The importance of impact as an investment imperative has never been stronger. Worldwide, the size of the impact investing market has surpassed $1 trillion under management – reaching an estimated $1.164 trillion in 2022, according to the Global Impact Investing Network (GIIN). It is also expected to experience double-digit growth through 2030. The report claims that “In recent times, the climate crisis, the drive for transparency around impact performance reporting, and global sustainability reporting standards have brought renewed attention towards the importance of implementing impact investing strategies throughout the investment process.” Demand for investments that can produce financial returns while addressing key issues like climate, biodiversity loss, and natural capital which are now at the forefront of the sector.

Investments in regenerative agriculture, particularly in farmland, can address the growing demand for solutions that deliver on climate, biodiversity, and public health benefits. With more than 15 years of experience investing at the intersection of farmers and farmland, Iroquois Valley is well-versed in maximizing these beneficial outcomes while also generating financial returns.

Meet One of the Longest -Standing Organic and Regenerative Ag Investors

Iroquois Valley was founded in 2007 by a doctor and a real estate investment banker, who were former college roommates. They aimed to address the ecological degradation, economic challenges, and health issues caused by conventional agriculture. They believed that organic and regenerative farming systems could offer substantial solutions. Committed to the idea that growing nutrient-dense, healthy food through organic methods is advantageous for farmers, consumers, and investors alike, they established a business centered on this vision. The founders recognized that to expand the ecological and social benefits of organic and regenerative farming, it was essential to first ensure that farmers have access to land on which to grow.

Today, the company pursues these goals as a Real Estate Investment Trust, or REIT, specializing in opportunities for individuals to invest in real estate – in Iroquois Valley’s case, organic farmland. Through this structure, Iroquois Valley functions as a perpetual entity that aligns with the long-term financial needs of farmers who face barriers to accessing farmland and transitioning to organic practices.

The company offers two investment products through which investors can achieve both financial returns and meaningful impact.

REIT Equity Shares are open to accredited and non-accredited investors, with a relatively low minimum investment of ~$10,000 and an annualized return of 9.2% since inception (and 13% in the last three years).

Rooted in Regeneration (RNR) Notes are open to accredited investors with a $25,000 minimum investment and investors earn between 0.5% and 3% interest, depending on the RNR Note’s terms. Unique to RNR Notes (and the impact investment sector in general) is that a portion of investors’ interest is used to reduce the mortgage interest rate for Black, Indigenous and People of Color (BIPOC) farmers. Launched just last year, RNR Notes have already attracted 65 unique investors and funded land purchases with four BIPOC farmers to date, as the company continues to raise capital for this vehicle.

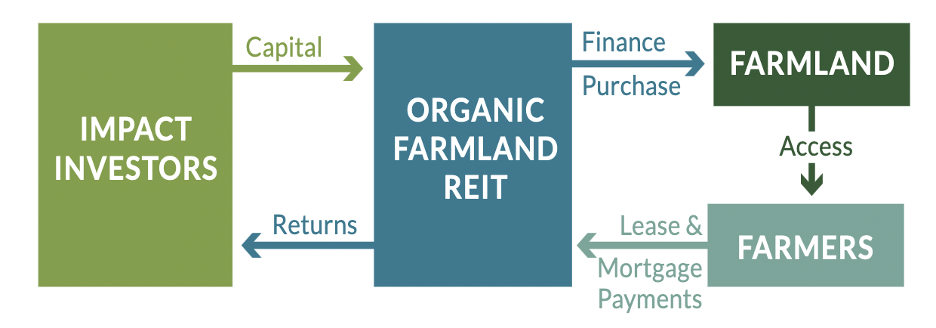

The investment-to-farm finance pathway looks like this:

Investors invest capital into the Organic Farmland REIT and the capital is pooled to purchase farmland in partnership with a farmer who has identified the property. Iroquois Valley then purchases the land and leases it back to the farmer with favorable terms that take into account the three-year organic transition period. Several states in the Midwest have anti-corporate ownership laws, prohibiting Iroquois Valley’s REIT from owning the land. In these states, the farmer will buy the farmland, and the company will issue a mortgage to the farmer. The terms of the company’s mortgages are interest-only for the first 5 years, giving the farmer an opportunity to transition to organic practices.

Since becoming a REIT in 2016, Iroquois Valley has sold $80 million in REIT Equity Shares and almost $30 million of impact investment notes. As a result, this capital has been used to finance a total of over 32,000 acres of farmland in 20 states, supporting 70 farming operations.

A Foundation of Impact

Impact sits at the heart of what Iroquois Valley does and why they exist. Today, Iroquois Valley tracks six impact areas: soil health, biodiversity, carbon capture, water conservation, farmer sustainability and human health. For each of these impact areas, Iroquois Valley goes through a structured process to ensure they are maximizing their ability to meet their impact targets. The process includes reviewing the current landscape, identifying the problems associated with that area of impact, and identifying how Iroquois Valley can contribute to the solution.

For example, let’s explore how the team approaches farmer sustainability. First, they reviewed the current landscape and identified the following characteristics:

- 98% of farmers in the US are not organic, and

- Approximately 40% of the $3.2 trillion of farmland in the U.S. will change hands in the next 15 years due to farmers retiring and passing the torch to the next generation

- The vast majority of farms are financially dependent on large subsidy programs sponsored by the federal government to reach profitability margins.

Associated with these insights are that farmers are struggling financially a problem exacerbated by three things:

- Farmers bear the increasing risks associated with weather and climate change

- Farmers face rising input costs

- Beginning farmers struggle to find patient capital to buy land

In response to these challenges, Iroquois Valley seeks ways to support farmers through their investment strategy. In this case, the company:

- Provides long-term, affordable access to land for farmers.

- Offers financial products with favorable terms to farmers during organic transition – often referred to as the Valley of Death – when the initial costs of transition can outpace the beneficial financial outcomes.

- Offers a shared network of farmers to provide support and guidance.

This process of identifying and tracking impact has informed the company’s investment products over the years, as well. The Rooted in Regeneration Notes, for example, arose out of a recognition that communities of color are largely left out of the conversation when it comes to organic agriculture, despite having been leaders in the development of the movement. Decades of financial discrimination have reduced the land base for communities of color, so Rooted in Regeneration Notes were designed to strategically address several of Iroquois Valley’s impact areas, especially farmer sustainability for this historically underfunded part of the population.

“Building a farm to call home will allow me to move into the last stage of my own life’s journey as a new immigrant who aspired to farm in this country but did not want to go at it alone,” says Reginaldo Haslett-Marroquin of Salvatierra Farm in Bridgewater Township, MN. Through the Rooted in Regeneration Notes, Reginaldo was able to get a discount on his mortgage interest rate, which served as a helpful piece of a larger financing puzzle for the regenerative poultry ecosystem he and others are building. “My farm can now be part of a system designed to aggregate our individual operations and build an interdependent system with other established farmers, but especially other BIPOC community members who identify with my own situation and want to work collectively.”

Impact in Action: Enabling Farmland Access

Rick and Corey Johnson, a father and son team that joined the Iroquois Valley portfolio in 2018, serve as a notable example of the layers of impact that Iroquois Valley’s financial partnerships can bring. The Johnsons are a fifth-generation farming family that leases 1,000 acres of land from Iroquois Valley, located in Will County, IL. Their crop rotation includes corn, soybeans, alfalfa, oats, and cereal rye.

Prior to working with Iroquois Valley, Rick and Corey farmed conventionally. But Rick began to rethink their practices, as he prepared to pass the operation on to Corey. He wanted to set Corey up for success. Motivated by organic farming’s positive impact on human health and the boost it provides to on-farm economics, they set out to start farming organically. But that transition required capital.

Enter Iroquois Valley.

As they do when evaluating any potential transaction, the Iroquois Valley team looked at about 40 objective criteria when exploring the opportunity to partner with Rick and Corey. They typically begin with consideration of qualitative factors and the farmers’ crop plan. Next, the farmer undergoes an in-depth underwriting, in which their financial statements, including income statement, balance sheet and cash flows, are reviewed. Rick and Corey Johnson easily met the criteria for investment, so Iroquois Valley offered the Johnsons a lease, which gave them the opportunity to pay lower rent during the transition period. Under the terms of the Johnsons’ lease, which is consistent with most leases offered by Iroquois Valley, the Johnsons pay a below market rate during the transition period. After certification, the interest rate is increased closer to the market rate. The Johnsons also have an evergreen option to purchase all or part of their property beginning in year seven.

“We are proud to support the Johnsons’ transition from conventional to organic farming and from father to son,” says Andy Ambriole, Managing Director, Farmland Investments at Iroquois Valley. “Rick wanted his son Corey to come back to the farm following college and be able to earn a living from his hard work on the land, and not to barely scrape by. Farming the land organically has allowed them to operate a profitable business. On top of that, the health of the soil is improving and providing better nutrients for their crops.”

Meeting the Financial and Impact Imperative from Investors

While impact has always been at the core of Iroquois Valley’s investment strategy, it’s certainly not just a feel-good effort. As the upward trend in impact investing indicates, investors today are increasingly prioritizing impact results – making the generation of outcomes that positively influence environmental, climate, and social problems imperative for all investment vehicles. Iroquois Valley’s founders assumed this would be the case when they started the company 17 years ago, and the team continues to hear the same from investors today.

Iroquois Valley is fortunate to have a large, diverse investor base of almost 900 individuals and

institutions. Recently, they surveyed this community to get a better understanding of why investors support Iroquois Valley’s bold vision of transforming agriculture through organic land stewardship. The survey responses highlight both the financial and impact value of investing in the organic agricultural transition, particularly through Iroquois Valley.

Among the top three impact reasons that investors support Iroquois Valley are:

- Providing patient financial support for organic farmers,

- Supporting environmental conservation, and

- Increasing the production of healthy foods.

Among the top three financial reasons for investing in Iroquois Valley are that:

- Organic agriculture is a non-resource-extractive form of investment,

- Organic agriculture offers strong financial growth opportunities, and

- The investment vehicles are outside the public equity markets.

Joseph Frankovic, an investor in the company, explains what brought him to Iroquois Valley: After retiring, Joseph sought to reallocate the contents of his retirement savings portfolio. However, the U.S. economy had changed fundamentally: inflation had reemerged after a decades-long hibernation and the Federal funds rate no longer hovered slightly above zero. For him, the mission was clear: identify investments that would perform favorably in an economy where interest rates and deficit spending were moving quickly, that would support genuine stewardship of ecosystems and their natural resources, and that would provide meaningful and gainful employment for workers, particularly for young adults.

“The Iroquois Valley Farmland REIT is a rare investment opportunity that fully satisfied my mission goals,” Joseph explains. “Most investments of capital have extraction or exploitation as a core component of their profit-making strategy. When I first heard about Iroquois Valley, my first thought was, ‘Here is a rare opportunity to make a profitable long-term investment that supports ecosystems and may perform well in an economy beset by creeping inflation.’” He adds, “It is an investment polestar with which my moral compass aligns.”

Agriculture Investment that Checks All the Boxes

But it’s not the financial outcomes or the impact outcomes alone that make investment in organic and regenerative agriculture – and in Iroquois Valley, in particular – so attractive. It’s that investment offers a truly unique opportunity to do it all – create outsized impact returns, contribute to immeasurable systemic benefits, and generate reasonable financial returns – all while meeting increasing investor demand for strategies that have multi-level beneficial outcomes.

It’s a pattern repeated over and over through Iroquois Valley’s investment vehicles:

- Capital investment is used to generate beneficial systemic outcomes for the soil, the environment, the climate, and human health through the production of healthier food.

- Social and financial benefits for the farmers they work with by enabling access to land, supporting the transition to less extractive production systems that allow them to thrive economically, and helping them regenerate the health of their ecological assets: soil, water, and biodiversity.

- Financial returns aligned with investor goals – ranging from 0.5-3.0% interest on Rooted in Regeneration Notes and an annualized return of 9.2% on REIT Equity Shares.

For many seeking impact in their investment portfolio, this is an ideal recipe. For Iroquois Valley, it’s the culmination of their founders’ vision of bringing investors and farmers together to generate positive outcomes for all.

“We are proud of our history as a leading organic farmland REIT, and we look forward to significantly growing our impact over the coming years.” Lacey Benz, Manager, Investor Relations, recently told RFSI.” Iroquois Valley is dedicated to enabling the next generation of farmers to positively contribute to a healthy food system, all while ensuring our financial returns remain aligned with our investors’ goals.”

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.