Nearly every week, RFSI News curates the latest news in regenerative agriculture and food systems investing, plus shares some stories of our own along the way, covering the latest strategies, players, challenges and opportunities that exist in the space.

This week, we are bringing you our first quarterly round-up of some of the highlights from the first quarter (January-March) of 2024. While we certainly don’t claim to have tracked all the deals, fund activity and other news happening across the world in this rapidly growing space, we do think digging into what we did track can add perspective, and over time, shed some light on emerging trends.

Have a read and let us know what you think!

Deals Tracked:

In Q1 2024, we tracked 19 investments deals or capital commitments made to the regenerative agriculture and food space, accounting for more than $722 million.*

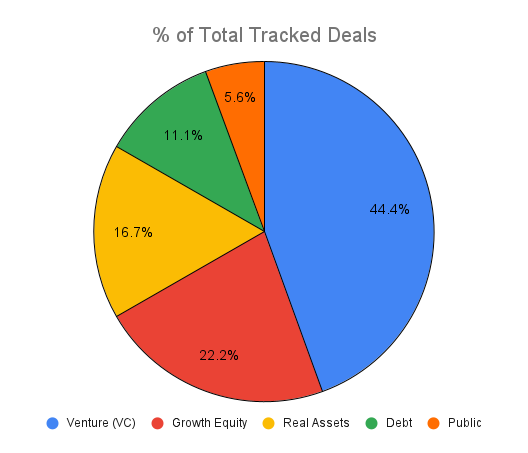

Venture deals led with 44% of the commitments, followed by growth equity (22%) and real asset investments (17%).

The largest deal tracked: M&G’s official announcement of €150 million commitment to the Regenerate European Sustainable Agriculture Fund, managed by climate impact investment managers, Regenerate Asset Management.

Top Investment Themes: Biologicals led in number of deals by theme, representing 32% of deals tracked. Farmland was close behind in number but led in total capital committed. Of note, were two commitments to the supply chain with public grant funding going to value add grain processing and Belgium-based The Nest’s commitment as a minority shareholder in fresh-frozen vegetable distributor, Ardo.

Signals of Recovery: RFSI continues to hear from our community that capital allocators are slow to commit and that many investors are reserving what capital they do allocate to support their portfolio companies. But despite this and an overall slow past 18 months for investment, there are signs of hope for the regenerative space. According to Agtech Navigator and the Q1 2024 Agtech Investment report from PitchBook expressed excitement about the regenerative ag space. Generally, the report claimed that “promoting and incentivizing sustainable farming practices in agribusiness market places not only enhances environmental stewardship but also fosters differentiation and value creation….” More specifically, it emphasized that “Regenerative Agriculture is gaining traction as a pathway to mitigate environmental impact and carbon footprint of agriculture, while also enhancing long-term farm health and productivity.” That VC led all investments by deal count in our Q1 tracking may be one indicator to support this belief that the regenerative space is remaining relatively strong.

Funds Launched in Q1:

Mad Capital officially launched their $50M Perennial Fund II to scale regenerative organic agriculture in the U.S.

A European food innovation coalition – including EIT Food and Foodvalley – has launched a €30 million portfolio to accelerate and scale regenerative agriculture.

Henry Dimbleby has set up investment firm – Bramble Partners – to transform global food systems.

Illinois has unveiled a $6.4 million food and farm infrastructure grant program.

Fund Closes in Q1:

Mirova, the world’s 10th biggest impact GP, has held a second close on Climate Fund for Nature, raising more than $200 million from corporate investors.

California-based venture capital firm Acre Venture Partners has closed a $140 million fund (Fund III) to invest in agrifoodtech startups to address climate.

Climate tech VC Satgana has reached an $8 million final close of its first fund, which aims to back up to 30 early-stage startups in Africa and Europe.

(Regen Adjacent) London-headquartered Cibus Capital, a specialist investment advisory firm focused on sustainable food and agriculture has closed its second mid-market private equity fund, Cibus Fund II, with more than $510 million in commitments, and its second venture fund, Cibus Enterprise Fund II (CE II), with over $135 million in commitments.

Funds in the Works:

Plans for a blended finance regenerative agriculture facility that could raise billions of dollars are underway, led by Pollination and the Green Climate Fund. A vehicle of this size could generate enough data to inform the rest of the world on how to transform 50% of global food production, Steven Lang of Pollination.

Corporate Commitments:

Walmart hits supplier emissions goal 6 years early.

Louis Dreyfus Company and The Nature Conservancy announced a collaboration on regenerative agriculture and deforestation- and conversion-free production

Walmart and General Mills are teaming up on remarkable project using 600,000 acres of farmland

Ceres Global Ag Corp Partners with Grupo Trimex are working together to advance regenerative agirculture initiatives

Regen Resources Released:

The long-awaited follow-on to SLM Partners’ foundational 2016 white paper on investing in regenerative agriculture has been updated to meet the needs of a new landscape for regenerative agriculture and invesment into it. For anyone interested in the space, this new white paper – called Investing in Regenerative Agriculture: Reflections From a Decade of Experience – is the necessary addition to the small but growing trove of literature on regenerative agriculture that exists today. Access report here.

Regenerative agriculture can increase crops and brands’ nutrient density, but consumers might not know it. The reluctance to trumpet nutrient density among brands may soon change, however, thanks to a new white paper by the Nutrient Density Alliance. Engaging Consumers on Regenerative Agriculture is aimed at helping farmers and brands measure and perhaps broadcast the nutrient density of their ingredients and products. Access report here.

The Yale Center for Business and Environment (CBEY) has realeased a new report examining options to improve and advance regenerative agriculture practices. “Bridging the Regenerative Agriculture Financing Gap,” proposes a new foundation for financing regenerative farms that takes into account the three factors that make financing regenerative agriculture difficult: outdated financial models; difficult financial returns; and cultural differences between farmers and investors. Access report here.

Global management consultancy Kearney released a new report revealing how food and healthcare systems can and should work in unison to unlock funding to create a healthy food future. The report, Food for thought: financing the food system transition, highlights the link between how we produce and process our food, and the health of our planet and its eight billion inhabitants. Access report here.

Coming in Hot! The link between how we produce food and human health and nutrition has taken a significant step into the spotlight in the first quarter of 2024. Of particular note, are the Nutrient Density Alliance’s white paper, ”Engaging Consumers on Regenerative Agriculture,” an announcement from The Rockefeller Foundation that it will invest an additional $80 million over the next five years to advance Food is Medicine programs in the United States, and a growing number of organizations taking this topic on from different angles (think: companies such as Edacious and non-profits such as Fresh Rx Oklahoma). We see this only picking up more steam in coming months and years. As awareness, resources, and research behind this movement grow, it’s likely that so will investment opportunities and investors and funds seeking to incorporate this into their approaches.

What did we miss? Send us a note and let us know!