Nearly every week, RFSI News curates the latest news in regenerative agriculture and food systems investing, plus shares some stories of our own along the way, covering the latest strategies, players, challenges and opportunities that exist in the space.

RFSI tracks investments and other capital allocations into regenerative agriculture and food systems initiatives, as well as investments and activities that can enable individuals and operations to transition toward regeneration. While we certainly don’t claim to have tracked all the deals, fund activity, and news happening across the world in this rapidly growing space, we do keep our eyes on a lot of things. We think digging into what we did track can add perspective, and over time, shed light on emerging trends.

Here’s what’s happened in regenerative agriculture and food systems investment in Q3 (July-September) 2024.

Download the Infographic here!

Investment Highlights

In Q3 2024, we tracked 34 investments deals or capital commitments made to the regenerative agriculture and food space accounting for more than $834.5 million.* While the number of deals remained unchanged from Q2, the amount of investment is a significant increase from the $247 million in the prior quarter. This is almost entirely explained by one deal – the combination agreement between Impact Ag and Riverstone Holdings-backed SPAC and the iconic Australian Food & Agriculture Company Limited (AFA).

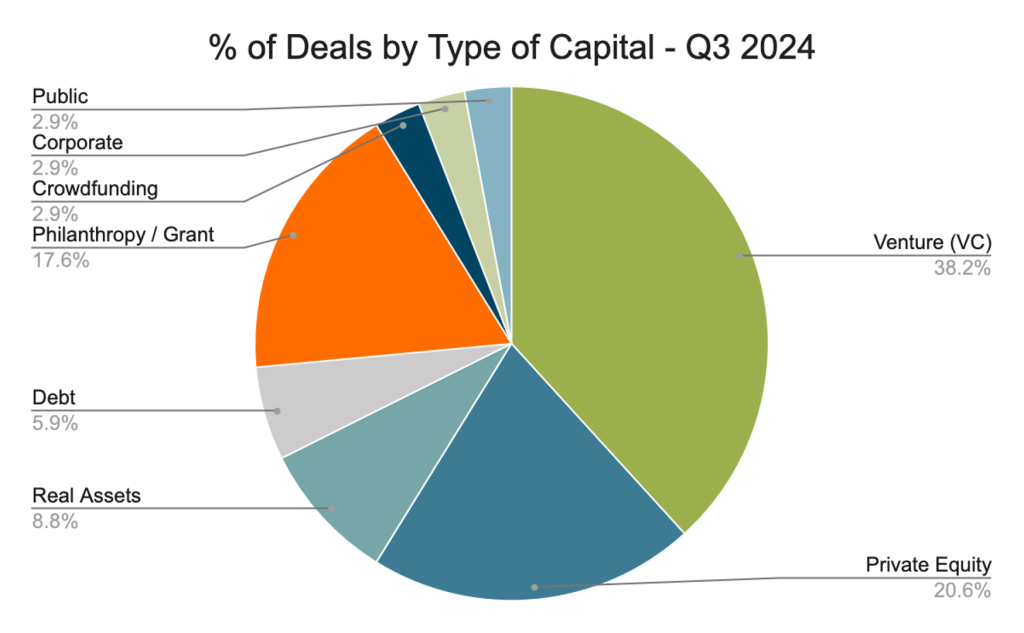

By deal count, venture capital investments represented the largest proportion – as it has in the past two quarters, with 38% of total deals, followed by private equity with 20%, philanthropy or grantmaking with 18%, and then real asset investment in farmland with 9%.

*Includes investments into funds, companies, and individuals from diverse investors and grantmakers. Total amount does not account for undisclosed financials.

Deals by Region: Of the deals tracked in Q3, two-thirds were made into the U.S., one-quarter into Europe, and the remainder were made into Canada, Australia, and South America.

Top Investment Theme: There was a new theme at the top of the deal count this quarter as investments into food companies and brands led with 6 investments. Two of these came from Grounded Capital Partners – a leader in holistic investment in regenerative systems who has a solid thesis behind later-stage investment in regenerative food companies. Not surprisingly, data platforms designed to help inform sector stakeholders – from farmers, to CPG, to investors – in the management of their operations and risks were also well represented with 5 deals. And of course, biologicals also had a role in the top deals tracked. In addition to fours deals in biologicals tracked, there were an additional three into companies serving the alternative inputs space in diverse ways, including processing infrastructure.

Insight: Glimmers of diversification in investment themes…Just as we are starting to hear more in our conversations about the important role investment in regenerative ocean-based systems can play, we tracked three deals this quarter that reflected this growing interest. One in seafood based fertilizer products and two in sustainable seaweeds. The latter two were out of Europe, where the thinking around investments in sustainable seaweed and sustainable oceans seems to be slightly ahead of North America. Stay tuned as this space gets more attention and perhaps more investment in the coming year. The three investments in ocean-based systems also represented another minor theme in Q3 deals tracked: processing. Five deals this quarter had some kind of processing or infrastructure for processing component to them – a welcome sign that investors are recognizing the importance of this piece of the supply system and that some are opening up to allocating capital to it. The strongest demonstration of this was the acquisition of Timeless Seeds by Mad Markets with backing from Builders Vision, Terra Regenerative Capital, Blueberry Capital and others.

Funds & Investment Vehicles Launched in Q3

Five investment vehicles focused on regenerative agriculture and food systems were launched in Q3:

Caspian Debt has introduced a new loan product to help Microfinance Institutions (MFIs) fund climate-adaptive agricultural products. The credit facility aims to boost farmer resilience against climate change. The initiative supports financing for irrigation systems and other sustainable farming solutions. Caspian Debt expects this to improve food security and farmer income.

Canopy Farm Management has launched a perennial crop investment vehicle, Second Story Farms LLC (2SF), to develop the next 1,000 acres of agroforestry in the Midwest. Backed by anchor investors – Zarpet Family Foundation, Zellis Family Foundation, and Matthew Zell Family Foundation – 2SF is targeting a $10 million raise and is uniquely positioned to expand agroforestry and its benefits in the region, while supporting the next generation of agroforestry farmers.

Terra Regenerative Capital has launched its first fund aimed at closing a major gap in the regenerative agricultural system: the often overlooked and underfunded middle supply chain. The Leaders Fund – aptly named for the systems leaders it aims to invest in – has already invested $2 million in a demonstration portfolio and secured a $10 million anchor investment on its path to a $50 million final close. With a systems-based investment strategy, Terra Regenerative Capital (TRC) is poised for catalytic impact.

Carbon assets and investment manager Silva Capital has announced the launch of the Silva Carbon Origination Fund, aimed at providing access to large-scale, high-integrity carbon credits from nature-based projects in Australia targeting reforestation and sustainable agriculture. Alongside the launch, Silva announced the first close of the fund, with mining companies Rio Tinto and BHP and airline company Qantas collectively committing A$80 million as foundation investors.

The Land Group announced its formal launch, after several years of operating in stealth. The company acquires, transforms, and operates farmland – employing regenerative approaches to deliver consistent, financially compelling, and environmentally sustainable investment returns and asset appreciation. Partnering with sophisticated investors, The Land Group offers uncorrelated returns through asset management and operational services.

Fund Raises & Closes in Q3

Dirt Capital Partners, a real asset impact investment company with a unique focus on improving farmer access to land, has raised more than $30 million upon the third close of its latest impact first farmland fund. Investors include the Schmidt Family Foundation, Cienega Capital, The Woodcock Foundation, DF Impact Capital, Blue Sky Social Justice Fund, High Impact Fund I LP, The Mighty Arrow Family Foundation, and others. The fund is targeting a final close of $50 million at the end of the year.

Conservation Resource Partners has closed its inaugural North American farmland private equity fund, Conservation Resource Capital VI, L.P. The Fund features an innovative, impact-focused strategy that seeks to develop and monetize the agricultural and environmental values of the properties in which it invests. Forty-nine limited partners – featured institutional as well as high net worth investors, from both North America and Europe – committed to the Fund.

Climate Asset Management – a joint venture between HSBC Asset Management and climate change investment and advisory firm Pollination – has raised over $1 billion for natural capital projects with the final close of its Natural Capital and Nature Based Carbon Funds, alongside its Restore Fund with tech giant Apple.

LandFund Partners’ open-end Soil Enrichment Fund has grown to $165 million, according to a US Securities and Exchange Commission filing. The Fund was launched in 2021 and seeded with $128 million of farmland comprised of 20,100 cultivated acres. The strategy focuses on reducing and sequestering carbon emission through regenerative farming practices in the US Mid-South.

Fractal, a US-based company helping to solve a key gap in farmer financing, has announced an expansion of their farmland co-investment product. Fractal has raised more than $15 million of capital and has deployed $8 million to leading farmers across five midwestern states over 12 deals.

Corporate Achievements, Commitments, and Partnerships:

RFSI tracked eight new or expanded corporate commitments from multi-national CPG companies, including Mars, PepsiCo, General Mills, Unilever and others.

We also shared an update from One Planet Business for Biodiversity (OP2B) coalition, one of the first private sector regenerative agriculture initiatives, convened by the World Business Council for Sustainable Development (WBCSD), which has reached some impact milestones as it celebrates its five-year anniversary. The coalition of agriculture value chain actors have invested $3.6 billion in the regenerative transition, enrolled 300,000 farmers in programs; and build at 3.9 million hectare regenerative agriculture footprint on their way to a 12.5 million hectare goal by 2030.

Regen Resources Released:

Smoketown has released a white paper, “Unlocking Demand for Regenerative – A Crowdsourced Blueprint for Accelerating Consumer Demand for Regenerative Agriculture.” The resource serves as a crowdsourced blueprint that has gathered the best practices and lessons learned from over 20 regenerative industry leaders across 18 brands and other companies who are shaping demand for regen. It is designed to help accelerate consumer demand for regenerative products.

Manulife Investment Management has recently released three reports detailing how it incorporates financially material climate- and nature-related investment considerations into its asset management and portfolio construction capabilities. Their Natural Capital Sustainability report highlights the importance of natural capital to institutional investment portfolios, the dependency the world has on these assets, and how these investments can create value beyond the physical products they generate. Manulife Investment Management’s integration of regenerative practices across its agriculture portfolio continues to focus on producing more food with a smaller footprint.

What did we miss? Send us a note and let us know!