By Toby Grogan, Natural Capital Manager, Impact Ag Partners

What is Natural Capital?

Natural capital comprises Earth’s natural assets (soil, air, water, flora and fauna), and the ecosystem services resulting from them, which make human life possible (UNEP Finance Initiative). Using a framework for natural capital presents a way for land managers and companies to appreciate nature and to embrace the imperative to measure, manage and invest in natural systems with the same due diligence we as a society use for other forms of capital.

The Australian Environmental-Economic Accounts (Australian Bureau of Statistics 2018) calculated the value of Australia’s natural capital to be over AU$6.4 trillion annually. Land (soil, water, biodiversity) accounted for 90% of the total value and had increased by 12% in comparison with other environmental assets (minerals, timber and energy).

In an agricultural setting, natural capital can be developed through a number of agricultural management practices that build and conserve carbon, enhance biodiversity and water quality and cycling. In the current marketplace opportunities are developing in the following areas;

- Carbon – emissions avoidance, reductions or sequestration via vegetation, soil or herd management to generate Australian Carbon Credit Units (ACCUs)

- Biodiversity – biodiversity and ecosystem health measured independently with tools and methods of assessment.

- Water – improved water quality and water use efficiency.

- Green finance – investment in the agricultural sector that delivers positive climate outcomes, namely resilience and emissions reduction.

- Renewables – investment in on-farm wind and solar energy infrastructure.

- Product premiums – receiving better prices for agricultural products such as organic food and grass-fed beef.

Building on-farm natural capital gives land managers access to a broad range of other social, environmental and financial benefits including;

- Increasing soil biology and farm biodiversity

- Decreasing the use of chemicals and fertilizers

- Increasing drought and climate change resilience

- Improving water use efficiency and off-farm runoff

- Increasing farm productivity

- Supporting regional economies and small businesses

Carbon Sequestration

Using sustainably managed grazing systems is a way of increasing soil carbon. Impact Ag Partners has assisted a client in establishing such a system in 6 years, building their soil organic carbon from 3.8% to 5.01%. This increase in soil carbon was achieved principally through grazing management which also led to an increase in pasture production (per 100mm/rainfall) while also achieving an increase in beef production with minimal agronomic inputs and without any supplementary feeding.

Implications of Natural Capital for Agricultural Investments

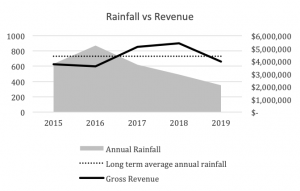

Regenerative agriculture that builds and preserves natural capital can deliver stable investment returns while improving climate resilience and storing carbon in the landscape. Improving natural capital function via increasing soil carbon, improving water efficiency and decreasing inputs can lead to more reliable revenue that is not as impacted by variable rainfall or climatic extremes. The graph below from an Impact Ag client, demonstrates how the establishment of regenerative management practices delivered relatively stable returns through a period of near record low rainfall, all while decreasing inputs and increasing soil carbon levels.

Investing in Agricultural real assets as a Nature-based Solution can respond to climate change, protect our natural resources and provide a sustainable pathway to food security. Agriculture has the potential to play a crucial role in providing financially tenable solutions to the worlds environmental issues as it is directly related to climate, biodiversity, soil fertility, and land remediation, it holds the key to bringing together often fragmented stakeholders – resource managers, producers, value-chain operators, advocates and policymakers.

—

Editor’s note: Impact Ag focuses on value creation and maximum return for investors through investments in a Natural supply chain and are based in Armidale, NSW, Australia. The views expressed in this article represent those of the author.