Regenerative food systems provide the key to unlocking solutions for interconnected challenges of climate change, biodiversity loss, food and nutrition security, and income inequality. To create regenerative food futures, the world needs business and financial models that support sustainable, just, and secure food systems.

Transformational Investing in Food Systems (TIFS) was created to increase investment in regenerative businesses. TIFS was incubated in 2020 by the Global Alliance for the Future of Food (a collective of 26 foundations and funders from around the world). They recognized that the early stages of regenerative market maturity requires strategic deployment of catalytic capital to accelerate growth of the sector. TIFS is building bridges between the worlds of finance and philanthropy to support this deployment.

The Missing Middle of Investing in Food Systems Transformation

The global financing gap to support widespread adoption of regenerative practices is considerable. Several studies estimate the global annual need for transition costs to be USD $200 billion – $450 billion for the next decade. Financial flows today are approximately one-tenth of estimated annual need. A lack of confidence that financing will meet financiers’ current risk and reward requirements is hampering the deployment of capital. Systemic barriers to accelerating finance for regenerative transitions persist that include: lack of pricing externalities; government policies, protections, and funding that support the incumbent system; a lack of data and evidence; as well as a range of farm-level transition complexities.

To narrow the gap between available capital and investable opportunities in the regenerative food system requires thoughtful and coordinated actions between public, private and philanthropic actors. To enable coordinated action across food producers, financiers, and companies, TIFS convenes frontrunners among food producers, companies, and financiers for thought-provoking dialogues followed by action. The dialogues have resulted in new investments in regenerative companies. The dialogues have also surfaced specific needs. For instance, in Chicago in April 2023, participants asked TIFS to identify specific projects where investment is needed to transition US landscapes towards regeneration. At the dialogue that took place alongside the Regenerative Food Systems Investment Forum (RFSI) in Denver in September 2023, participants identified the need for two different conversations: developing a collective intelligence among a network of food systems investors; and fostering systemic problem solving among investors who are deploying landscape-level investments. TIFS is helping each conversation advance at separate but aligned speeds.

Matching Finance to the Early Maturity of Regenerative Agriculture Markets

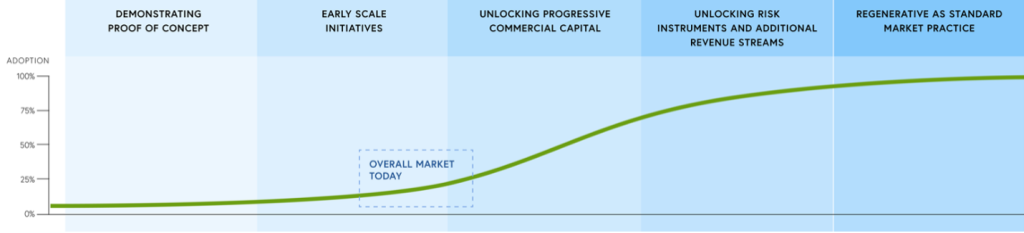

To help large-scale capital providers find pathways to invest in regenerative agriculture, we partnered with Pollination Group and The Rockefeller Foundation to write Financing for Regenerative Agriculture. In the report, we describe a market maturity curve that allows practitioners to self-identify where they should engage based on the relative market maturity in the geographies where they invest. Globally, practitioners involved in financing regenerative agriculture suggest that the market is between Phase 2 (early scale initiatives) and Phase 3 (unlocking progressive commercial capital).

At this early market stage, both commercial and concessional capital providers play a key role in accelerating capital deployment for regenerative agriculture. Early scale initiatives rely on pools of progressive grant capital, technical assistance facilities, supply chain finance, and structured offtake agreements to supply affordable transition finance, provide targeted technical support, and build the early infrastructure to support commercial viability of regenerative products.

We are starting to see opportunities for projects to scale replicable initiatives and leverage learnings across crops and contexts. In the report, we provide examples of Phase 3 financing mechanisms that expand and deepen the impacts of viable operating models by deploying concessional and impact capital to realize scale. Cutting edge structures are now emerging that create a range of future opportunities for commercial investors, insurers, and companies targeting different risk-return profiles and segments of the regenerative value chain.

Deploying Concessional Capital to Accelerate Market Maturity

The market maturity curve explains why concessional capital is needed now to accelerate the regenerative agriculture financing market toward maturity. Significant pools of concessional capital need to be deployed across a range of opportunities to mobilize additional private capital, catalyze origination of new regenerative projects, create best practice models, and build precedence for the commercial viability of regenerative agriculture.

Development finance institutions, philanthropies, private foundations, impact investors, and state-owned banks provide a broad spectrum of concessional capital, ranging from grant capital to higher-risk debt finance. However, concessional capital is in short supply and coordination among concessional capital providers in specific landscapes would improve leverage and maximize long-term impact.

The tradeoffs between a wide range of uses should be considered within regional contexts to deploy concessional capital to their greatest effect. Effective uses may include:

- Grants for technical assistance facilities that support producers and businesses with implementation of regenerative practices is crucial.

- De-risking individual transactions and structures to mobilize early private finance into projects otherwise perceived as too risky.

- Investing in innovative new structures that are yet to be established in the market but are likely to have significant impact leverage and contribute to the development of the market.

- Supporting the acceleration of regenerative agriculture data, policies, standards, and stakeholder coordination to develop the market.

Recognizing the timely need for concessional capital, the Global Alliance for the Future of Food along with over two dozen philanthropic partners launched an initiative called Cultivating Change: Regenerative and Agroecological Food Systems Transformation to catalyze a transition to 50% regenerative and agroecological systems by 2040, and to ensure all agriculture and food systems are transitioning by 2050. Catalytic capital is part of their holistic vision for financing that is more transformative, grounded, flexible, aligned for impact and better leveraged.

Financing Mechanisms for Scaling Regenerative Food Systems

To empower collective ambitions such as Cultivating Change – and accelerate the maturation of regenerative agriculture finance markets – the financial sector needs examples of financing structures that contribute to regenerative transitions at scale. In July 2024, TIFS partnered with Metabolic to co-convene a week-long session at The Rockefeller Foundation’s Bellagio Center, to build systemic initiatives and financial innovations to unlock scale in regenerative agriculture.

We assembled a diverse group of investors, companies, and farmers from Brazil, East Africa, India, and the US Midwest to identify replicable initiatives and develop scalable financing structures. We continue to work together to develop four concepts for innovative financing structures, share learnings across contexts, and build trust and confidence.

The diverse group of investors, companies and farmers that met at the Bellagio Center in August 2024.

Source: Transformational Investing in Food Systems

Our goal is to turn these examples into replicable models for scaling proof-of-concept commercial models, integrating and developing markets, and creating pathways for large institutional capital to enter the regenerative agriculture finance market.

Continuing to Solve for the Missing Middle

As we build this body of work with and in support of many partners, we are excited to be back at RFSI in Denver in October 2024. In advance of the RFSI Forum, we will organize a Missing Middle of Food Systems Investing dialogue: “Unlocking Markets for Regenerative Ingredients.” The workshop will engage producers/producer organizations, finance providers, and representatives from a range of markets (e.g., biofuels, textiles, livestock, grain trader/buyer, ecosystem service) to explore options for better alignment of markets for regenerative producers.

We will follow up with a co-design session at the Sustainable Agriculture Summit in November 2024 on “Financing the regenerative enterprise systems to benefit regenerative producers.” The workshop aims to organize the financing needs of regenerative enterprises in the Midwest, articulate the joint opportunities for growth in the next 5 years, and develop models for mobilizing and de-risking investment in and ecosystem of enterprises that transform food systems in the Midwest.

In parallel to these activities, we are implementing a Regenerative Agricultural Systems Review and Innovative Finance Opportunity Assessment to identify catalytic investment opportunities that accelerate farmer centric paths for regenerative transitions in Midwest landscapes. There are multiple projects in Midwest landscapes, but many are not connected or lack systemic vision. This industry-level work aims to bring cohesion across collective efforts in specific landscapes to deepen impacts on the ground. The work will make the case for existing investable opportunities that can catalyze systemic changes and identify opportunities for financial innovations that accelerate deeper regenerative transitions.

Ultimately, TIFS’ shares RFSI’s goal to increase financial flows to companies and financial practitioners that invest in food security and nutrition, dignified livelihoods for food producers and workers, and a stable climate and healthy ecosystems.

This is a guest article submitted by Rex Raimond, Director at Transformational Investing in Food Systems (TIFS). He can be reached here.