In an agricultural system where degradation is perpetuated by an antiquated financial system that incentivizes the status quo, financing options that meet the unique needs of farmers transitioning to regenerative or organic practices are limited. Enter Mad Capital, an operation committed to finding innovative ways to support regenerative and organic farmers in their financing journey. Mad Capital is pushing the envelope about how we think about regenerative agriculture finance by blending new debt and traditional debt models, all within a larger MAD! ecosystem that supports other transitioning farmer needs. This effort took a big step forward in late 2022 when Mad Capital announced a $4 million seed round fund raise in December, bringing them a bit closer to meeting their goal of financing 10 million acres of farmland by 2032. We had the opportunity to talk to Mad Capital Co-Founder and CEO, Brandon Welch, to dig into their work today, the recent fundraise, and how they plan to keep changing the trajectory of regenerative agriculture finance.

Addressing A Finance System Decoupled from Nature

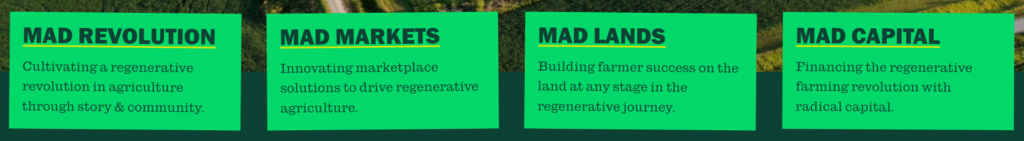

Mad Agriculture was founded in 2017 to revolutionize the way we practice agriculture, to move us to a new paradigm that works with nature and not against it. Their revolution centers around building a thriving regenerative organic agriculture system and they do this by starting with the soil and the people who steward it – the farmers. To fulfill this mission, Mad Agriculture works through three branches that address the diverse challenges farmers meet in transitioning to regenerative. These include: Mad Lands (for strategic farm planning), Mad Markets (for connecting farmers to markets), Mad Revolution (for connecting farmers and the broader regenerative movement). Sister company Mad Capital serves farmers’ financial needs. Together, these entities provide a holistic support system for regenerative farmers. Separately, they can serve all kinds of farmers with their specific needs when they need them.

While Mad Agriculture (and the three branches under it) operate as a 501c3, Mad Capital was recently spun out and as a separate for-profit entity. It was designed to help fill the enormous gap in financing options that support farmers taking on practices and systems that lie outside of convention. Financing in traditional markets is short-term, extractive, and disincentivizes movement to new regenerative or organic systems by increasing financial risk, so Mad Capital set out to address this. They explain that their work seeks to “replace traditional loans with capital that invigorates the imagination, liberates them from the industrial shackles of debt obligations and enables the transition to regenerative organic agriculture.” The company shares this sentiment and their efforts to align agriculture finance with nature in their value statement.

Listen as Brandon Welch shares some of the values and principles Mad Capital is trying to relay into their financing here:

To date, Mad Capital financing has been deployed across over 44,000 acres. Most of the farmers being served by this financing are broad acre row croppers transitioning to organic in traditional commodity crop systems. Their average farms size is 2,000 acres and many use cover crops, practice conservation tillage, use a 4-5 year rotation, and some integrate animals. Their most diverse operation grows 16 different crops over 12,000 acres.

“Conventional farming and farming organically are two different worlds. To go from conventional to organic takes changes in equipment, inputs, practices, and mindset,” says Angela Knuth of Knuth Farms. And these changes require capital and risk management.

Right now, Mad Capital can support farmers’ capital needs with different types of loans in order to meet farmers along the spectrum of needs, no matter where they are in their financing journey. The first of these is what CEO Brandon Welch calls innovative funds. These are private funds that Mad Capital raises to solve specific niche problems that they see holding farmers back from transitioning more land. Mad Capital’s Perennial Fund falls under this category – it was designed and raised for more financial flexibility during transition and therefore was written with certain investment criteria.

The kind of capital offered in the Perennial Fund can be essential to reducing financial risk for transitioning farmers, but Brandon explains that Mad Capital wants to serve all farmers along the spectrum. Generally, he says that they’ve found that, “For every $1 of flexible financing that we are lending there is about $4 of other need that can fit a much more traditional bucket – whether that’s a 20-year fixed mortgage, a five-year equipment loan, or a more standard 12-month operating loan.” Because of this Mad Capital also provides traditional loans.

Traditional funders are banks and non-bank lenders that Mad Capital partners with to provide operating loans. These funders are also looking for certain criteria, they have different debt coverage ratios, needs for historical track records on the farm, FICO scores, and risk ratings that they apply to the credit, which changes the cost of capital they are willing to offer Mad Capital and their farmers. At present, Mad Capital is able to offer real estate and equipment financing from traditional debt providers, as well as innovative funding from the Perennial Fund.

The important thing for them is to provide flexible financing and support farmers as they evolve and grow. “We want to make it easy for them to make sure they have one partner they can work with,” says Brandon. That way, farmers can call Mad Capital and know that they will have access to whatever finance they need.

It’s almost counter-intuitive but Mad Capital’s bread and butter and their backbone is actually traditional financing. Brandon explains that this will ultimately build viability and continue to enable them to provide the innovative and hyper flexible financing that is critical to transition but that is only necessary for a limited period.

He explains the premise, “If regenerative organic agriculture is what we think and know it is – it’s profitable, it’s a better risk management tool, it reduces downside, and there’s lower volatility – then there’s no reason farmers should be limping along with hyper flexible cash flow-based financing post transition. They should be using traditional financing and they should be improving their financial position over time.”

The Fund Raise & Perennial Fund 2

The $4 million in funding that Mad Capital raised in December will serve to strengthen and expand their mission by helping build out their team and create new partnerships to continue to serve farmer capital needs. In contrast to the fundraise for their Perennial Fund – which included capital from registered investment advisors, foundations, and family offices – the Mad Capital seed round presented an opportunity for investment in a growing company but not real assets. This investment was less diversified and a bet on the company, and its investors reflected that. Regenerative-focused VC firm Trailhead Capital led the round with participation from Bonaventure Capital, Homecoming Capital, Impact Assets, One Small Planet, Pelican Ag, Lacebark Investments and 17 others. And despite the rocky macro-financial environment of the past 9 months, the raise moved relatively quickly, according to Welch, taking about 6 months. This was no doubt due in part to Mad Capital’s unique approach.

Trailhead Capital’s Mark Lewis emphasizes this point: “Values aligned financing is one of the key bottlenecks to transitioning more acres to organic and regenerative practices. You not only need creative debt structures, but that needs to be accompanied by technical assistance, a community of practice, and access to specialized markets for transitional and certified organic and regenerative crops. Mad Capital is uniquely suited to address this market need. Lots of food and agriculture venture capital never focuses on the unique needs and problems of the farmer on their land. Mad Capital is unique in that this team rolls up their sleeves, walks the land, and meets the land steward where they are.”

Building out and evolving this debt-focused strategy are part of the plan and the recent fundraise are very much a part of this. While Mad Capital continues to manage the Perennial Fund, the newly raised seed capital will be used to build the human capital to set up a second fund – Perennial Fund 2 – in 2023. The team will apply the lessons learned with the first Perennial Fund to the development of this new fund, which will still focus on transitioning farmers and acreage but will be $25 million. Where the first fund was focused on flexible, lower-cost senior debt, the second fund will be incorporating more flexible, higher cost junior debt. That is, it will take a junior position and therefore will be in line behind senior debt providers to be repaid if the farmer defaults. Brandon explains that while this is moving them further out on the perceived risk spectrum, there are numerous mechanisms of hedging this risk while filling a major gap in the financing sector. He also explains that this can be a good instrument for certain types of real asset acquisition in particular, such as land access and infrastructure focused on grain or meat processing – two areas in high need of capital support.

The Evolving Solution Mad Capital Presents

Today Mad Capital’s approach is strictly debt-focused, but the team continues to think through how they can help create incentives from a business standpoint. How do farmers improve financial position? How do farmers have less debt?

“We want to build long term relationships with borrowers,” says Brandon, “and if we’re doing the best we can, then it’s not getting them more settled with debt, it’s helping them get into a better financial position.”

That is part of the reason behind their move from senior debt to junior debt in Perennial Fund 2 and why one day they may also be involved in the equity side. Brandon explains that they want to serve a certain type of farmer but they also want their incentives to align with their mission. As a debt only shop right now, Mad Capital’s natural incentive from a financial standpoint is to loan more and more money to farmers, however, that is not what most farmers need. So their team is putting together models, such as junior debt, that would allow farmers they work with to continue to improve their financial position or get a higher return on invested capital when they borrow from Mad Capital than other lenders.

Brandon adds, “Ultimately, we would love it if our farmers had half the amount of debt they have today. Debt is a tool and it’s not the tool for every job.”

Scaling Success

So what about that bold goal to finance 10 million acres by 2032? When we asked Brandon what it was going to take to scale to this level he told us two things: larger pools of capital and much larger financing opportunities on the farm side. The work Mad Capital is doing today will serve to set them up to meet these two needs.

Ultimately, the company’s long-term financial strategy is to be positioned to unlock capital from the Wells Fargos, Goldmans, and JP Morgans of the world. Brandon thinks it’s going to take $10 million to $20 million per month in loan volume for these types of players to bat an eye. While the goal would be that they buy large pools of loans that represent regenerative farmers, the opportunity would need to be presented with a track record and conveyed risk that large-scale investors can be comfortable with. To do this, Mad Capital believes that economics will have to be the focus and they will continue to build the financial case.

Perennial Fund 2’s work in the U.S. will be a step toward their 10 million acre goal. But to meet the need for larger financing opportunities – or in other words the need for larger-scale farms – the team knows they will need to go international one day. Moving beyond the U.S. base market, Brazil, Australia, Canada, and Mexico would likely be next. These are markets where organic is a large and rising movement and that have large landscapes that need to be restored. But the move to international work is likely 3-5 years off, as Brandon explains that they want to have an evergreen model set in the U.S., a strong cash buffer, a strong ARR, and a solid team before they take on the complexity of new cultural and regulatory environments.

For now, the team recognizes they are still in pilot phase – and that all their work testing out their strategies today is building the case for the future of financing this space.

“We have a lot of experience but with the new $25 million fund, we are still very much piloting these ideas, before we can truly scale to $100 million, we still have some learning. We will move from theory to practice before we can scale up.”

The good news is this ambitious work is not just a pilot for Mad Capital. It’s a pilot for all of us, as we too, get to watch and learn how this strategy can support the scaling of regenerative finance around the world.

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.