The transition to healthier, more resilient and regenerative agriculture and food systems presents a tremendous opportunity to address some of the planet’s most pressing challenges, including climate change, environmental degradation caused by extractive production practices, and a human health crisis caused by declining nutrient density in food. However, obstacles to transitioning to these systems remain, not the least of which is ensuring there is a functioning and accessible supply chain into which diverse, regenerative crops can flow post farmgate.

As it stands today, most U.S. agricultural supply chains – especially in the Midwest – are built for the few commodity crops that dominate the agricultural landscape: corn and soy. That means the infrastructure for getting crops to market – all the equipment and facilities necessary for cleaning, processing, and distribution – is not necessarily designed for diverse crops of varying volumes. It also means much of the middle supply chain is not built for transparency and traceability, but rather for commodity crops that are pooled together with no identity preservation and with little to no tracking of where they came from. Moreover, minimal information is provided on the location, type, and capacity of the infrastructure that does exist.

Without this infrastructure and information, it can be difficult for farmers and stakeholders across the value chain to market diversified crops. This can be a major impediment for farmers seeking to diversify their production systems and incorporate more regenerative soil health management practices, as well as to buyers seeking to source more sustainable ingredients – ultimately slowing the overall transition to a healthier food system. Investment in supply chains and infrastructure may provide a significant solution to this challenge but there is still a lot that needs to be understood about how to do that. With the launch of their new “Supply Chain Infrastructure Asset Map,” Builders Vision has set out to address this issue as an initial step.

Who is Builders Vision?

Builders Vision is an impact platform, founded by Walmart heir Lukas Walton, that works to shift markets and minds for good in pursuit of its vision for a more humane and healthy planet. The organization is tackling some of the most urgent environmental and sustainability challenges across three interconnected sectors: oceans, food and agriculture, and energy. Through a combination of investment, philanthropy, and advocacy, Builders Vision is uniquely positioned to catalyze systems change. They allocate diverse forms of capital—from grants to catalytic and market-rate investments—to drive innovation and build a better future.

As part of their agricultural philanthropy work, Builders Vision invests in the transformation of the current agriculture system to one that features more diversified, regenerative cropping systems. In the context of current systems, they focus on strategies that integrate more conservation practices into existing corn and soy acres at scale. Simultaneously, they invest in projects that work to build new cropping systems that can help build diversity, health, and resilience in the overall agriculture and food space. Across both these approaches, no matter what they are funding – current systems change or building new systems – they do so with an eye towards solutions that are viable in the market, or in other words, solutions that will eventually be self-sufficient and not always need to be supported by philanthropy or outside investment.

This work gives Builders Vision an important view into the inner workings of the systems in which they invest and allows them to identify critical gaps that need to be filled. Haley Burns leads Builders Vision’s agricultural philanthropy strategy. The work started in agricultural diversification about 3 years ago, and it soon became clear that in order to scale diversified crops, there needed to be markets for these crops. Haley explains that the team started to see a recurring theme in the needs of many of their grantees. “Everyone is butting up against the challenge of infrastructure – largely centered on corn and soy,” Haley explains. “The infrastructure that exists outside of corn and soy is hard to find through a Google search and, even if found, it’s difficult to understand who they work with and with what scale and what crops.”

Builders Vision concluded that in order to scale the system, there needed to be a more comprehensive understanding of what infrastructure exists, how close it is to crops, and where are the gaps. They wanted to make this as user friendly as possible and sought out a partner to help build an interactive map with this information. Builders Vision hired The Climate Source, a consultancy specializing in addressing food and agriculture supply chain challenges for climate resiliency, to help gather data, design, and build the map.

The Climate Source had also been approached with a lot of questions that echoed the same information challenges around diversified crops and supply chains that Builders Vision had identified, according to Jessie Deelo, CEO at The Climate Source. From producers and suppliers, they heard questions such as: “How do I get my product to market?” Buyers asked them: “How do I get access to this, and what are going to be the KPIs and metrics around that?” They even heard from investors: “We think there’s an opportunity here. But how do we even gauge what that investment case is, and what the ROI could be?”

This gap that both Haley and Jessie’s teams were seeing is often referred to as the “missing middle” – the absence of the essential middle supply chain that gets products from farmers to end users. Jessie also refers to this as the “opaque middle” because if it does exist, it’s still very difficult to find. This is the challenge they set out to solve.

A Solution Identified & Addressed

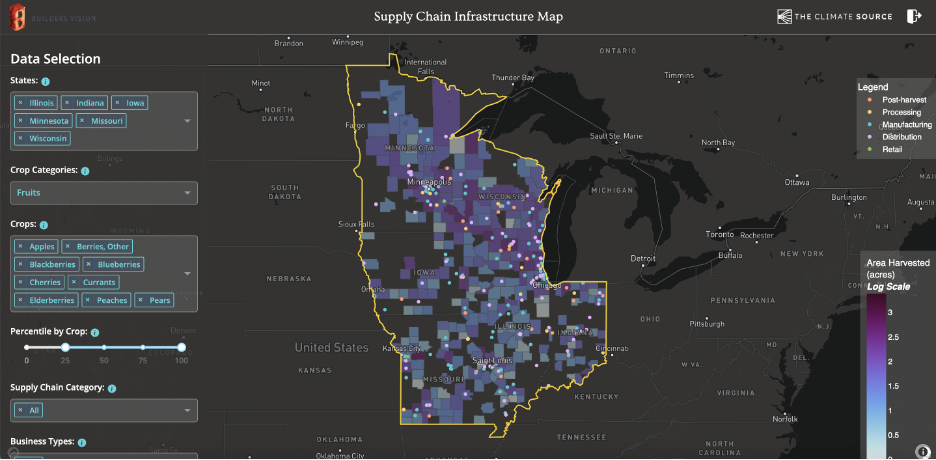

The October 2024 launch of the new “Supply Chain Infrastructure Asset Map” was the culmination of these efforts to fill the significant gap in information about the infrastructure for crops in the U.S. Midwest. After over a year of research, interviews, and partnerships with stakeholders across the sector, the Builders Vision team developed an interactive tool that provides a heat map of production zones and market access options.

It’s designed to be an instrumental tool in assessing opportunities and barriers for investing in supply chain infrastructure to advance a more diversified cropping system. “Our ultimate goal is to catalyze investment in the ‘missing middle’ of the supply chain, such as processing, storage, and aggregation,” says Haley. “The lack of investment, a key barrier to scaling diversified crops, has been fueled by a lack of shared insight and transparency into the existing supply chain. We hope this map will begin to address these gaps and improve collaboration across the system to ultimately scale up the cultivation of diverse crops for a more resilient and climate-friendly agricultural system.”

This digital, online tool is open to anyone and directly addresses the need for a better, more comprehensive understanding of the infrastructure for diversified crops. This first version focuses on diversified crops in the Midwest, including fruits, winter oilseeds, small grains, pulses, and tree nuts. Users can search by different criteria to pull infrastructure information by state, county, crop category, specific crops in each category, supply chain category, and business type.

Sample image from the Builders Vision Supply Chain Infrastructure Map

The data held within the tool was pulled together from a variety of sources. Production came from county level data from USDA NASS, census data, and Organic Integrity data, and the asset layer data came from Data Axle, Grain Major websites, manufacturers, and distributors. They supplemented this with data from the Builders Vision grantee network and expert interviews with producers, grower associations, cooperatives, brokers, millers, and extension programs for each cropping system and stage in the supply chain. The team then categorized activities by supply chain stage tailored to each cropping system to allow for the filtering capability and to support decision-making processes.

Unlocking Impact

The map has the potential to unlock critical system frictions for infrastructure development, investment, and the regenerative transition, and is intended to be a tool for stakeholders across the value chain including farmers, buyers, and investors. Below are a few sample use-cases for the map as a tool for different system stakeholders.

For Farmers

For farmers who have taken – or are seeking to take – the leap to produce diversified crops such as oats, elderberry, or any number of other crops that aren’t corn and soy, the challenge they often face is where they can process and sell their product. Landon Plagge farms 4,000 acres and raises about 10,000 hogs, chicken, and cattle in North Central Iowa. Over the past 10 years they have transformed their operation to 100% no-till, cover crops and diverse rotations. One of the key challenges of this transition, however, has been finding markets for small grains in the rotation, such as oats, wheat, kernza, and others. The pricing and logistics challenges are ones that he’s felt deeply in the past few years. So much so that he and a group of 65 farmers are investing in building their own oat mill. These farmers have put down about $5 million of their own money toward this $55 million dollar project. Once in operation, the mill could impact the rotation on 90,000 acres of cropland.

Landon explains the importance of a map in this context: “Having a map like this to look at and see where other mills are, at what other processing is out there, is helpful to just see what the opportunities are.” He goes on to explain that being able to identify where the major interstates are, where the supply chain is at, and where their products are going to have to go can help them better manage logistics and costs in the mid-supply chain.

Maggie Greenberg of The Climate Source adds that in their initial data collection process one of the points shared with them that stood out most was that the most profitable farms are those that are closest to the post-harvest facility.

For Buyers

Brady Barnstable is co-founder of 13-year-old, Minneapolis-based cereal brand Seven Sundays. He and his wife Hannah started the company with a dual mission to serve both human health and planetary health. One way they accomplish this is through healthy diversified ingredients and a commitment to supply-chain transparency, so they work as directly as possible with Midwest growers. The biggest challenge they’ve faced – especially as they have scaled – is sourcing and processing locally or regionally. They run into very similar missing middle challenges that farmers like Landon do, only from the other end of the supply chain. For some ingredients, like sunflower protein, Brady and their team have had to build their supply chain from scratch – piecing together the first processor, the secondary processor, and the manufacturer of the end cereal product. That’s a significant amount of logistical work, particularly for start-up brands.

This story, however, is not unique to Seven Sundays, it’s one that is repeated across emerging brands in the regenerative space. Not only are these companies building new brands, they are also working to build their own supply chains and creating important markets for farmers. In order to support these brands in their efforts to scale regenerative food for consumers, these supply chains need to be more readily available. The infrastructure map can aid in their building of these bespoke supply chains faster by allowing brands to more easily identify growers and processors within their regions. This can ultimately enable these brands to focus on building and scaling better products and companies.

For Investors

Sara Balawajder co-heads the Builders Bridge investment portfolio at Builders Vision and oversees the food and agriculture strategy. Her team has a very flexible mandate that allows them to use various financial tools – including providing debt and equity to early-stage ventures (pre-seed to Series A) and investing in funds. The strategy’s aim on the agricultural production side of food systems is to unlock frictions preventing growers from transitioning to sustainable production practices. “Very early on we identified that the missing middle of the food system was a major issue area for farmers – the processing infrastructure, and the lack thereof, or the underutilization of it, or the difficulty of finding it, we’ve come to understand as a major barrier,” says Sara. As such, they have made key investments in the missing middle to date, including Mad Markets (read more on this case here) and Agroforestry Partners (read more on this opportunity here and here).

In October 2024, Sara explained on stage at the RFSI Forum the tremendous amount of research and learning that is involved in making the decision to invest in a new supply chain, like agroforestry. This is one reason we often hear from fundraisers in the regenerative space that capital moves slowly – it’s often a result of investors needing to spend a lot more time learning a new sector, crop, or market. That’s why Sara is so enthusiastic about the new Supply Chain Infrastructure Asset Map.

“This map is just really exciting to help facilitate that information flow,” she explains. She goes on to share a whole host of questions that the map can address for prospective investors, enabling them to expedite the critical learning and decision-making process. Questions include:

- What existing processing facilities are already there?

- Where is this groundswell of farmer interest in growing new product types diversifying in their crops?

- Is there enough capacity in those existing facilities to meet that new demand?

- Is there underutilization of those processing facilities?

- How old is existing infrastructure and can investment help modernize it?

Sara also identifies the overarching systemic issue of matching supply and demand with what’s missing in the middle. She explains, “There’s a chicken and the egg problem.” On one side there are growers that “would love to grow these crops, but we have nowhere to process them.” And on the other side of the supply chain there are buyers that wonder, “where can we partner with farmers who really are seeking those processing facilities and building novel processing in those regions.” This map serves to fill some of that informational connective tissue between supply and demand that is so needed to move the chicken and the egg at the same time.

What’s Next for this Work?

As of December 16, 240 people had registered to use the map, spanning across sectors such as academia, CPGs, foundations, farmers, investors, and government. Builders Vision and their partners hope to see this number grow in the coming months. So what comes next?

The map that is available today, Haley explains, is a first iteration – a powerful one at that – but the intention has always been to share this with stakeholders that can benefit most from it and learn from their experiences. “The map has a ton of potential, and it took a lot to just get here,” she says. “We want to get feedback and see what type of data is needed to make it even more useful.”

The team wants to understand: is it being used, is it useful, who is using it and for what purposes, as well as what barriers users hit during use and what else they need from it. Over the first 6-12 months, the team will continue to collect data via user surveys and sift through and digest the feedback they received from the audience that attended a December webinar introducing the map. Then, they will decide what comes next and how to maintain or continue to build a tool that works to fill a critical gap in the missing middle.

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.