With a sold-out crowd of more than 500 attendees, the 2024 RFSI Forum kicked off last week in Denver, Colorado. The program was packed with sessions to take attendees on a learning journey about the critical role of capital in building regenerative agriculture and food systems. From where we are today, to the investment tools we have at our disposal, to where we want to be – with greater market maturity and increased acreage, capital and impact for regenerative – the program was packed with insights as diverse as the stakeholders in the room.

Here are 15 (yes, you read that right!) key insights and reminders from this year’s RFSI Forum program:

1. Regenerative has (Re) Arrived… Now the Real Work Begins

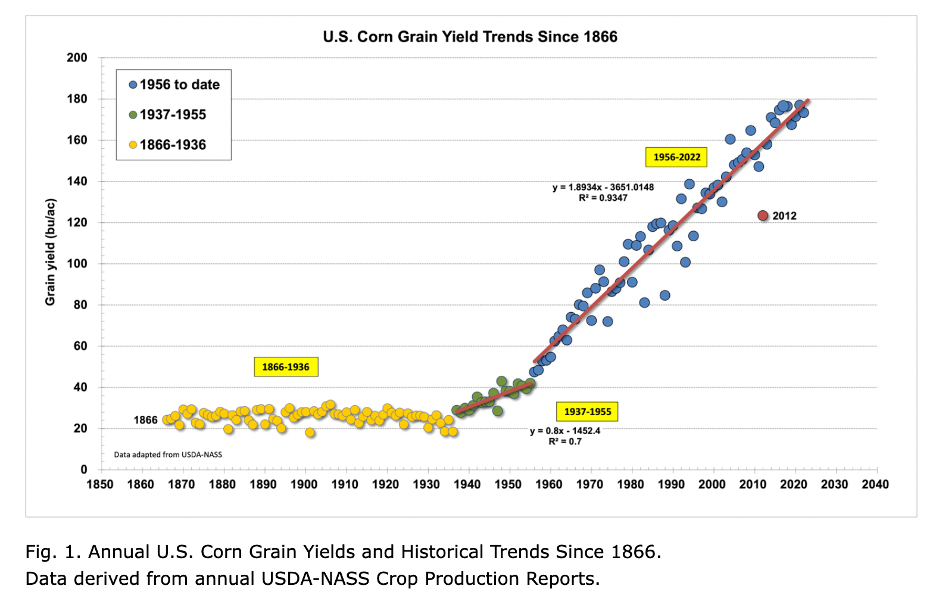

Regenerative practices and mindsets have their roots in indigenous communities but decades of extractive systems have pulled us away from these. Today, the broader agricultural and investment/finance landscape is starting to see the importance of transformation and what regenerative can bring to this change. We see this through the adoption of new frameworks and policies, as well as increased public funding and private investment into the space. This view is reinforced by a recent report published by The Rockefeller Foundation, along with Transformational Investing in Food Systems (TIFS) and Pollination. Tim Crosby of TIFS (and an RFSI advisor) shared findings from the report on where regenerative agriculture market stands today: still in the early stage and on the cusp of unlocking more commercial scale capital. So, there’s still a lot of work to do to ensure the expansion continues.

Regenerative Agriculture Market Maturity Curve:

Source: Financing Regenerative Agriculture report.

2. We Get What We Manage For – Decide Carefully

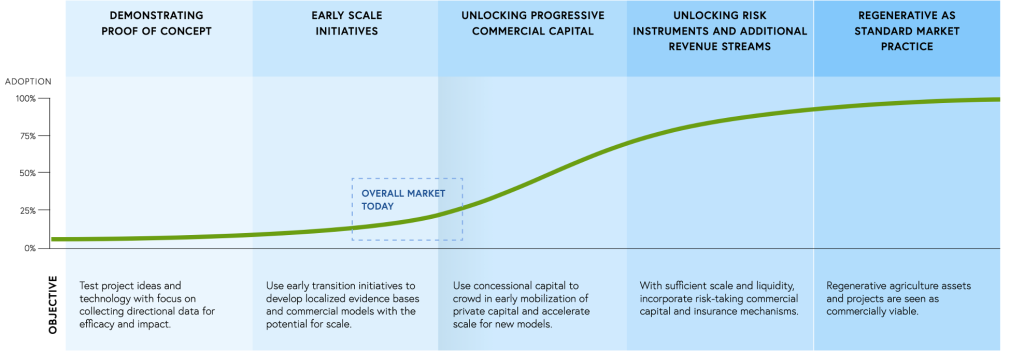

The U.S. and many other industrialized countries have spent the past 50 years managing agricultural systems for yield. As a result, yield increase is indeed the outcome we have achieved. Case in point: U.S. corn grain yields, which have steadily increased since the 1950’s at almost 2 bushels per acre per year. This has come at the expense of soil and ecosystem health and at the cost of farmer well-being for many who are now reliant on expensive crop inputs that are designed to feed the goals for maximizing yield but not necessarily other farmer or systemic outcomes. This management is also a driving force behind the American health collapse, which Nora LaTorre of EatReal and Devon Klatell of The Rockefeller Foundation spoke to in a workshop on investment opportunities to support improved human health and nutrition outcomes. Now that we better understand all the negative implications, the alternative is to manage instead for the systemic outcomes we want and need: systems health that values farmer well-being, ecological resilience, and positive human health outcomes, among other things.

Source: Purdue University

3. Solutions Must Match the Diversity, Scale and Urgency of the Challenge

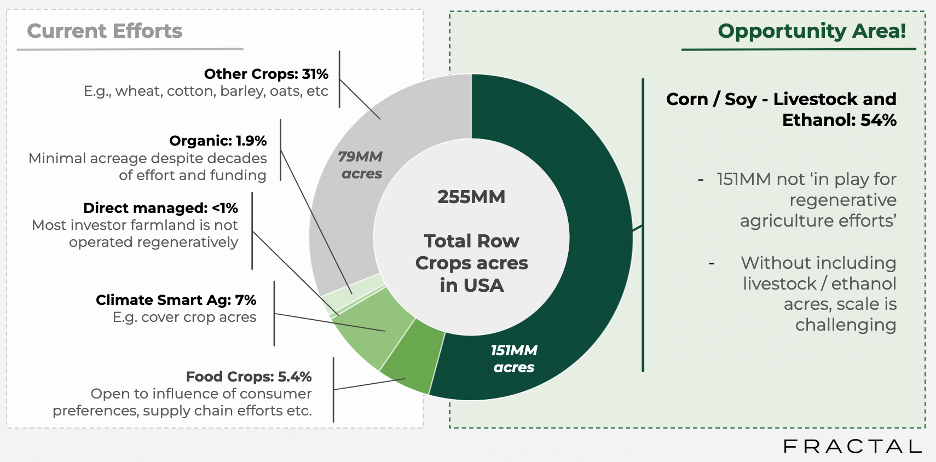

The scale of the necessary agriculture and food systems transformation requires a diversity of solutions. Many of the current approaches address small and medium scale farms and projects. We need more of these and the capital to support them, but we also need solutions that solve for acreage transition at scale and that therefore require scaled capital investment. Emma Fuller, co-founder of Fractal Ag, articulately drove this point home as she kicked off the RFSI Forum program with a framing of the massive opportunity. Among other insights, she shared the scale of the regenerative acreage gap and impact opportunity: 151 million acres that have not yet been addressed with regenerative management.

4. Farmers Must Stay Central

Farmers are the foundation of regenerative agriculture and food systems – their realities must be understood and accounted for – always. Each farmer’s context is unique and understanding both the nuance between each operation and some of the consistent themes across farms – such as the need for fair compensation for farmer contributions to the system, patient capital, and more shared risk – are important for successful transition finance. During an opening panel discussion with farmers, Benina Montes of Burroughs Family Orchards in California wants capital to understand her natural constraints. Johnny Hunter of Castor River Farms explained that he just wants capital to keep sending the checks and call him once a year. The audience laughed as he said this half-jokingly but the comment also reflected some truth in a general desire for flexible, non-intrusive capital. Others on the panel hoped for capital to invest in market development and for investors to spend more time actually on the farm (something a smaller group did do the day after the Forum with a trip to Savory’s West Bijou Bison Ranch).

5. Consumer Demand and CPG Play a Critical Role But Need More Attention

Building out regenerative food systems will rely on both push factors (supply side) and pull factors (demand side) for regenerative. Two important levers for the latter will be the evolution of consumer demand and the development of CPG markets for regenerative products. We dug into these topics with several sessions at the Forum. On the consumer demand side, Ryan Pintado-Vertner shared key concepts from his newly released white paper on how to build consumer demand for regenerative.

On the market development side, Anthony Corsaro of ReGen Brands led a discussion with off takers -including emerging regenerative brand SIMPLi and multinational CPG McCain Foods. These stakeholders play a critical role in both providing outlets for regenerative crops from the farm and in driving awareness among consumers about the quality and role of regenerative food products. But many emerging brands, in particular, also need investment to scale their operations and impact. Without appropriate capital support, they can’t play the critical role of connecting farm products to consumers. Fortunately, this challenge just got a huge boost with a big announcement from ReGen Brands about the launch of an entire support ecosystem for emerging regenerative brands. This new ecosystem will provide consulting services, industry support for brands and in 2025 a capital funding vehicle. Read more here.

6. The Messy or Missing Middle is Being Recognized

Beyond the farm gate lies the messy or missing middle of regenerative food systems – the under-developed and under-invested part of the system that take farm outputs and then processes, distributes, and brings them to market. This lack of development in this space and the lack of funding for it have been increasingly talked about in recent years and especially in 2024, but still require more understanding, as well as more investors to recognize its importance and allocate capital. See work done by both Transformational Investing in Food Systems (TIFS) and Terra Regenerative Capital to learn more. Speaking of messy…

7. Doing New Things Can Be Messy… But It is Worth It

Investing in regenerative food systems is not investing as usual. Making investments in relatively nascent spaces, such as regenerative, can require extra time and consideration to get it right. We saw how this played out with two different investment case studies. First, the investments into Mad Markets and Timeless Seeds, led by Terra Regenerative Capital and Builders Vision, respectively, required many collaborative conversations between lots of stakeholders and several iterations of what the final investment terms would look like.

We also heard from the Propagate and Agroforestry Partners ecosystem, who received key investment capital from Builders Vision to expand agroforestry in Kentucky with farmer, Keavin Hill. Sara Balawajder of Builders Vision shared how critical it was to go through an intensive learning process about agroforestry before they invested. From the stage she explained, “We identified agroforestry as a really important tenant of regenerative agriculture from an impact perspective, but we had no idea how to actualize that from an investment perspective…There was a steep learning curve, but once we started to understand the financial benefit and the strong return profile, it became a no-brainer.”

8. Proving Economic Viability Still Needed to Drive Expansion

Showing the economic viability of regenerative practices and investments into them is critical to expansion. This point was driven home by farmers in the room who need to be assured of economic security to make this transition less risky, and also by farmland asset managers working with land managers to drive their practice change. Kevin Wright of Manulife and Michael Shoemaker of Vayda shared the stage to talk through what they are seeing in their work to transition Manulife’s large farmland portfolio to more regenerative management. In the past two years, the operation has seen a significant increase in regenerative practices used by their farm managers and they are seeing positive economic outcomes. However, to continue to convince land managers and large-scale land owners to transition the positive economic outcomes must be continually reinforced by data, case studies, and general discourse.

9. It’s Never Too Late to Consider a Systems-Based Approach to Investing

Because food systems are inextricably linked to so many other systems – not the least of which are climate, the environment, human health, policy and financial systems – it’s critical to invest in them in such a way that accounts for the complex relationships. The risk in not doing this is unexpected negative externalities that could have been prevented. The good news is, no matter where you are on your investment journey, it’s not too late to shift your strategy toward a systems-based lens. We heard from Hallie Fox at The Nest, whose firm has made several investments across agriculture and food and is now reflecting, learning and shaping a systemic approach around these. David Leon of Biome Capital Partners reflected on his firms roots in systems change and how they are developing a unique strategy to invest in farmland real assets through a systems lens. Grounded Capital – another ecosystem investor worth checking out – has also exemplified this systemic approach anchored by founder Stephen Hohenrieder’s decade-long journey through regenerative systems. All three exemplify the diversity of paths that can still lead to a systems-based approach.

10. Capital Needs to Be Context Specific

Just like regenerative practices are specific to the context in which they are being applied, capital used as a tool for regeneration should also be specific to the context in which it is being applied. We heard an example to the need for context specific capital with an introduction from Reginaldo Haslett-Marroquin of Tree-Range Farms and Diane Christophore of Regenerative Agriculture Alliance of their finance vehicle – the Ecosystems Transformation Fund (ETC). They explained the impetus for and path toward creating this mechanism, which included the need to bring the right type of non-extractive capital to the early stages of the regenerative systems they are building.

Their story also helped drive home the tremendous need for more catalytic and concessionary capital in many parts of the system right now, especially in emerging operations. However, alongside this need, is the need to continue attract to the space more mature, growth-stage, and scaled capital (often non-concessionary) to both invest in more mature projects and so that there is a “next” investor for those taking concessionary capital today.

11. Relationships are Central to Regenerative

This is an oldie but a goodie. RFSI News wrote about this about a year ago and the message continues to resonate. We see over and over that the success stories in regenerative food systems investment are reliant on the relationships they are based on. The case studies described in #7 above both emphasized the importance of the relationships between farmers, project managers, and investors. And at the root of regeneration is food systems’ relationship with nature. So, one question to ask yourself is: are you building regenerative relationships? This includes relationships with your business partners, with your investees or investors, and most importantly with nature. When we start to ask this question, we can start to identify where approaches and strategies can be adjusted to be fruitful for all parties and to share more risk and reward.

12. Is it Regenerative If…

Regenerative is not only a set of principles to guide production practices, it is a mindset. This mind set should account for regeneration not just of our ecological systems but also our social systems. Therefore, the role of equity and inclusion for diverse and under-served communities within organizations and entire food and finance systems is critical to address in order to achieve truly regenerative outcomes. Candace Spencer of Meridian Institute and Kia Sims, American Pride Rises Network dug into this in a workshop designed to allow participants reflect on their and their organizations’ roles addressing diversity, equity, and inclusion.

13. We Have to Rethink Risk

Risk – real and perceived – wraps guardrails around the work of each entity in this space… guardrails that ultimately influence decisions about what one can and cannot do in the space. Farmers face undeniable weather and market risk every single season that influence management decisions. Add to that the adoption of new practices and systems and the risk is only escalated, at least in the near term. More broadly, the food system as a whole faces climate risks and other risks amplified by decades of extraction. And the list goes on. But what risks are we actually accounting for? Short-term? Long-term? How are these risks being measured? What about the risk tools that the current system has in place, such as crop insurance – how are these influencing how decisions are made around transition? If the answers to these questions aren’t supporting the outcomes we need to see, what needs to change and how? Farmers spoke to the critical importance of solving for these barriers and speakers – including Jonathan Sherrill of insurance provider AON and Amanda Pinelli of NatureX Studio – started to scratch the surface of how we generate change specifically from an insurance perspective. For starters: we have to rethink how we are accounting for, managing for risk, and sharing risk… and adjust accordingly. This will be an increasing and exciting body of work as the space evolves.

14. Innovation and Adaptability Required

Six years into this convening and with several stakeholders in the room who have been working at this for a decade-plus, the innovation generated by both new and experienced stakeholders was abundant. We saw innovation in a solution-filled pitch session hosted by The First Thirty and showcasing the work of SeedLinked, Susterre, Range Revolution, and Rooted. These start-ups and the almost 60 others that applied to pitch highlighted the diverse ways technology and new approaches to old systems can support the acceleration of regeneration.

We also saw innovation in the way investors and fund managers are developing and evolving their strategies. Bert Glover of Impact Ag Partners shared their latest endeavor – a SPAC that has purchased a large, conventional Australian farming business that will be transitioned and listed on the New York Stock Exchange – something we haven’t seen for regenerative agriculture before. Paul McMahon of SLM Partners briefly spoke to the evolution of their strategy over the past 10+ years and how farmers have become even more central. Mitch Ruben shared how Elemental Impact developed a new D-SAFE mechanism to more easily fund climate projects.

The increasing role of blended finance has a role to play here, too. Connie Bowen of Farmhand Ventures and Eva Goulbourne of Littlefoot Ventures led a fascinating workshop exploring the potential relationship between the different types of capital available – venture, philanthropic and debt – for new ventures, as well as how and when each can be useful. In the pre-event RFSI Bootcamp, Tom McDougall shared how his diverse capital stack helped address the diverse needs of his business – 4P Foods – throughout their venture building journey. This type of adaptability on the parts of both capital providers and those fundraising to pool different capital together can be key help drive mutual success.

These and other strategic reimaginings of the way we do things that were heard discussed throughout the event represent the kind of adaptability we need to see in the space. Farmers and land managers need to be hyper adaptable in their line of work, stated one speaker, how do we continue to inject more of this type of adaptability into the investment side of the equation?

15. Collaboration Continues to Be Key…

I know, I know – collaboration is key to all things these days – so much so that it might feel tiresome. Everywhere you turn around there is a proclamation about how important it is, but that’s because it actually IS critical to systemic transformation. None of this work can be done in a silo – especially with the scale and urgency with which it needs to be done. The case studies and sessions at the 2024 RFSI Forum were a reflection of all the great things that can happen when diverse players decide to dig in to build and invest together. Our hope is that even more collaboration was seeded by all the new connections made and relationships built last week.

What did we miss? Let us know what your big take-aways are here.

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.