Canopy Farm Management has launched a perennial crop investment vehicle, Second Story Farms LLC (2SF), to develop the next 1,000 acres of agroforestry in the Midwest. Backed by anchor investors – Zarpet Family Foundation, Zellis Family Foundation, and Matthew Zell Family Foundation – 2SF is targeting a $10 million raise and is uniquely positioned to expand agroforestry and its benefits in the region, while supporting the next generation of agroforestry farmers.

The transition to organic, cover crops, and no-till farming will not be enough, according to the Canopy team. In the race to climate mitigation and adaptation, perennializing farmland with trees – a shift that can bring climate and other benefits – is essential. As the next step in this effort, this new investment vehicle distinctly combines superior agroforestry expertise, complimentary business relationships, and a pipeline of farms to transition, all in an effort to drive positive outcomes for farmers, investors, and the region.

Rooted in Agroforestry Expertise

Agroforestry – defined as agriculture systems that incorporate the cultivation and conservation of trees and other perennial crops – is known around the world for the diverse benefits it can bring for climate, the environment, on-farm ecology, and farm economics. It can be and is integrated into a diverse range of production systems around the globe. However, it is much less prevalent in U.S. agricultural systems. Canopy and others are working to change this.

The case for agroforestry is many-fold, and includes:

- Climate change mitigation through carbon sequestration: Plants sequester carbon dioxide (CO2) from the atmosphere and turn some of it into woody roots, trunks, and branches—where it can remain for decades or even centuries. In fact, agroforestry systems are able to sequester 1-5 tons of carbon dioxide1,4 per acre per year depending on the practice and environmental conditions.

- Reducing environmental degradation: Agroforestry practices can help build soil health by reducing soil erosion (as roots hold soil in place), building organic matter in the soil, and contributing to better water quality.

- Economic diversification on the farm: Depending on what perennial crops are used, agroforestry can help diversify farm income by cultivating additional, potentially higher-margin, specialty crops.

- Social and community benefits: Specialty crop cultivation can drive job creation in rural communities, while increasing local food sovereignty through new and diverse crops.

Agroforestry and expertise around how to activate its benefits are deeply embedded in Canopy Farm Management’s DNA. Canopy was founded in 2022 as a for-profit spin-out of the Savanna Institute – an 11-year-old non-profit created to lay the groundwork for widespread agroforestry adoption in the Midwest, with particular focus on crop development, demonstration farms, ecological research, and farmer education. Recognizing a key bottleneck to the expansion of agroforestry in the region, Canopy Farm Management was established as the first at-scale, agroforestry-focused tree planting and management service for farmers and landowners.

Since 2022, Canopy has planted nearly 300,000 trees and is currently managing seven farm properties. They are fully staffed with a trained field crew and use precision-enabled equipment for faster and lower-cost management – their proprietary tree planting technology and equipment allows them to plant a tree every four seconds!

Timber trees with alley cropped corn at harvest.

Source: Canopy Farm Management

Opportunity Knocks

As Canopy worked to build out this important mission of supporting the expansion of agroforestry in the region, the team had already identified a number of systemic barriers for farmers.

Transitioning to perennial agriculture requires years of upfront investment – this they knew, but there was more. In the Midwest, decades of low-value commodity crops have created conditions where farms are land rich but cash poor. On top of that, these traditional annual cropping systems have resulted in a farm culture and mindset fixated on the short-term nature of grain crops. This makes it hard for some farmers to step outside annual systems and see the potential of longer-term perennial cropping that, while offering many benefits, may take 5-8 years to start bearing a marketable crop. Even when landowners do want to convert, they often cannot risk the cost of conversion.

Herein lie some key obstacles:

- There are few productive perennial farms operating at commercial scale with proven financial history in the Midwest, and

- Catalytic capital to assemble established pieces – such as crop genetics, a business model, and management – together at scale, is often missing.

Canopy saw this as an opportunity, and, as a result, Second Story Farms – a finance vehicle for perennial cropping systems in the Midwest – began to take shape.

“Second Story Farms has been a concept we’ve been planning since before Canopy was formed,” explains Kevin Wolz, co-founder of Savanna Institute and CEO of Canopy. “It was crucial for us to first establish what we believe to be the most efficient, mobile, and adaptable farm services business to consistently meet the demands of large-scale, perennial systems. Now that these pieces are in place, we are excited to take the next step in scaling agroforestry with 2SF, providing valuable proof points for farmers and landowners who need to see tangible results to make the transition.”

How a Perennial Crop Vehicle Works

Second Story Farms (2SF) was created as a financing vehicle to better enable the adoption of agroforestry. The basic premise: raise catalytic capital that can be used to secure long-term leases and purchase trees as assets to be planted and managed on leased properties. 2SF will also finance capital expenditure and infrastructure development, while contracting Canopy to manage the on-farm operations.

The $10 million vehicle will target the conversion of 1,000 acres across Illinois and Wisconsin – a scale that they think is appropriate so as to not flood crop markets all at once. They are pursuing long-term leases of a minimum of 15 years for farms that range from 30-300 acres spread across different communities in the identified states. The region they have chosen was done so, in part, for the temperate climates that are expected to maintain abundant rainfall and water availability over the next decade. They will identify exactly where to plant using their proprietary farm mapping tool (available for use at CanopyCompass.com) that looks at a variety of factors, including soils that are suitable for their targeted portfolio species mix. They plan to alley crop black currants, which are anticipated to provide early cash flows to the vehicle, and chestnuts with the goal of providing long-term value from fresh and processed market sales. In addition, approximately 10% of portfolio land will be allocated to conservation-focused agroforestry practices, such as windbreaks and riparian buffers, that protect the crops from extreme weather, stabilize soil, and keep waterways clean.

2SF has already identified their first farm that fits squarely within its targeted criteria – a scenic 100-acre farm near one of Canopy’s hubs in Spring Green, Wisconsin. 2SF intends to begin planting this fall.

Returns for investors will be generated through both crop sales (when plantings hit productivity in the 3-8 year mark, depending on crop) and through farm exits. Although the intent is for an exit, agroforestry farm markets are nascent in the U.S., and there are limited precedents for agroforestry exits or sales of at-scale agroforestry operations in the Midwest, particularly on a long-term lease. This makes it difficult to commit to a traditional fixed lifespan, which is typical of traditional funds. This is one reason Canopy structured 2SF as an LLC, and because of this, 2SF’s financial projections currently exclude exit projections to also demonstrate the projected viability of a buy-and-hold investment.

Also not included in their financial projections are a host of other potential upside opportunities that could contribute to the overall impact and/or returns of the vehicle. These include carbon and ecosystem services credits, incorporating silvopasture in later years (which is often cited as a leading natural climate solution, integrating animals, pasture, and trees into diverse ecological systems), and USDA programs (such as CRP and the Expanding Agroforestry Program).

Hazelnut trees with alley cropped prairie providing pollinator habitat.

Source: Canopy Farm Management

Leveraging Expertise & Relationships

The ecosystem that Second Story Farms was born into – which includes the Savanna Institute and Canopy Farm Management – will play a key role in its success, bringing expertise, management, relationships and more.

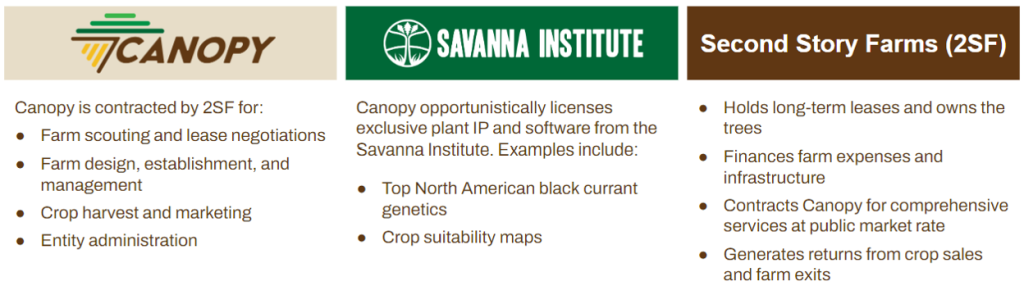

2SF will contract Canopy for comprehensive project development, design, establishment, management, harvest, and crop marketing services.

“This is a key differentiator for 2SF,” says Patrick Michaels, Canopy’s CFO, “as most agroforestry project developers rely on subcontracted labor that have little to no experience in tree crop management. Experienced tree crop management is essential to realize the yield potential of tree crops – from proper early tree care, ground cover selection, mowing frequency, and pest and weed management regimens.”

Canopy’s staff and fleet of equipment are fully mobile and can travel to jobs around Illinois and Wisconsin, ensuring management continuity across regional 2SF farms. On top of that synergy, 2SF will be able to leverage the Savanna Institute’s plant IP – which includes top North American black currant genetics – and software, including crop suitability maps.

Here’s a quick look at what this ecosystem looks like:

Second Story Farms (2SF) Ecosystem.

Source: Second Story Farms / Canopy Farm Management

Beyond expertise, 2SF will be also able to capitalize on the relationships that the Savanna Institute and Canopy have built in the region over the past 11 years. For example, based on the relationships created over a decade of work in Midwest agroforestry, 2SF already has a pipeline of 350 acres of farms that could turn into long-term lease agreements. As these entities continue to build relationships – through things like Canopy’s direct mailings to 8,000+ landowners, on-farm events and field days, and the Savanna Institute’s community of 12,000+ agroforestry supporters – they expect this pipeline to grow. These relationships will also be useful as 2SF starts to seek farm exits at year ten.

Relationships with a variety of other ecosystems players will also play a role in 2SF’s success and in allowing a diverse landscape of players to participate in agroforestry. Kevin Wolz explains that there is a potential to work with the many institutions who have been specializing in farmland buying for decades and could lease to 2SF. This would enable institutional-level portfolio diversification of land use practices with agroforestry. In line with this approach, 2SF already has relationships in place with institutional landowners, including SLM Partners, Iroquois Valley Farmland REIT, and Dirt Capital Partners to capitalize on relevant opportunities when they arise.

Building Confidence and Capital for Agroforestry

While agroforestry investment is a relatively new investment theme in the U.S., Canopy is confident they have a winning recipe to meet both their goals for agroforestry expansion and investor expectations.

“The key components of the vehicle on their own are not new,” Shelby Strattan, Canopy’s Director of Investor Relations shares. “Things like long-term leased farmland, precision agriculture, leading tree crop genetics, professional farm management, and regenerative agriculture practices are all well known. However, they have not all come together at an impactful scale until now. We are putting the pieces together to catalyze a new agricultural paradigm for the Midwest.”

Shelby adds that, while they are looking to demonstrate compelling financial evidence for agroforestry, they want to prioritize investor partners that are excited about being part of this journey with them. “This is a long-term venture, and as a pioneer in this space, over the course of the years as we plant each farm, tree by tree, we will contribute significantly to overall industry findings with our early lessons learned.”

Proof that others believe in the approach: 2SF has recently secured an anchor investment from three foundations – the Zarpet Family Foundation, Zellis Family Foundation, and Matthew Zell Family Foundation – representing a significant step on the vehicle’s road to its $10 million target.

An Investment in Adoption and Implementation

The anchor investment – in the form of a PRI (Program Related Investment) – was a natural fit for the Matthew Zell Family Foundation, says Aaron Zell, a Foundation board member, because they had already built a relationship with Savanna Institute as one of its philanthropic donors. This long-established relationship meant Aaron and others were already familiar with agroforestry and the business partners. Equally important, was that this investment supported one of the Foundation’s underlying goals for their work in regenerative agriculture: making adoption and implementation of regenerative practices easier for farmers and entrepreneurs.

Specifically, Aaron explains three things that both supported this underlying goal and made this investment attractive: The potential to:

- Demonstrate the financial viability of this type of investment in tree cropping systems.

- Establish a dispersed set of demonstration farms in the region that will allow other farmers to see agroforestry in action, generating awareness and familiarity.

- Create real opportunities for beginning and BIPOC farmers to access agroforestry work through both partnership with Savanna Institute’s apprenticeship and demonstration farm network and, through the lease-hold structure with opportunities at the end of the lease for those farmers to step into an actual management role

Another thing that was appealing about 2SF as a vehicle to invest in? “It’s highly tailored to a specific geography and it’s a geography that really matters.”

Aaron goes on to explain that if you look at the emissions profile of the Midwest in comparison to the rest of the U.S., it’s very high and a large component of it comes from the agriculture sector in particular. The approach also focuses on Midwest-style agriculture using Midwest native crops and the investment strategy – a lease-hold model – is tailored to a region where there are a lot of absentee landholders. These all position 2SF for both success and impact.

Oh and there’s one more thing that appeals to Aaron about the Midwest focus: “it’s also our backyard so it feels important for us to be stepping up in this work.”

Ultimately though, Aaron explains that it was the Canopy team and their execution that sealed the deal for him, “As they have laid out the vision and gone out and executed with conviction, we have gotten more and more excited about the partners, and as a result our conviction grew for this strategy as a demonstration vehicle.”

Meaningful Success for the Region and Beyond

By all accounts Aaaron doesn’t appear to be wrong about this investment opportunity. The pathway that Canopy Farm Management is paving with Second Story Farms can generate systemic impacts from 1,000 new acres of agroforestry and also serve as a blueprint for learning and refining how we invest in and scale agroforestry beyond this 1,000 acres and beyond the Midwest.

With an efficient structure, a strategic approach, and the potential for substantial impact generation, Second Story Farms is positioned well for success … and it will all start with this first $10 million.

Learn more about Canopy! Visit their website here or connect with their staff here.

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.