Part 2 in our series: How Investment Capital Can Enable Profitable Regenerative Agriculture

Regenerative agriculture CAN be significantly more profitable than conventional agriculture because the system of practices can lead to lower input costs; the ability to grow higher value crops and access new markets and premiums; and as an additional benefit, increase resilience, reducing risks associated with volatile weather. However, even if regenerative can lead to better economic outcomes – there is still initial risk during the process of the change, when transition costs – both human and financial – are highest, and premiums are not yet attainable. Barriers to transition include the challenge of behavior and cultural change, a lack of trusted technical assistance, inadequate regenerative supply chains, and the need for financial capital and incentives to take on the risk. These barriers can be significant, but diverse forms of capital can play a role in addressing them.

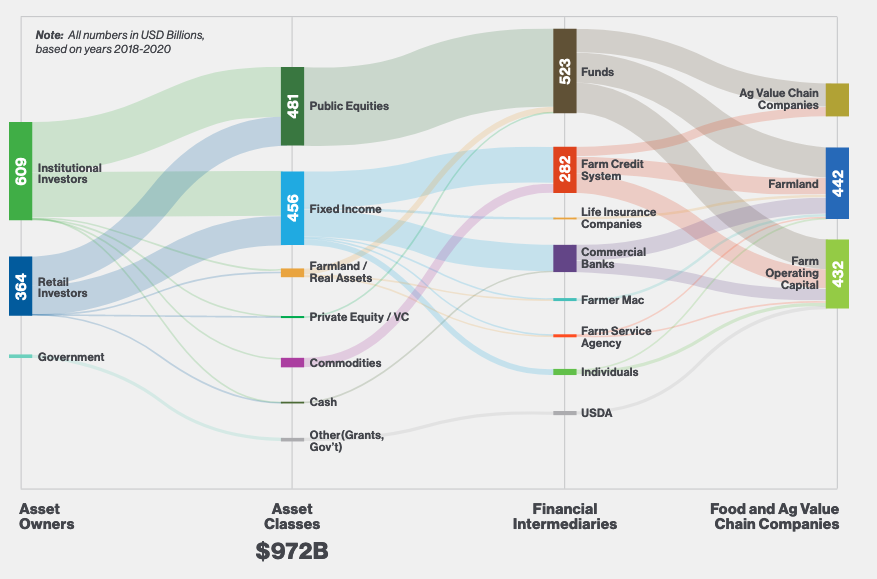

Capital Flows to Agriculture

In 2020, $972 billion in capital flowed to agriculture from capital allocators, according to the USFRA Transformative Investment Report. The largest portion of that came from institutions, while government capital represented only a small fraction. On the receiving end, farmland received the most allocations, followed by farm operating capital and then ag value chain companies. As one might expect, of this almost $1 trillion, very little flowed to regenerative operations but that’s not necessarily because the opportunity doesn’t exist.

Annual Agricultural Capital Flows in the United States

In the US alone, the 2020 Soil Wealth Report estimated that more than $700 billion in investments will be needed over the next 30 years to scale the regenerative agriculture market — and that that investment will generate $10 trillion in net financial returns. $10 TRILLION!

Yet, to that point in 2020, only $47.5 billion in investment in regenerative had been executed.

So, there is significant opportunity remaining… and funders are increasingly catching on to this. In the past few years alone, we’ve seen the interest and dollars in this space increase. In fact, from 2018 to 2020 we saw a dramatic increase in funding in companies and funds working in regenerative – from $49 million to $1.35 billion (using a sample of 128 companies as reference), according to CREO Syndicate’s report Unlocking Investments in Regenerative Agriculture.

A New Crop of Investors

Despite a healthy skepticism from farmers about outside investment in agricultural operations, an increasing number of investors and funders are seeking to use their capital to advance the goals of scaling regenerative by addressing barriers – including risk, lack of capital, technical assistance, and new markets. Just as farmers are looking at shifting practices and mindset – the capital flowing into agriculture is doing the same.

A new crop of investors seeking more than just capital returns is emerging – they want to build solutions and generate impact. They are looking for some of the same public and private benefits that also drives farmer and consumer interest, according to the Soil Wealth Report. These include nutrient cycling, carbon storage, sustainable livelihoods, improved yield stability, water quality and quantity, public health and nutrition, and more.

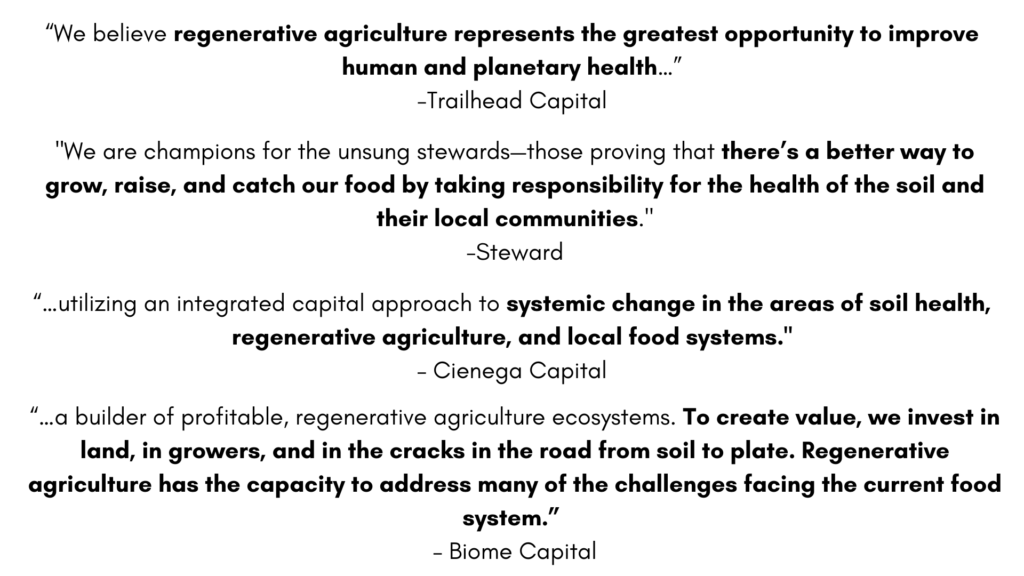

This group of capital allocators is starting to understand the interconnectedness of the food system – and particularly that soil health and the way we do agriculture impacts the entire system. We can see this change in investor interest, approach, and mindset in the language that they use and the investments they make. These investors speak of improving human and planetary health, systemic change through soil health, and using regenerative agriculture as a tool to address food systems challenges. Their words and their investments demonstrate an increasing understanding that the connection between soil, human, ecological AND economic health is far deeper than once thought. They are not perfect, but they do represent progress toward regenerative food systems investment.

Samples of Language Used by New Crop of Regenerative Food Systems Investors

With this new crop of investors, we are seeing increased capital flow to regenerative farming and food. Most of this is flowing to the two ends of the value chains – to the farm and to the consumer.

Along the value chain we’re seeing capital flow to farmland, first and foremost. $22.8 billion of the $47.5 billion already invested in regenerative agriculture has been in farmland and real assets. We’ve seen an increasing number of funds and REITS designed to invest in the transition of land from conventional production to regenerative in the past 2-3 years. New funds like Clear Frontier and Biome Capital join veterans operating in the space like Iroquois Valley Farmland REIT and SLM Partners.

We also see increasing investment in new solutions and technology that support the farmer and enable regenerative production – examples of this, are investments in inputs (like biologicals) and tools and services (think innovative fencing systems for pastured livestock) and of course we also see capital flowing to carbon markets.

On the other end of the value chain, the consumer side, we’re seeing investment in new food brands and technology to support CPGs in measuring the impact of their supply chains, companies like HowGood.

Investment in these areas alone, represent tremendous growth opportunity for the next decade and beyond, but we can’t build a truly regenerative or even sustainable system if some of the pieces are missing.

Where we haven’t seen tremendous investment YET and where there is a great white space for increased research, attention and ultimately investment is in what we call the missing middle. The infrastructure, processing, and distribution of regenerative crops into regenerative ingredients and end products. Even though Covid-19 shone a bright light on the weaknesses of the conventional supply chains we’ve built, the capital is not flowing there at the same rate as it does to the ends of the value chain. But this is changing – an increasing number of individual investors and funds, such as the Regenerative Harvest Fund from Mission Driven Finance, are seeking to learn about the opportunity to invest in the middle and as a result the supply chain should continue to strengthen.

So how exactly is this increasing investment in regenerative agriculture addressing the barriers to transitioning to regenerative practices? Let’s take a look.

The Role of Investment Capital

There is increasing innovation going into designing financial vehicles that address the barriers to regenerative adoption – including risk, capital, technical assistance and new markets. Just as the approaches to the way we farm need to and are shifting, so too are the approaches to investing in agriculture and this has been particularly true in debt finance. Here, the evolving approaches to investment seeks to de-risk transition and there’s an increasing number of organizations taking this on.

Mad Agriculture and their Perennial Fund stand out among these organizations as a pioneer in debt vehicles that put farmer realities front and center. The non-profit developed a new type of loan to address the gaps that exist from a lack of adequate bank and Farm Bill funding for land stewards. What’s different about this vehicle is that the team understands the risks of transition and has developed a system to address the barriers that can get in the way of success. They have set up a long-term (10-year) revolving operating loan that is low-cost and offers flexible repayment options, so that producers aren’t bearing the brunt of expense during the riskier transition period. The Fund’s team works with growers to assess resources, create a transition and business plan, and provide technical assistance throughout the transition. Finally, the team also works to secure end markets for regeneratively produced products to ensure those transitioning are able to capture the premium value of their regenerative crop.

rePlant Capital, whose mission is to improve farmer profitability and environmental outcomes through financing the transition of farmland to regenerative and organic agriculture, is another example of a capital allocator taking an innovative approach. In collaboration with farmers, agronomists, and food companies, rePlant seeks to build a new financial system that can support the scaling of a new agricultural approach that provides important ecosystem services. They do this by deploying capital to farms through an evergreen private debt fund. One unique way they approach some of the barriers, is by working through the supply chain to support farmer transition. Through their foundational fund, Soil Fund, rePlant finances multi-million dollar farmer transitions through partnership with large multinational food brands like Danone North America.

The Regenerative Harvest Fund from Mission Driven Finance is innovating beyond the farmer level to also finance processors and packagers in order to close a capital gap in a supply chain from harvest to market. The fund, which will also seek to serve underserved and overlooked communities, will offer flexible debt and debt-like financing ranging from $200,000 to $1 million and ranging from 6 months to 3 years. The fund is only available to accredited investors. If investors choose lower rates, the fund passes on those cost savings to the farmer, processor, or packager.

Steward, led by innovative founder Dan Miller, is an online lending platform that makes it easy for almost anyone to financially back regenerative agricultural projects and businesses. The company started by funding land acquisitions and debt, but much like Mission Driven Finance, has seen the need to shift lending capital to middle-market infrastructure projects that will help build more robust market opportunities for farmers and other food producers. Currently the platform offers two pathways for lending – an evergreen, Steward Regenerative Capital, which provides short-term bridge loans, and individual lending campaigns for specific projects ranging from $10,000 to over $1 million. Stay tuned as more projects come online and the young company continues to innovate with new funding opportunities.

A Call for Continued Innovation in Finance

The debt models described above are only a few examples of innovative models being developed to address barriers to farmer transition and expansion of regenerative practices.

Beyond these examples, there is an entire ecosystem of financial vehicles developing to support the transition to a regenerative food system. This ecosystem includes new venture capital funds, private equity funds, banks, crowdfunding platforms, and public and private grant vehicles seeking to strategically invest not only in farmers and farmland themselves but also in the technology and tools that enable transition on the farm, the processing and infrastructure that can help get regenerative products to premium markets, and the food companies that are building regenerative supply chains and consumer products. We’ll explore these in more detail in future pieces.

These examples and others also represent investment opportunities for a variety of types of funders, as they each were brought to life and will continue to evolve through capital campaigns fueled by investors. The innovation that these models represent is welcome and more of it is needed, as is the capital to seed and grow them. In turn, these will continue to reduce the barriers inhibiting adoption of profitable regenerative farming.

This is part 2 of a series: How Investment Capital Can Enable Profitable Regenerative Agriculture. To read part 1: Is Regenerative Agriculture Profitable? click here.

The articles in this series are based on a February 2022 presentation from Sarah Day Levesque on the same topic.

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.