Dirt Capital Partners, a real asset impact investment company with a unique focus on improving farmer access to land, has raised more than $30 million upon the third close of its latest impact first farmland fund. Investors include the Schmidt Family Foundation, Cienega Capital, The Woodcock Foundation, DF Impact Capital, Blue Sky Social Justice Fund, High Impact Fund I LP, The Mighty Arrow Family Foundation, and others. The fund is targeting a final close of $50 million at the end of the year.

The experience Dirt Capital has gained over the past 10 years positions it well to achieve great success with this latest endeavor. The fund – which has already invested over $8 million in 6 projects – applies Dirt Capital’s proven approach to customizing each investment to the needs of the farmer, creating multiple sources of revenue from the real asset investments, and structuring a path to farmer ownership from the outset. Meanwhile, investor downside risk is protected by owning productive agricultural real estate in attractive locations.

Their unique approach is also gaining recognition industry-wide. Dirt Capital has been featured on ImpactAsset 50 2024 managers, which showcases impact investment fund managers annually, and was recognized as one of the 2024 Transformative 25, a list of funds, banks and initiatives that demonstrate the power of integrated capital strategies to reimagine and recreate financial systems that work for people and planet.

Deep Roots

This is the fourth fund for a company that has quietly thrived under the radar for a decade. Founded in 2013 by Jacob Israelow, Dirt Capital started with a pilot fund designed to test whether an impact investment model could offer a solution to the challenge of land access, particularly among farmers advancing a more sustainable and regenerative approach to agriculture. The challenge Israelow identified 10 years ago – which still remains today – is this: innovative farmers practicing regenerative agriculture are capable of solving many challenges that society is facing (think: climate mitigation, and benefits to the environment, communities, and human health), but securing long-term land access can be very difficult. This important step – land security – is often critical to unlocking farmer investment in land regeneration, with cascading effects.

A multitude of factors contribute to this challenging dynamic. One of which: that conventional capital providers are not yet prioritizing the growing segment of regenerative, sustainable, and organic farmers. But there are deeper barriers that exist, including in the type of complexity needed in regenerative agriculture projects, limited farmer equity, lack of money for a down-payment, and more. Given all of these, Dirt Capital saw the need for financial partners that can both understand real estate and a regenerative approach to land stewardship.

Their strategy is centered on Dirt Capital being an experienced and creative partner to farmers on the real estate transaction side – supporting with capital and necessary expertise, as well as offering a series of other services that contribute to the success of the farmer and the investment. This approach is a natural fit, as Israelow and others on the team bring strong experience in real estate investment from previous careers. Alongside this, the team also brings decades of experience working with farmer organizations and even farming themselves.

“We are experienced and proactive real estate partners that jump in with our farmers to unlock complicated real estate opportunities that may otherwise be unavailable,” says Israelow. Dirt Capital offers more than capital – they bring expertise on managing those transactions. Their funds don’t simply finance a property and wait for repayment, they actively work to integrate diverse revenue from real estate. Initially, this meant working with land trusts and the conservation community to sell deed restrictions to conserve farmland and make it accessible and affordable for farmers in perpetuity. Increasingly, they are also working on projects that generate other revenue from real estate, including farmer housing and co-locating complementary and thoughtfully designed renewable energy on properties.

This approach continues to be a key differentiator of their work in comparison to other capital providers and lenders.

“We have seen several private equity sustainable farmland funds think deeply about environmental impact, but Dirt Capital is paving a new path and building the market infrastructure to grow the supply of regenerative farmland and help farmers acquire farmland at flexible terms,” explains Ishita Shah, Director of Catalytic Capital at Align Impact, who already has several clients invested in Dirt Capital’s fourth fund.

The approach has also driven the success of three funds and sets a strong foundation for their fourth Fund.

Members of the Dirt Capital team and others at Amaltheia Dairy in Montana.

Source: Dirt Capital Partners

Three Going on Four

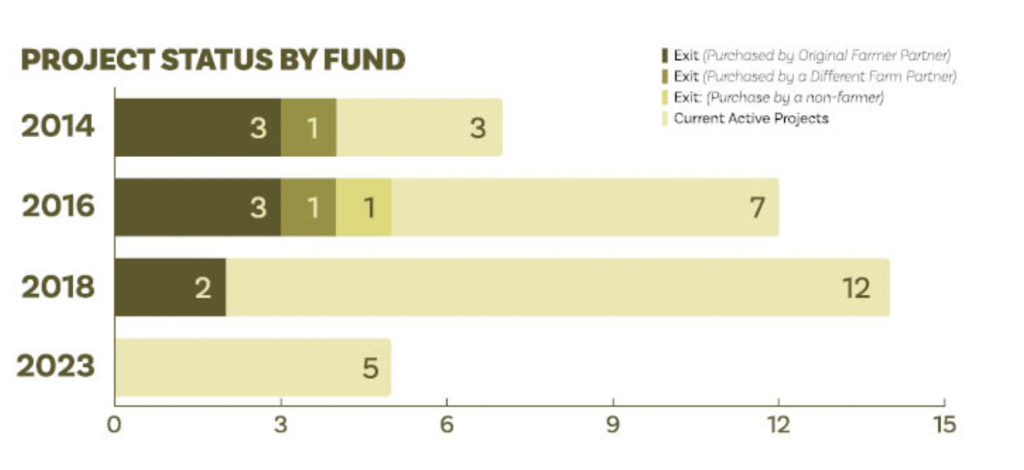

The 2014 pilot fund ended up deploying $5.26 million across 7 projects on 1,140 acres and gave the Dirt Capital team the results to prove that investing in good land stewards is not only a good investment but can yield significant benefits to land, farm businesses and their communities. They followed the pilot fund with a 2016 fund that deployed $5.23 million across 11 projects on 1,809 acres and a 2018 fund that deployed nearly $17.5 million across 14 projects on 2,203 acres.

While the first two funds invested solely in farms in the Northeast, investments out of subsequent funds have expanded geographically to California, the Pacific Northwest, Mid-Atlantic, Midwest, the south and the upper Mountain West. The deals they fund also vary greatly in scale and in what they produce, from dairy to meat to fruits, vegetables, and grains. They even have one aquaculture investment. Diversification within single operations is also a valued feature, with more than 50% of the projects having two or more different production types generating significant revenue and 27% having three or more different production types.

In general, their funds have attracted a mix of investors, including individuals, family offices, and foundations (as well as some who are investing via PRIs and Donor Advised Funds). These investors tend to be drawn to Dirt Capital’s lower risk, catalytic return, high impact strategy that has an emphasis on downside protection and capital preservation.

Key Themes Driving A Unique Strategy

Over the past 10 years and three funds, several lessons have emerged that have become core to their strategy: innovative finance, farmer capacity building, and impact outcomes.

Innovative Finance: The importance of providing creative and flexible financing solutions tailored to the specific needs of each farmer.

“Dirt does not shy away from complex deal structures,” explains Shah of Align Impact. “They are looking to make things work and use an array of tools in their toolkit – whether it’s structuring a joint venture with a farmer or figuring out how to be the most additional in a blended capital stack.”

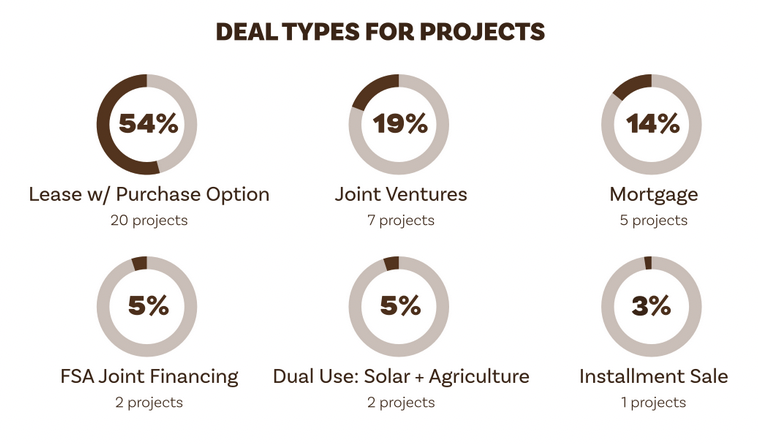

This mentality is reflected in the diversity of deal types that Dirt Capital has facilitated, including leases with purchase options, joint ventures, mortgages, FSA joint financing and more.

Source: Dirt Capital Partners 10 Year Impact Report

Dominick Grant, Managing Director, explains, “Traditional financial products often fail to meet the unique challenges faced by farmers, particularly those looking to implement regenerative practices. By developing customized financial support, we’ve been able to help farmers overcome barriers to land access while also balancing the other capital and resource priorities of expanding an operation, diversifying production, and investing in soil health.”

Recognizing the importance of collective action in addressing the scale of challenges farmers face, Dirt Capital’s approach to finance innovation also includes collaboratively working with other capital providers. They have reciprocal project referral relationships with Potlikker Capital, MAD Capital, Foodshed Capital, Iroquois Valley and other groups. They also actively explore ways to consider joint financing on projects, understanding that bringing diverse capabilities and types of capital to a project can lead to greater outcomes and success.

Rancho Corralitos, a diversified fruit and vegetable operation in Watsonville, CA, is an example of their creative and collaborative financing efforts with big impact. The project arose out of an identified barrier for getting Latino farmworkers access to land. To address this, three organizations – Dirt Capital, Kitchen Table Advisors, and The People’s Land Fund – pulled together an $11.4 million blended capital deal structure that featured grant dollars and 36 individual investors as low interest lenders, anchored by investment from Dirt’s third fund. The result: a replicable project that demonstrates the role capital can play in enabling land access for underrepresented farmers.

An added benefit to Dirt Capital’s willingness to collaboratively work through complex projects and customize financing is that it builds the field of knowledge around how to use catalytic capital to drive results.

“What sets Dirt apart from others is its process of innovating and learning,” says Shah. “Dirt Capital has mastered the conservation easement process, and the team is now scaling their learnings by offering their technical expertise with conservation easements to multiple portfolio farms. When things do not work as well, they take their lessons learned and adapt their approach to improve them.”

This transparency helps demystify investment in the space for others, and ultimately leads to new, replicable finance models, so that capital can continue to support sustainability and regeneration long into the future.

Farmer Capacity Building: The value of active partnership beyond capital.

Capital is only part of the puzzle. Resources and technical expertise are also necessary ingredients to make farmland more accessible for farmers. Beyond capital, farmers need holistic support for things like business planning, technical assistance, and connections to quality service providers – things Dirt Capital seeks to bring to every farm partnership. While they don’t offer full wrap-around services, their expertise and relationships allow them to provide both direct support and relationship referrals to farmers they work with. This support includes: 1. technical assistance for land evaluation and acquisition, 2. negotiation and management of conservation easement transactions, 3. value-added real estate asset management – including subdivision and development and placement of leases with solar companies, and 4. business and financial decision-making.

Amanda Zakharov, Director of Investment, explains “This hands-on approach not only helps farmers navigate the complexities of land ownership and makes our investment stronger, but it’s also essential to allowing farmers the space to focus on what they’re best at and building support networks for what’s a growing edge for these farmers.”

Impact Outcomes: The importance of continuously evolving impact measurement and assessment processes.

Dirt Capital’s success is exemplified in the impact that has been created. The company released a 10-Year Impact Report this year that tracks impact performance across the past three funds. By both defining and expanding their concept of “impact” they are now able to give name to the outcomes they’ve seen achieved through their past ten years of work, as well as provide tools to communicate this to investors and farmers. Impact measurement also provides a tool for them to continue to evolve their strategy to meet systemic needs.

A foundational goal for Dirt Capital investments is to generate moderate financial returns with deep impact – with particular attention on improving access to land for their farm partners. Of the 32 projects that Dirt Capital funded in their first three funds, they have already successfully exited one-third. Even more exciting is that eight of these exits have been through purchase by the original farmer partner and two others have been through sale to a different regenerative farmer partner.

Source: Dirt Capital Partners 10 Year Impact Report

Beyond exits, Dirt Capital measures a wide variety of other impact outcomes. Their impact report introduces a new impact framework that includes four key themes – ecological stewardship, farmer equity, community benefits, and field building – and a series of intended outcomes under each of the themes. Dirt Capital uses the framework to define clear outcomes, track progress with specific metrics, and integrate impact considerations into their investment and portfolio management processes. It is designed to be adaptive and continuously improved based on feedback from farmers, partners, and the wider impact investment community.

Source: Dirt Capital Partners 10 Year Impact Report

This is something Shah appreciates. “We see funds try to simplify a complex area with a single metric: greenhouse gas emissions offset. While that is helpful in some ways, we love that Dirt is transparent about the nitty-gritty impact activities of portfolio farms: crop rotation, cover cropping, reduced tillage, and more.”

While the work of developing impact frameworks and defining impact outcomes and metrics can be seen as “investor-driven,” Dirt Capital says much of their thinking and evolution around this has been spurred by the farmers they work with. “We built our new impact framework as a testament to the hard work and achievements of our farmer partners – our investments are catalytic but it’s through their effort that this multitude of wide and varied impacts on the land and community are possible,” explains Martín Lemos, Director of Impact and Agriculture.

With this new framework, Dirt Capital can look backwards to evaluate the degree to which their portfolio of investments has been able to hit all the different impact points that are important to them, their investors, and their farmers. Some highlights:

- 73%, or 27 out of 32 projects prioritize Equitable Land Access and Security as a central “key impact outcome” of the project

- 51% or 19 of 32 projects prioritize soil health impacts

- 24% of projects or 9 of 32 prioritize biodiversity

“It is incredibly rewarding to know that the financial platform we provide allows farmers to gain equity based on their experience, skill, and work; and it’s inspiring to see how that financial platform allows for a cascade of opportunities for farmers. Because of secure land access they invest in their businesses, they take firmer root in their community and generate new relationships, grow their customer base, and feed more of their community,” explains Dirt Capital Director of Investments, Amanda Zakharov.

Read Dirt Capital’s full Impact Report here.

These three strategic themes – innovative finance, farmer capacity building, and impact outcomes – have become the bread and butter of the Dirt Capital investment strategy and have fostered their success as they invested in 32 projects across their first three funds. They are also key to driving the success of an ambitious fourth Fund.

Scaling on a Decade of Success with Fund 4

The impact created and lessons learned thus far by Dirt Capital’s decade of work provides a strong foundation for their fourth fund. The $50 million target is significantly higher than their previous funds, but the team is confident that this can be achieved.

“We believe that the model is replicable and can scale to $50 million while achieving the same financial and impact outcomes. There is a significant demand for our model and approach from regenerative producers throughout the country and new investors are recognizing our track record of success and prudence and the real-asset based impact-first investment thesis,” says Managing Director Dominick Grant. With more than $30 million already committed, the Dirt Capital team is clearly on to something special.

They are seeing significant momentum out of this third close heading into a final close by the end of the year. “We have a diverse group of 40+ LPs already in our currently open fund and are deploying capital into projects throughout the country. Investors are responding in particular to our track record of success, the quality of our team, and our robust impact framework,” Israelow explains.

Investors share this confidence and excitement in Dirt Capital’s latest fund.

“After investing in Dirt Capital’s third fund, the Schmidt Family Foundation was excited for the opportunity to invest in their fourth fund and see them scale their model nationwide,” says Loïc Comolli, Portfolio Manager of Impact Investing at the Schmidt Family Foundation. “Given Dirt Capital’s long trajectory of investing in the Northeast, expanding nationally was important both to achieve greater impact on farming communities as well as to develop a larger platform. With a greater presence, Dirt Capital will be able to better engage the food and agriculture investment sector to spread the benefits of their unique model.” He adds, “We have also been excited to see the types of farmers impacted by the fourth fund, which include a number of BIPOC farmers who have been able to secure land, stabilize, and grow their operations.”

With a successful 10-year track record of financial and impact outcomes, and loads of momentum, Dirt Capital is positioned to lead the regenerative agriculture investing space for the next 10 years and beyond.

If you are interested in learning more about Dirt Capital Partners, visit their website here or reach the team here.

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.