Nearly every week, RFSI News curates the latest news in regenerative agriculture and food systems investing, plus shares some stories of our own along the way, covering the latest strategies, players, challenges and opportunities that exist in the space.

RFSI tracks investments and other capital allocations into regenerative agriculture and food systems initiatives, as well as investments and activities that can enable individuals and operations to transition toward regeneration. While we certainly don’t claim to have tracked all the deals, fund activity, and other news happening across the world in this rapidly growing space, we do keep our eyes on a lot of things. We think digging into what we did track can add perspective, and over time, shed light on emerging trends.

Here’s what’s happened in regenerative agriculture and food systems investment in Q2 (April-June) 2024.

(Updated 7/26/2024)

Investment Highlights

In Q2 2024, we tracked 34 investments deals or capital commitments made to the regenerative agriculture and food space accounting for more than $247 million.* In addition to these allocations, the USDA announced in April a record $1.5 billion commitment to the 2024 Regional Conservation Partnership Program (RCPP), representing another significant public allocation to the transition to regenerative practices.

Outside of the $1.5 billion RCPP commitment, the Q2 numbers represent an increase in the number of deals tracked over Q1 – there were 14 more this quarter – but represent a significant decline in the amount of capital committed. The total amount of deals was approximately one-third of the amount in Q1, due in large part to the smaller deal sizes in Q2

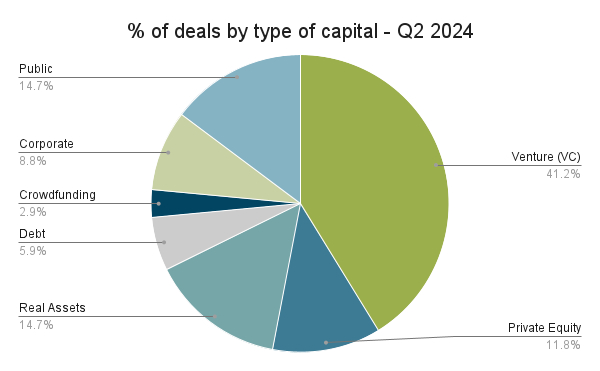

By deal count, venture capital investments represented 41% of total deals, followed by real asset investment in farmland and public commitments, each representing 14.7% of total deals.

*Includes investments into funds, companies, and grants programs. Total amount does not account for undisclosed financials.

Deals by Region: Deals originating in the U.S. represented 45% of all deals tracked in Q2 (or 15 deals), while another 10 deals came out of European countries. Asia and Africa represented four and 3 deals, accordingly.

Top Investment Theme: Investment in biologicals remained a strong theme in Q2, representing nearly 18% of deals. Investments into companies working on data and intelligence platforms represented nearly 15% of the deals and more than $34 million across the 3 investments that reported financials. These technologies ranged from Miraterra’s affordable soil measurement tool, to Climate X’s platform to help financial institutions report and manage climate risk, to Downforce Technologies’ digital measurement, reporting and verification startup in soil organic carbon measurement and prediction.

Beyond venture investments in diverse technology, investments in regenerative land use management and practice adoption was the focus of 20.5% of investments (or 7 deals). These represented all of the corporate investments tracked and the bulk of the public investments.

Insight: The apparent uptick in deal flow for this space in Q2 creates some reason for cautious optimism that investment outlook will continue to improve. Only time will demonstrate whether this will be maintained. The increased activity and allocation of funding (primarily corporate and public, here) to efforts to shift land use to regenerative management and practices is indicative of the increasing awareness of the positive environmental, climate, economic, and social benefits that these changes can bring… and even more than awareness – willingness to act on this awareness and allocate capital. These investments are an essential first step that need to be followed on and/or executed in tandem with investments that address other barriers to on-farm adoption – namely in the supply chain development and markets to ensure secure offtake for products and access to appropriately patient and non-extractive capital, to name a few.

Funds Launched in Q2

Three new funds were launched in Q2 2024 – all venture based:

Climate-focused investment and advisory firm Pollination launched the Climate and Nature Impact Venture Fund, aimed at investing in early-stage climate and nature solutions companies, with a primary focus on Australian startups. The new fund is targeting a final close of $150 million.

UK-based VC firm, Pelican Ag, formally announced their £50 million debut fund to invest in tech relating to regenerative agriculture, supply chains and nutritious food.

Octopus Investments, an investment manager investing in the people, ideas and industries that will change the world, has launched a natural capital strategy aiming to generate high-integrity carbon removal credits through comprehensive conservation and land use.

Fund Raises & Closes in Q2

Agriculture technology-focused venture capital firm Tenacious Ventures hits first close of second fund with an $18M raise in hard market.

LandFund Partners raised $25.6 million from five LPs – U.S. based endowments and foundation – for their Soil Enrichment Fund Blocker, according to the SEC and Agri Investor.

Corporate Achievements, Commitments, and Partnerships:

ADM’s global regenerative agriculture program expanded to more than 2.8 million acres in 2023, exceeding its 2 million acre goal. In addition, the company announced that it is targeting 3.5 million regenerative acres in 2024 and is increasing its 2025 goal from 4 million to 5 million acres globally.

The McKenna Institute at the University of New Brunswick (UNB) has announced a $3.75 million investment from a partnership led by McCain Foods and other New Brunswick institutions that will change digital agriculture, progress regenerative farming practices and minimize the impact of climate change on farmland. Over the next five years, McCain Foods is committing $2.76 million to create a project that imitates farming with regenerative agriculture practices, with the goal of increasing the uptake of more sustainable potato farming, globally.

Diageo will invest over €100m (£85.6m) to decarbonize its historic St. James’s Gate site in Dublin, where Guinness has been brewed for 264 years. The investment underpins the drink giant’s goal to accelerate to net zero carbon emissions for the site and will transform energy and water consumption with the aim to make it one of the most efficient breweries in the world by 2030.

Tetra Pak launches its 25th Sustainability Report that highlights a 47% reduction in operational greenhouse gas emissions since 2019 and launch of an aseptic beverage carton featuring a paper-based barrier, with 90% renewable content.

Chivas Brothers, the Pernod Ricard business dedicated to Scotch whisky and makers of Chivas Regal and Aberlour, announced a new agriculture program supporting sustainable farming practices among Scottish barley growers represented by Bairds Malt and Scotgrain.

Partnerships:

AgMission™, a global initiative co-founded by the Foundation for Food & Agriculture Research (FFAR) and the World Farmers’ Organisation (WFO) to unlock agriculture’s potential to reduce greenhouse gas emissions, has partnered with PepsiCo to award three grants to researchers in Australia, Mexico and Canada for a total combined $6.7 million investment to support evidence-based research on the effectiveness of climate-smart agriculture practices that incorporate regenerative agriculture principles.

ADM is collaborating with The J.M. Smucker Co. and the National Black Growers Council (NBGC) to support the adoption of regenerative agriculture practices across 20,000 peanut acres in the southeast United States.

CIBO Technologies has announced a multi-year strategic partnership with The DeLong Co., Inc. Through this collaboration, CIBO Impact will help farmers within The DeLong Co., Inc.’s grower network find, qualify for and enroll in regenerative agriculture incentive programs backed by the USDA and private companies with Scope 3 emissions targets.

A new partnership between Cargill and Nestlé Purina will support the adoption of regenerative agriculture practices across more than 200,000 acres of corn and soy farmland in the Midwest and is estimated to reduce the carbon footprint of the Purina grain supply from Cargill by up to 40 percent over the next three years. Cargill has advanced regenerative agriculture practices on 880,000 acres of North American farmland since 2020.

Insight: There’s been an observable uptick in 2024 in the number corporate commitment to regenerative agriculture goals, projects, and partnerships. We see this at both the brand level and the multi-national corporate level. There also seems to be an increase in reporting on achieved goals – see ADM exceeding 2 million acre goal above, a promising sign that we can move beyond reporting on promises alone. On one hand, the sheer number of operations talking about what they are doing shows how prolific regenerative is becoming. The conversation around what “our company” will do in the regenerative space, and how “our company” will engage appears to be penetrating diverse entities across the agriculture and food system. This should add pressure on even more to take this into consideration. On the other, that so many companies are sharing their regenerative work – with the understanding that it is good PR – does give pause to think about how one might vet what is authentic additive work to the space and what is greenwashing. Beyond this debate, this trend also represents an opportunity. With an increase in announcements of partnerships comes a sense that companies stepping into the regenerative space – into what might be new territory for them – do not want to go at it alone. It shows a willingness to find collaborative solutions working with organizations that can serve functions and fill their own gaps along this journey. It also is reminder of the tremendous opportunity there is for traditionally conventional operations stepping into the space to invest in relationships and partnerships with organizations that have on-the-ground expertise and experience building regenerative programs and systems.

Regen Resources Released:

Transformational Investing in Food Systems (TIFS) and Pollination, with support from The Rockefeller Foundation, released a foundational guide for mobilizing and scaling capital for the regenerative transition. Canvassing the market of available resources for financing regenerative agriculture solutions, Financing Regenerative Agriculture offers insights from key market participants and provides interested stakeholders with a broad catalogue of the innovative regenerative financing instruments currently being deployed globally.

On April 18, European Alliance for Regenerative Agriculture (EARA) launched a policy paper with recommendations for the European Common Agricultural Policy (CAP) called “Toward a farmer-centric CAP rooted in agrosystem health. Facilitating the transition of EU agrosystem”.

The deterioration of the UK’s natural environment could lead to an estimated 12% loss to GDP. In comparison, the financial crisis of 2008 took around 5% off the value of the UK GDP, while the Covid-19 pandemic cost the UK up to 11% of its GDP in 2020. This, according to a first-of-its-kind analysis, led by the Green Finance Institute (GFI) – that examines the impact of the degradation of natural ecosystems, both domestically and internationally, on the economy and financial sector in the UK.

A new report from AgFunder News highlights gaps and opportunities to invest in climate adaptation for smallholder farmers. Investment in climate adaptation reached an all-time high of $63 billion in 2021/2022, a 28% year-over-year increase, yet it declined as a portion of overall climate finance – to 5% from 7% – as climate mitigation finance grew at a faster rate, according to nonprofit climate researcher Climate Policy Initiative. Current investment is only fraction of what’s needed; low and middle-income countries alone need some $212 billion a year by 2030.

Download Q2 2024 Highlights here.

What did we miss? Send us a note and let us know!