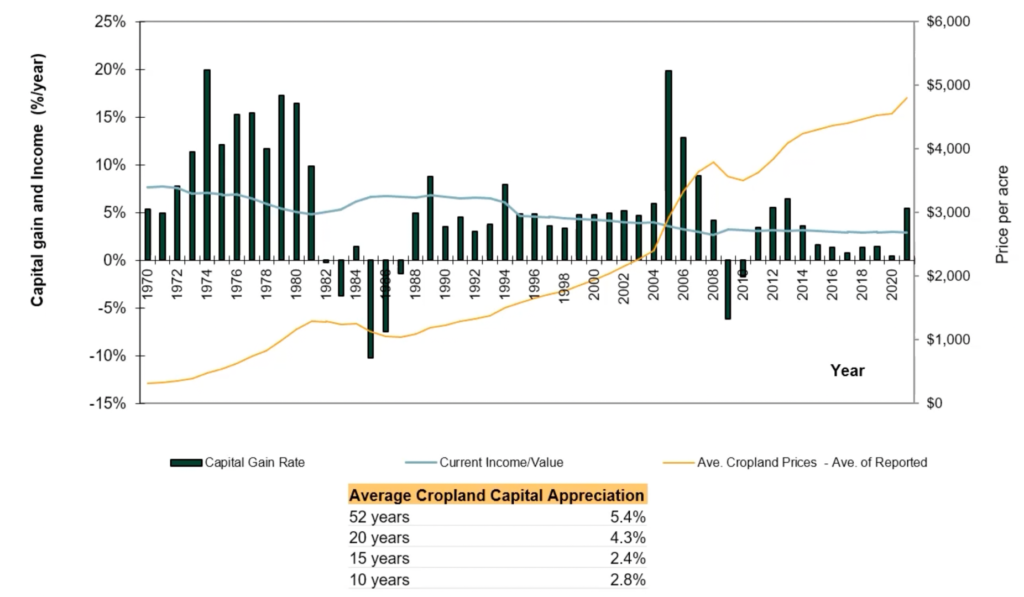

Returns from investment in farmland come from both capital appreciation and from current income from the farm, which according to John Evangelista of SLM Partners, in many ways serves to double the capital appreciation.

Investment in conventional or industrial farmland, however, comes with unique risks, primarily associated with the chemically intensive way farmland has been managed for the past 50+ years, which degrades the asset itself. These risks include the use of costly synthetic chemical inputs that can also kill valuable soil life and biodiversity as well as strip soils of their nutrients, which then can lead to increased wind and water erosion and declines in productivity. It can also lead to run-off that pollutes waterways. These in turn, perpetuate climate change and other environmental impacts. The on-farm impacts can lead to decreased productivity and profit for the operation, which negatively impacts farmer incomes and well-being, as well as harms rural communities. The off-farm impacts – which are often unaccounted for – can negatively impact larger ecosystems, wildlife, and human health.

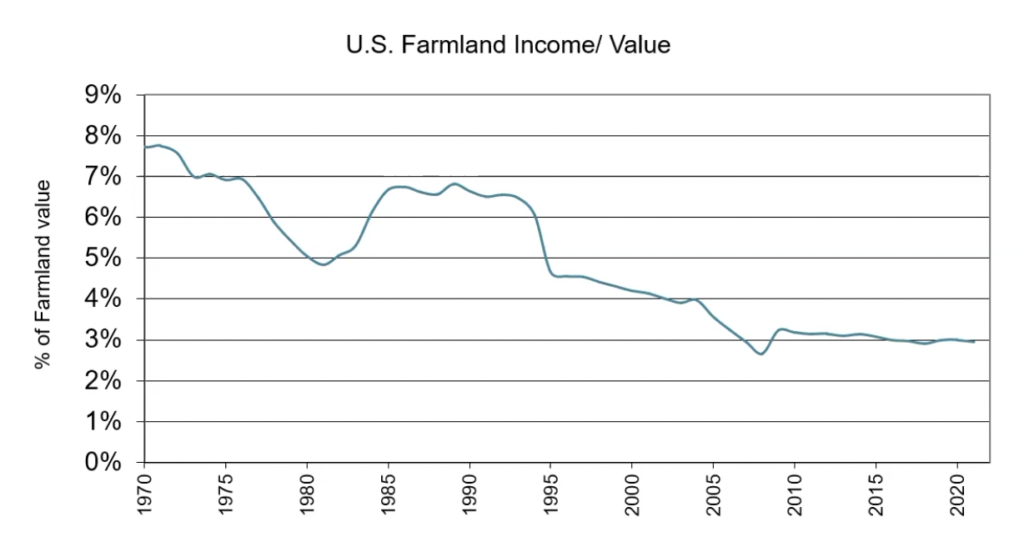

John Evangelista shared in a 2022 presentation with RFSI, while the blue line in the table above appears relatively stable, if you zoom in, it actually shows steady decline in U.S. farmland income over the past 50 years and in the past 3 years the income as a percentage of land value has settled at an average of 3%. This is financially suffocating farmers, making it more difficult for the average farmer to compete in the current economy, let alone invest back into their operation. As a result, in order to grow income, farmers need to either get larger so they can produce more, or find other ways to build more income on their existing farms. Transition to regenerative farming can offer solutions here.

Building Value in Your Asset Through Regeneration

The premise of this article and this entire content series is to explore how different types of investment can drive profitable regenerative farming and grow regenerative food systems. Private equity or real asset investment in regenerative farmland enables scaling of regenerative acreage faster than might be otherwise possible without larger scale capital investments. In return, investment in the systems of practice used in regenerative farming can drive current farm income and regenerate the asset to ensure longer-term value.

In part 1 of this series, Is Regenerative Agriculture Profitable?, we learned how regenerative production systems could lead to agronomic, environmental, consumer, and climate level benefits. We also learned that regenerative could lead to better profits than conventional systems, driven by opportunity to cut costs, access more premium pricing, and build systems resilience to weather and climate risks. In addition, there are increasing opportunities to generate income via carbon and ecosystems service payments to farmers.

The management practices employed in regenerative systems simultaneously work to improve the asset itself, making it more valuable. Further opportunities exist to improve asset through investments in infrastructure that help better manage the farm. Examples may include water rights or fencing that can increase the land value, while investing in processing infrastructure can improve asset value as well as help secure higher prices for farm outputs and reduce risks.

Addressing Barriers to Adoption Through Farmland Investment

Among the barriers to adoption of regenerative farming practices are:

- Access to land: Farmland is expensive to buy and short-term farmland leases (often less than three years) can significantly discourage farmer investment in the transition to organic or other practices that. The positive ecological and financial returns of these decisions are often times unrealized or insignificant until the end of the lease term when they were made.

- Financial risk (particularly during a transition period): As explained in part 1 of the series, the financial risks associated with transition is a big barrier to adoption of regenerative techniques. Even if regenerative can lead to better economic outcomes eventually, there is still initial risk during the process of the change, when transition costs are highest, and premiums are not yet attainable.

- Technical assistance: To make a wholesale shift in practices requires trusted technical assistance. Additional barriers exist associated with the challenges of changing entire systems that have sometimes been used for decades in any given operation.

- Regenerative supply chains and markets for products: If farmers don’t have processing infrastructure and markets to sell their regeneratively produced products then they will lose out on the financial benefits of price premiums.

Investing in regenerative farmland as an asset presents an opportunity to address some or all of these barriers by working to reduce risks associated with each. To explore how this can be done, we’ll take a look at some of the existing farmland investment vehicles that exist today.

Who’s doing it and how?

In 2020, the Soil Wealth Report identified 70 investable strategies that included regenerative agriculture features, worth $47.5 billion. Of this $22.8 billion, or 48% of that total, were invested into farmland/real assets. Today, less than three years later, there are even more farmland/real asset vehicles that focus on organic or regenerative farmland investment. Newer funds like Clear Frontier and Biome Capital have joined pioneers of the space like SLM Partners and Farmland LP.

SLM Partners

SLM Partners is one of the oldest asset management companies working to fund ecological and regenerative farming and forestry. The company was established in 2009 and now has strategies on three continents: grass-fed beef in Australia, forestry and orchards in Europe, and organic grains in the US Eastern Cornbelt. They are also working on an organic and regenerative irrigated specialty crop strategy in the US West.

Their US organic grain strategy started in 2019 when SLM received investment from an impact-focused family office to prove out a strategy and later raised more capital from institutional investors to expand the strategy and acreage to about 3,800 acres in Illinois and Ohio. They use a buy and lease program, where they purchase the farmland and lease it back to an experienced organic grain farmers on a 10-year lease, with the option to extend to another 10 years. Through this strategy, SLM is able to expand organic and regenerative acreage and improve farmer livelihoods by enabling producers to manage more land and increase their income. To address financial risk of transitioning the land, SLM charges below market-rate rent during transition and aligns rent payments with cash flow. Technical assistance is less of a barrier in this model because the company partners with experienced organic farmers, but should assistance be needed, SLM offers organic farming mentors.

Farmland LP

As the largest asset manager converting conventional farmland to sustainable and organic production in the U.S., Farmland LP works to address the large gap between demand for sustainably produced food and the amount produced in the U.S. Also founded in 2009, Farmland LP buys conventional farmland and builds value in the asset by converting it to more complex biologically managed system. The company operates an owner operator strategy where they buy the farmland and operate it themselves. They currently manage more than 15,000 acres in Northern California, Oregon, and Washington, and more than $200 million in assets through two funds, Farmland LP Fund I and Fund II – Vital Farmland REIT, which closed earlier this year. The investor base for these funds include institutional investors and their consultants, family offices, clients from numerous wealth management advisory firms, and accredited individual investors.

The Farmland LP strategy looks for “U.S. farmland regions poised for long-term appreciation, with strong demand for locally grown, organic food, robust existing farming communities, and favorable long-term climate projections.” They also look for farmland that may benefit from infrastructure and technology improvements as another means to build value in the asset. At present, they have acreage in a diverse range or permanent, perennial and annual crops across their three geographies.

Agriculture Capital

Agriculture Capital currently manages two funds that invest in regenerative farm and downstream businesses as real assets. What sets this firm’s strategy apart from others already described is the focus on investing in “permanent cropland and synergistic midstream assets to create a vertically integrated enterprise that grows, packs and markets high-value produce.” The firm uses an owner operator model, buying farms and adding value through regenerative farm practices and the processing and sale of the farm products as a means of enhancing returns. Agriculture Capital currently operates 20,000 acres across farms in the California, Oregon, Washington, and Australia but also operates marketing, packing and nursery companies in these regions. The vertical integration strategy creates transparent supply systems from plant to distribution, adding value to the assets and reducing risk.

Other Fund Structures

In addition to these examples, many other opportunities for investment in regenerative farmland as a real asset exist.

Similar to SLM Partners, Clear Frontier operates a buy and lease strategy, purchasing conventional farmland and leasing it back to farmers who want to transition acreage to organic. Justin Bunch, CEO of Clear Frontier explains, “We are providing them an opportunity to be able to grow their business locally, supporting both the local farm communities as well as supporting the supply of a healthier food, all while improving the environment.” The company currently owns more than 3,000 acres across six grain farms in Nebraska and Colorado.

Biome Capital Partners brings a unique approach to farmland investment and a team with decades of diverse experience as one of the newest players in the regenerative farmland investment space. Their strategy centers around “investing simultaneously in land, farmers, infrastructure, technology and distribution in a regionally coordinated approach to maximally realize the full value of needed change.”

Fintech Meets Farmland

In recent years fintech has entered the farmland investing space, with several new companies creating platforms that democratize the farmland opportunity for retail investors. These platforms allow access to the same types of benefits from farmland investment but remove the barriers of potentially high entry fees and the necessity to understand farming. AcreTrader is one of these platforms and has closed more than 50 deals representing more than $100 million in assets. While not touting investment in regenerative farmland, Certified Organic operations have represented as much as 25% of the farms on its platform. FarmTogether is another leading online investment platform for investment in farmland as an asset. All the acreage on their platform is enrolled in the Leading Harvest Sustainability Standard, which requires farmland meet 12 sustainability principles. These online platforms could be a game-changer for the expansion of regenerative farming because it can unlock investment capital not previously available to to the farmland asset class. The trick will be driving assets to the platform with operations that are regenerative or seeking to transition.

Other Innovative Approaches

Farm is a new financing vehicle that leverages its own curated investor list to provide interest-free funding for land stewards seeking to expand their operation or land base. The platform offers up-front capital and in exchange receives a revenue share and/or a portion of land ownership for an agreed period of time. The land steward can buy out Farm’s shares at any point. At present Farm focuses on farmers and ranchers in Colorado, Nebraska, Oklahoma, Kansas, South Dakota, North Dakota, Texas, Wyoming.

Agrarian Land Trust is working to reimagine farmland ownership to be “Nationally supported, community-held land and agrarian property that supports sustainable food production, ecological stewardship, community vitality, and equitable land access for the next generation of farmers and ranchers.” As a single national 501(c)(3) land trust with multiple local 501(c)(2) community land commons across the United States, Agrarian Trust partners with local and regional entities to raise funds to purchase land that they can then put into a commons structure of ownership. A recent press release for their most recent funding drive explained, “The Agrarian Commons model addresses two of the primary obstacles for contemporary farmers: the high cost of land and high debt burden of modern agriculture. With 400 million acres of farmland currently changing hands, now is the time for transformation in how land is owned, accessed, valued, and tended.”

Where do we go next?

To meet climate goals and increasing demand for climate-friendly foods, millions of more acres of farmland (worth billions of dollars) will need to be converted to regenerative practices. The investment vehicles already participating in the regenerative investing space have continued to evolve their investment strategies to address the barriers to the expansion of regenerative agriculture. New players and traditional farmland investors will have to devote more of their portfolios to regenerative and organic management to meet the enormous shortfall of regenerative farmland that currently exists. The farm gates of opportunity have been thrown open, and time will tell if investors and the vehicles they use to activate capital can continue to rise to the occasion.

—

This is part of a larger content series called “How Investment Capital Can Enable Profitable Regenerative Agriculture,” that explores the role of different types of capital in scaling regenerative outcomes and systems.

Read Part 1: Is Regenerative Agriculture Profitable?

Read Part 2: The Role of Debt Financing in Fueling Regeneration

Read Part 4: Venture Capital’s Emerging Role in Driving Regeneration

—

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.