Impact Ag Partners has been in the business of building natural capital for more than a decade. Founded in Australia by Bert Glover, the goal was to build a differentiated asset management offering to serve the increasing number of investors who were looking for long-term investments in agriculture with a focus on building financial wealth, environmental wealth, and social wealth. Today, the firm boasts AU$600 million assets under management (AUM), 7-11% returns for clients, and AU$1 million in soil carbon credit revenue. These are great achievements, but another enormous and under-recognized contribution that Impact Ag Partners brings to the space is experience and data that supports the case for investing in regenerative agriculture and building natural capital.

Data is a key missing link inhibiting broader-scale adoption of regenerative agriculture. It’s key in helping those already operating in the space refine their practices – whether those are on-farm practices or investment strategies. It’s also essential for building credibility among those who are just starting to peer over the figurative fence to see what regenerative agriculture, and investing in it, is all about. Regenerative management of several properties in Australia over the past decade has allowed Impact Ag to collect years of data to start to fill this data gap and tell the story of what a powerful investment natural capital can be.

“It’s getting easier and cheaper for us to collect huge amounts of data on farm to demonstrate the positive changes we’re having in the landscape,” says Toby Grogan, Chief Operations Officer & Natural Capital Manager at Impact Ag Partners. “And in sharing the positive impact we’re having with climate, nature and our produce, we’re getting access to new and improving income streams back to the farm gate.”

Here we share three micro-case studies from their work that support how changes in land management can build natural capital and improve farm economics by decreasing costs and monetizing natural capital.

Case Study 1: MONETISING ON-FARM NATURAL CAPITAL

Project Start: 2010

Project Description:

Impact Ag Partners were engaged to assess opportunities to monetize on-farm natural capital and explore multiple options in regulated and private markets. Sequestering carbon into our soils has great potential at scale to reduce atmospheric CO2 and effectively address the global climate crisis. A driver for Impact Ag Partners client was to be part of this solution. With operations across the New England/North West of New South Wales, they have integrated principles of regenerative agriculture to maintain productivity balanced with enhanced ecological health. This carbon project was the next step in building their capacity to deliver an alternative income stream while future-proofing their assets.

Regenerative Practices Used:

- Rotational grazing – using a small number of large herds moving frequently across the landscape and grazing small areas for short periods of time and not returning for a considerable period of time. In essence, planning, rest and matching stocking rate to carrying capacity, optimizing livestock numbers in order to harvest grass efficiently

- Reduction of inputs and exclusion of synthetic fertilizers.

- Mixed species pastures and tree plantings.

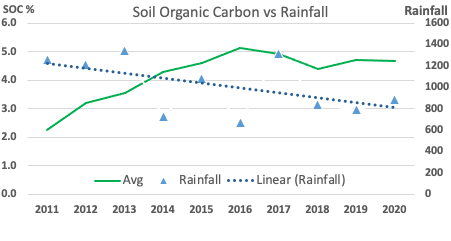

- Annual soil analysis to track changes in fertility and soil carbon

The Outcomes:

- Continued sequestration of soil carbon in a changing climate. The investment builds the on-farm natural capital assets and drives the means to effectively create pathways for addressing current global challenges.

- Having been successful in meeting these challenges through management that supports significant emission drawdown while future-proofing the asset and delivering long-term investment returns.

Natural Capital Monetized: Carbon credits sold starting in 2021.

Case Study 2: A JOURNEY TO LANDSCAPE RESTORATION

Project Started: 2018

Project Description:

To regenerate a dysfunctional and degraded landscape after a failed timber plantation that resulted in great losses in natural assets through many years of mismanagement.

Impact Ag Partners’ strategy was to implement regenerative agricultural practices and principles, coupled with a visionary management team to turn the property into an ecologically functioning and climate-positive profitable beef enterprise. In addition, to ensure Management have resources, training, and technology they need to make informed decisions backed by data.

Regenerative Practices Used:

- Rotational grazing – using a small number of large herds moving frequently across the landscape and grazing small areas for short periods of time and not returning for a considerable period of time. In essence, planning, rest and matching stocking rate to carrying capacity, optimizing livestock numbers in order to harvest grass efficiently

- Reduction of inputs and exclusion of synthetic fertilizers.

- Planting deep rooted, legume trees, Leucaena for fodder with mixed species perennial pastures enabling productive and vigorous biomass growth that provides high ground cover year-round, maximizing water capture and reducing run-off and erosion.

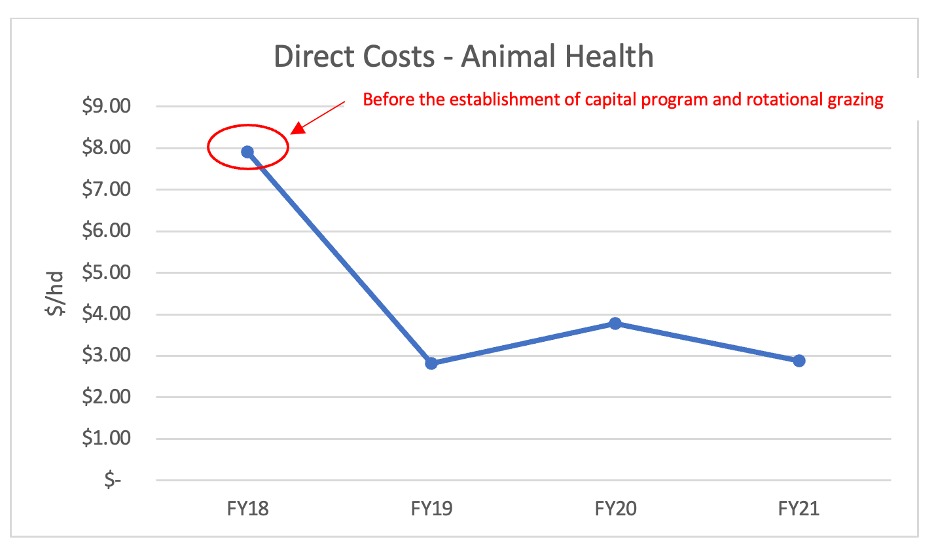

- An extensive infrastructural upgrade that included the development of a pasture/fodder system that has supported the integration of livestock. Integral to this success was the adoption of time-controlled grazing regime that has been effective at matching the land’s carrying capacity with livestock numbers.

The Outcomes:

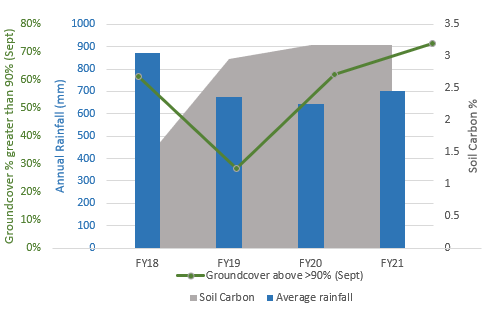

- Regenerated landscape and increased soil carbon

- Decreased input costs

- Increased productivity more than two-fold since acquiring the land.

Natural Capital Monetized: Not yet.

Case Study 3: A NEW APPROACH TO GRAZING MANAGEMENT

Project Started: 2015

Project Description:

Successive years of droughts and depressed commodity prices, coupled with looming social license pressures, compelled this farming management team to take action and reinvent the way it does business.

Impact Ag Partners client recognized the need to transform and build future resilience into its business model, embarking on a change management journey in 2016.

The evolution of the business from traditional grazing practices to a modern, productive, and profitable land manager, demonstrates how investing in change through data-driven decisions and enlightened stewardship, generates value across financial, environmental, and social indicators.

Investing in a grazing management software tool that supports the decision-making process and enables the on-ground team to make confident decisions in variable climatic conditions.

Regenerative Practices Used:

- Time controlled rotational grazing, matching stocking rates to carrying capacity and removing livestock from paddocks during reduced rainfall periods.

- Soil monitoring and amelioration

- Tree plantings

- Reduction of inputs, particularly synthetic fertilizers

The Outcomes:

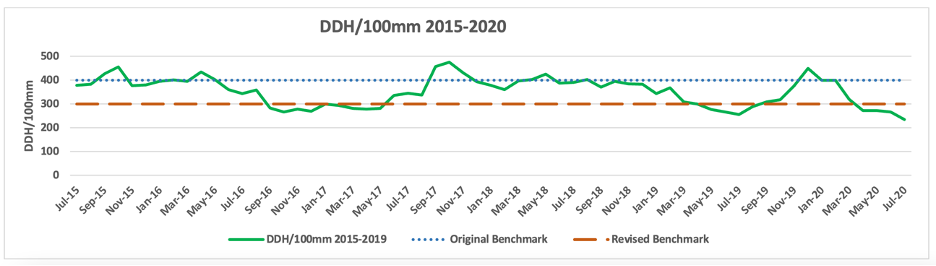

- Being an early adopter of the “MaiaGrazing” technology and with their regular data inputs, soon demonstrated the tool’s value in the day-to-day decision-making. The mindset of the business and those working in it has shifted from a focus on livestock to a focus on landscape management with the use of graze planning and feed budgeting tool such as MaiaGrazing.

- The alignment between stocking rate to carrying capacity has been tracked using MaiaGrazIng (see below diagram). Originally a benchmark of 400DDH/100mm was targeted, however, this was dropped back to 300DDH/100mm as landscape capability was determined. Aligning DDH/100mm to the 3000DDH/100mm benchmark is the target o achieving a match between stocking rate and carrying capacity.

- Of particular value has been the ability to schedule stock movements based on data across remote areas of the property, reducing labor to monitor pasture growth as well as grazing pressure.

Natural Capital Monetized: Carbon credits sold starting in 2021.

Download a summary of these case studies here.

Learn more about Impact Ag Partners at www.impactag.com.au.