In 2023, the ecosystem of operations working to build regenerative farming and food systems seems to be growing rapidly. This is in large part because regenerative agriculture – at scale – promises to address many of the challenges to the current system, with positive impacts that include agronomic, operational, environmental, health, consumer, and climatic/ecosystems level benefits. But without a singular definition of regenerative, measuring the growth of the regenerative market is difficult. So, we put together some market signals that we think indicate both past and future growth potential.

Growth of Certified Organic

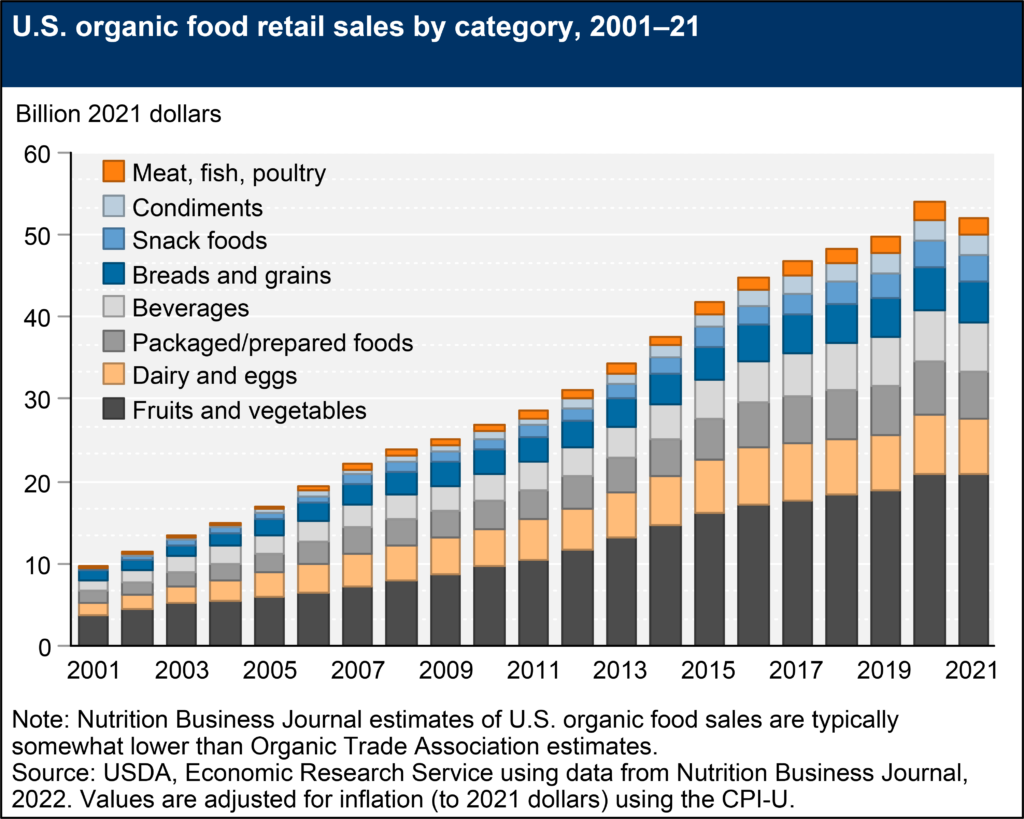

Using Certified Organic as one proxy for movement toward regenerative, the USDA National Agricultural Statistics Service reports that from 2011-2021:

- Certified Organic Cropland grew 79% to 3.6 million acres

- Pastureland and Rangeland grew 22% to 1.3 million acres

- Certified Organic Operations grew 90% to 17,445 farms

In addition, U.S. sales (adjusted for inflation) of organic food products was reported by the Nutrition Business Journal to have grown by 93% to $52 billion between 2001 and 2021.

Use of Cover Crops

The use of cover crops is one of the most commonly understood regenerative practices and can also serve as good proxy for adoption of regenerative production programs. It does not mean more regenerative practices have been or will be adopted but it does provide insight into moves in that direction. The most recent SARE/CTIC National Cover Crop Survey found a steady increase in average acreage planted to cover crops per farm between 2015 and 2019 – a 40% average increase in that period.

Increase in Regenerative Brands and Labeling

The number of consumer packaged goods (CPG) brands focused on regenerative is on the rise.

At the recent 2023 Natural Products Expo West – which gathered more than 65,000 attendees and more than 3,000 exhibitors in the natural products sector in Anaheim – the number of exhibitors making regenerative claims increased by 19% over 2022, according to analysis by Wolf Tree Ventures.

Another indicator of the brands thinking about regeneration is the number of certification and verification schemes that have are cropping up. The number of these that are designed to identify regenerative products by the practices used to produce them or their ingredients is also on the rise, with Land to Market from Savory Institute, Regenerative Organic Certified, Green America’s Soil Carbon Initiative, and Regenified leading the way, among others.

Labeling is also playing a role here. In the past five years, according to consumer products insight platform Planet FWD, regenerative claims have grown 130%, representing one of the fastest growing types of claims.

Increased Interest from Food Corporates

Growing commitments from nations and multi-national CPG companies reflect growing awareness of the critical role regenerative agriculture plays. G20 nations have pledged to restore 1 billion hectares of degraded land by 2030, according to the United Nations. At the same time, in 2021 the number of multi-nationals making corporate commitments to incorporating regenerative agriculture into their supply chains took off, with JBS, Mars, Nestle, PepsiCo, Walmart and others joining early adopters like Danone and General Mills. The following year saw continued commitments from others. These all point to the growing awareness of the global imperative for agriculture and food to shift from a contributor to a solution to environmental degradation, climate, human health and more. General Mills, an early adopter in this effort, exemplifies this

Capital Investment in Regenerative

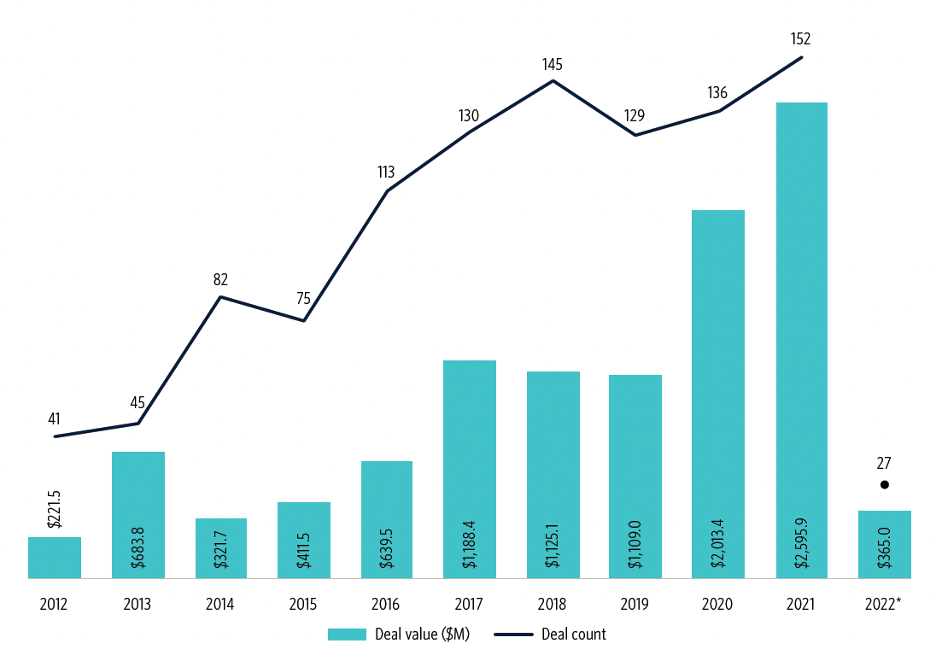

There has been a steady increase in investment in regenerative agriculture and food projects across the value chain in the past years, coming from a variety of capital sources, including private equity, venture capital (VC), philanthropic foundations, debt providers, and corporates. VC investment, for example, has seen dramatic increases in both the total value of the deals and the deal count increasing significantly over the past ten years changes, according to Pitchbook data. The number of deals in regenerative agriculture has grown 270% (from 42 in 2012 to 152 in 2021) and the value of the deals has grown more than ten-fold in the same period. Four major areas of investor interest that address regenerative agriculture are leading this growth: biologicals – which offer biological solutions to reduce the use of synthetics pesticides, remote sensing – which include imagery analytics and in-field sensors, field machinery – which includes precision equipment that reduces chemical inputs and soil compaction, and herd management – which includes tools to track and move livestock in rotational grazing systems.

Drivers of Regenerative Agriculture Expansion

So, what are the drivers behind these signals? In short: external factors influencing decisions on the farm and demand coming from off the farm.

On the Farm

On the farm we are seeing a myriad of factors contributing to decisions to adopt new practices and entire systems, including increasing pressure on farm economics, rising climate risk, on-farm health and safety concerns, and environmental concerns. In industrial commodity production systems, already razor thin margins are being exacerbated by low commodity prices, combined with rising input costs, which led to stagnation or decline in overall farm profitability in 2019. Rising input prices, in particular, continued to impact profitability in 2021 and 2022.

Meanwhile, regenerative systems are offering an increasingly attractive alternative. It is true that farmers shifting to regenerative practices can be met by many barriers – including lack of technical expertise and financing, cultural disapproval, and a transitional period of decreased profits – but regenerative farming systems can ultimately lead to positive economic outcomes that can leave farmers better off financially. These outcomes are the result of three systemic improvements:

- reduced input costs

- growing diverse and higher value crops and accessing new markets that reward the attributes of regenerative products, and

- creating more resilience that helps the system withstand volatile and potentially costly weather and climate risk

An increasing amount of research is leading to the same conclusion but more will be needed to drive more system-wide understanding of the economic opportunity.

Demand

Consumers today are increasingly seeking to understand where their food comes from and how it was produced. They want their food to also be a reflection of their values – and today that means good for people and planet. That means they want safe, chemical-free and nutritious foods. They also want to know about and reduce the climate impact of the food and fibers they consume, making traceability of increasing importance.

These consumer desires continue to influence purchasing decisions and Planet FWD explains that:

- 55% of all growth in CPG came from sustainably marketed products from 2015-2019

- Consumers will pay a 39% premium for sustainably marketed products compared to conventionally marketed counterparts

- 69% of consumers have changed the products they use due to concern about climate change

So, even as many consumers still may not know the term regenerative, they do understand and want some of these beneficial attributes that regeneratively produced goods can offer. This will continue to drive the demand for and value of regenerative farming systems.

Pressure to Decrease Scope 3 Emissions

The growing consumer demand described above is pulling on producers to change the way they produce food and fiber products, but producers are not the only ones being pulled. Companies, of all sizes are feeling pressure from consumers, investors, and regulators to change the way they produce products.

The desire for food corporates to make commitments to regenerative is driven by at least two factors:

- Increasing demand from consumers for the attributes that regenerative ingredients and foods represent (as discussed above) – which therefore results in a need build traceable and high integrity supply systems, and

- The necessity to address Scope 3 emissions. Scope 3 emissions are indirect emissions that are not directly from a company but are tied to them in their value or supply chain. In the food system, these emission account for more than 90% of a packaged food company’s total emissions on average, according to Rabobank. So as public and private pressure mounts to clean up climate impacts of companies – food companies can’t stay idle. By addressing their agriculture and food supply chains and applying more regenerative systems, these companies can make significant strides.

General Mills, an early adopter in the corporate transition to regenerative, exemplified this driver this week. The cereal and snacks giant — which in 2020 set a goal to reduce its greenhouse gas emissions 30% by 2030 — launched its annual sustainability report this week where it called regenerative agriculture the “most promising solution to reach our climate goals.”

Forward Momentum

The global agricultural system is facing some significant hurdles as it grapples with extractive nature of the current paradigm and the opportunity for a future of regeneration. The path to the latter may be challenging but momentum continues to build behind regenerative systems as indicated by the data shared here. It will be up to a myriad of market players – from producers, technology companies and brands, to food corporates, funders, and investors – to capitalize on the growing opportunities.

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.