Nearly every week, RFSI News curates the latest news in regenerative agriculture and food systems investing, plus shares some stories of our own along the way, covering the latest strategies, players, challenges and opportunities that exist in the space.

RFSI tracks investments and other capital allocations into regenerative agriculture and food systems initiatives, as well as investments and activities that can enable individuals and operations to transition toward regeneration. While we certainly don’t claim to have tracked all the deals, fund activity, and news happening across the world in this rapidly growing space, we do keep our eyes on a lot of things. We think digging into what we did track can add perspective, and over time, shed light on emerging trends.

Here’s what happened in regenerative agriculture and food systems investment in Q4 (October-December) 2024.

Download the Infographic here!

Investment Highlights

In the final quarter of 2024, RFSI tracked 23 deals in the regenerative agriculture and food space accounting for $215.7 million*, representing the lowest quarter of investment (by dollar value) of the entire year. Outside of this relatively unexciting result, there was a bright light in the form of the November announcement of the allocation of a record $1.5 billion from the USDA, through the Regional Conservation Partnership Program (RCPP), to 92 conservation and climate-smart agriculture projects. The quarter also enjoyed significant activity on related fronts – including funding vehicles and platforms launched, capital commitments made, and lots of reports! Read on for more details and be sure to scroll all the way to the bottom for a bunch of new reports on regenerative agriculture and food systems released in Q4.

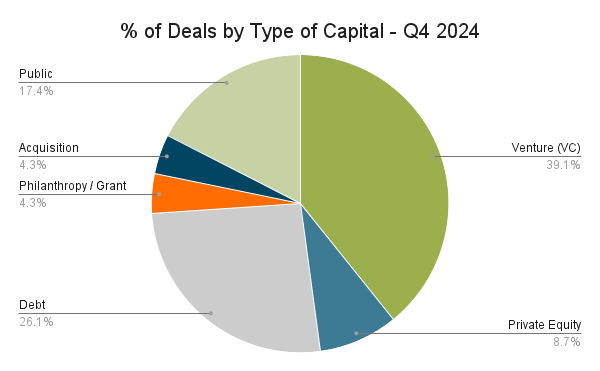

Venture-backed deals remain the largest proportion of overall deals (by deal count) – as it has for all of 2024, accounting for 39% of total deals in Q4, followed by debt representing 26% of deals and public funding representing 17%. Equity, acquisitions and philanthropic grantmaking each represent less than 10% of total deals tracked.

*Includes investments into funds, companies, programs and individuals from diverse investors and grantmakers. Total amount is not claim actual investment totals as it does not account for undisclosed financials.

Deals by Region: Of the deals tracked in Q4, The U.S. and Europe led – both with 39% of the deals tracked. However, in terms of dollars invested, the U.S. accounted for just one-third of total, while Europe accounted for 54% – a change from the previous quarters where the U.S. led significantly in count and investment totals. The remainder of the investments were made into Canada, Africa, Asia, and Australia.

Top Investment Theme: Unsurprisingly, biological based input innovation led the number of deals in Q4, much like it did in the first half of the year. Not as expected, is that investment and funding into farmers practice adoption – largely in the form of debt financing and grants was a close second, representing more than 20% of deals.

Insight: The high prevalence of debt and grant funding for on-farm practice adoption is a good sign! On-farm practice adoption is a (if not the foundational) critical lever for transitioning to regenerative food systems, but often requires investment on the farmers’ part to learn, alter inputs, change equipment and much more. While these investments are often expected to pay off for the farmer – in economics and increased resilience – they can serve as a barrier. Financial support in the form of outside investment or financing must meet the farmer where they are. This means traditional VC funding with it’s high return expectations and need for an exit is almost never a fit and equity is often not the route that fiercely independent farmers would prioritize (although the innovation in this space to meet farmers’ situations is encouraging). Debt and grant capital are essential to the on-farm transition as these are non-dilutive to the farmer and when done with the right terms can support farmers during what can be a more financially tight transition.

New Funding Vehicles & Platforms Launched in Q4

We continued to see new funding vehicles and platforms dedicated to regenerative agriculture crop up in Q4, with the launch of these four:

The Land Group announced its formal launch, after several years of operating in stealth. The company acquires, transforms, and operates farmland – employing regenerative approaches to deliver consistent, financially compelling, and environmentally sustainable investment returns and asset appreciation. Partnering with sophisticated investors, The Land Group offers uncorrelated returns through asset management and operational services.

Santiago, Chile-based investment fund Toesca Asset Management and London-based global sustainable real-asset investment firm Astarte Capital Partners, have partnered to establish an institutional platform focused on regenerative agriculture investments in Chile and the broader Latin American region. This first fund, Toesca Permanent Crops II is set to invest US $350 million in a diversified portfolio of permanent crops based on regenerative and sustainable practices, with Toesca and Astarte already having committed c.$45 million as sponsor capital to start investing in the strategy.

The Green Climate Fund (GCF) has approved funding from its Project Preparation Facility to Climate Asset Management to develop a combined blended finance and technical assistance facility. This facility will aim to accelerate the scaling of regenerative and agroecological landscapes, advancing climate adaptation, mitigation, and food security, whilst enhancing the livelihoods of smallholder farmers in Sub-Saharan Africa.

Privium Fund Management has launched a new biodiversity impact fund. The Biodiversity Impact Fund (BIF) will focus primarily on core themes such as regenerative agriculture, sustainable forestry, ocean preservation and sustainable fishery.

Fund Raises & Closes in Q3

Amsterdam-based Pymwymic, an impact investment firm, has closed its Healthy Food Systems Impact Fund II at €71.5M, surpassing the target of €70M. Over 250 private investors and seven institutional investors – AGCO, ASR, Invest International, Invest-NL, Klaverblad Verzekeringen, Oost NL, and Van Lanschot Kempen, backed the fund.

The Blue Revolution Fund (BRF) – an aquaculture impact investment fund established by Hatch Blue and advised by The Nature Conservancy – has closed with €93 million in commitments. These commitments will enable BRF to invest in more than a dozen early-stage aquaculture ventures, with the aim to improve ocean health, address the impacts of climate change and support coastal communities.

Insight: In our Q3 Round-Up, we shared an uptick in investments in sustainable oceans and the blue economy, explaining how this confirmed the increasing interest we are also hearing about across the investor community. In Q4 this momentum was sustained as we tracked another investment in the space – in Canada’s Cascadia Seaweed – as well as the launch of Privium’s Biodiversity Impact Fund that will look into sustainable fisheries and the close of The Blue Revolution Fund with €93 million in commitments. (See announcement for both above.) We also recently shared a piece from World Economic Forum outlining four reasons why 2025 might be the year we start to see progress toward regenerative blue economies.

Corporate Achievements, Commitments, and Partnerships:

In 2024 we saw a number of food and agriculture corporates adding or expanding to their regenerative agriculture commitments, some with more ambitious goals than than others. Many commitments are made on a certain amount of acres and adoption of regenerative practices. We will be following their implementation and are looking forward to impact reports that describe the outcomes of these programs.

General Mills, Walmart and Sam’s Club announced a collaboration to help accelerate the adoption of regenerative agriculture on 600,000 acres in the U.S. by 2030. This represents the approximate number of acres General Mills engages to source key ingredients for its products sold through Walmart and Sam’s Club. Initial projects will be supported through grants administered by the National Fish and Wildlife Foundation.

Cargill RegenConnect® has surpassed one million enrolled acres for the 2025 U.S. planting season, a milestone that underscores Cargill’s ongoing efforts to support farmers in adopting regenerative agriculture practices.

Fresh Del Monte expanded regenerative agriculture practices across its farms by 10.9% between 2022 and 2023 as the produce giant sets new targets on human rights and discloses that it’s accomplished some sustainability goals early. The company has a goal of implementing regenerative and soil health management practices on all owned and associated growers’ farms by 2030.

The Soil and Water Outcomes Fund, an agricultural ecosystem services program, announced that McCormick & Company, a global leader in flavor, has joined its Midwest Climate-Smart Commodity Program. In collaboration with PepsiCo the organizations will provide greater financial and technical support to farmers enrolled in the Midwest Climate-Smart Commodity Program helping to drive adoption of voluntary, regenerative agriculture practices.

Mars Inc. has announced collaborations to provide financial incentives to farmers as they implement regenerative agriculture practices in North America. These partnerships aim to encourage wheat, corn and rice farmers in select regions to implement regenerative agriculture practices, contributing to Scope 3 carbon reductions as part of the Mars Net Zero Roadmap. Multi-year partnerships have begun with partners and suppliers.

Nestlé’s Purina has committed to regenerative agriculture across its European pet-care sectors and has secured partnerships with Sols Vivants in France and LENS in the UK, Italy, Hungary and Poland. These partnerships come as part of the commitment to source 20% of key ingredients from farmers, adopting regenerative agricultural practices by 2025 with a target of 50% by 2030.

Report Alert! Regen Informational Resources Released:

The inaugural report, State of Regenerative CPG Report, synthesizes ReGen Brands’ proprietary learnings from almost three years studying regenerative CPG, including 80 podcast episodes interviewing brand executives and other key ecosystem stakeholders. The report details the ways regenerative brands are winning today, along with the key challenges they face on the road to additional progress.

Gullspang re-food and and Adam Partners, have published a new report – Food is Investable – on why venture capital, private equity, and infrastructure funds should consider agrifood in their investment strategies. Despite the agrifood sector’s critical role in sustaining life and driving 12% of global GDP, in 2023, agrifood was only 2% of private equity’s total assets under management and received only 5.5% of global venture capital. From a climate perspective, it’s even more underinvested: Agrifood emits 26% of GHG emissions but attracts just 1.3% of climate-focused private capital. This is concerning, given the sector’s potential for massive impact and financial returns.

A team of MBA students from the Berkeley Haas Sustainable Food Initiative, in collaboration with Ideagarden Institute, have conducted a new study titled Flourishing Farmer: Business Models for Regenerative Agriculture. The report examines innovative business models ranging from small community-rooted farms and food hubs to large-scale vertically integrated operations and impact investors.

Global interest in regenerative agriculture is gaining traction, but few corporates have allocated financial budgets to support transition finance needs, according to global climate and nature investment and advisory firm Pollination. They have published a new report, Resilient Farms and Food Supply: Who Foots the Bill?, that explores what food industry leaders and companies can do to bridge the capability gap and find solutions for meeting the cost of transforming global food systems.

Yorkshire farmer and entrepreneur Alastair Trickett has published his Nuffield Farming report: The Role of Corporate Supply Chains in Scaling Regenerative Agriculture – A Farmer Perspective. In the 45-page document that is based on research across the U.S. and Europe, he explores the current situation of farmers trying to transition, the role corporates are playing today, and what might make their role in the transition more effective.