Part 1: Is Regenerative Agriculture Profitable?

The numerous beneficial outcomes associated with using regenerative production practices have gained much attention in recent years. This attention has tended to emphasize the agronomic, environmental, consumer, climate level benefits, while the ECONOMIC OUTCOMES of transitioning to regenerative agriculture have garnered far less attention. However, the economics outcomes are critical to the discussion of transitioning to regenerative agriculture because the prospect of positive financial returns is crucial to incentivize what can be risky, wholesale change. In other words, if the positive economic outcomes don’t exist, we won’t be able to scale the transition to regenerative agriculture.

Benefits of Regenerative Agriculture:

What is the Deal with Yields?

One of the biggest misconceptions about regenerative agriculture is the assumption that regenerative agriculture leads to lower yields and therefore is not profitable. That, however, is an oversimplification of what is at work in these systems. Like many things in agriculture – the answer to whether yields (and profit) decrease with regenerative farming practices is – it depends – in large part on crops and local conditions.

There is an increasing body of research seeking to understand the connection between yields and profitability in regenerative agriculture. Here are some of the highlights:

- Rodale Institute has been running side-by-side field studies for the last 30 years, comparing organic and conventional agriculture. Their results have shown that after a 1-2-year transition period (when yields do tend to decline), there is no difference between conventional and regenerative farming in terms of yields. Even more, a 2020 EIT Food article explains that in stressful conditions, particularly during droughts, the organic fields perform better because they are more resilient. This is because the soil contains more biomass and can therefore absorb more water.

- The American Farmland Trust looked at the economic impacts of switching to regenerative management on eight farms across the U.S. representing a diversity of crop and livestock production. The case studies examined which practices on each farm created an increase or decrease in income and costs. Overall, all eight farms showed meaningful growth in net per acre income with the regenerative practices.

- South Dakota State University surveyed farmers to compare the profitability, resilience, and optimism of regenerative vs. conventional producers. The poll found that:

- 31% of regenerative practitioners increased their profitability in 2019, compared to just 12% of conventional practitioners;

- 83% of regenerative practitioners expected their operations to be more resilient to extreme weather, compared to 60% of conventional practitioners; and

- 69% of regenerative practitioners compared to 36% of conventional expected increased profits over the next 3 to 5 years.

- A 2018 study written by Jonathan Lundgren of Ecdysis Foundation and Claire LaCann investigated how moving to more regenerative systems might affect yields, pests and profitability on 20 farms. The researchers looked at soil organic matter, pest presence, crop yield and profit. As expected, crop yields decreased in regenerative systems, and by 29%. But that is not the whole story. The study found that the farms with regenerative practices were 78% more profitable than conventional plots.

The increase in profitability in all these cases can overwhelmingly be explained by two main factors: input costs and end markets. Regenerative agriculture CAN be significantly more profitable than conventional agriculture because the system of practices can lead to lower input costs; the ability to grow higher value crops and access new markets and premiums; and as an additional benefit, increased resilience, reducing risks associated with volatile weather.

Explaining Better Economic Outcomes

Let’s walk through these, starting with one of the biggest economic drivers of the transition to regenerative farming: input costs.

Farmers are operating on thin margins – low commodity prices, combined with rising input costs, led to stagnation or decline in overall farm profitability in 2019. Rising input prices continued to impact profitability in 2021 and show no sign of letting up yet. A December 2021 DTN report explained that where fertilizer expense typically accounts for about one-third of a corn farmers crop input costs, in 2022 that cost may rise to 45 percent or higher.

A March 30, 2022 DTN report on fertilizer prices explains that several types of fertilizer products continue to reach new record price levels, which is likely to have a big impact on corn breakeven levels.

Fertilizer Prices Continue to Rise:

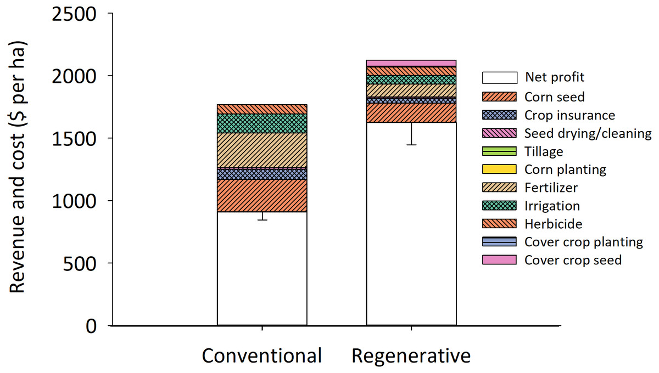

Given the significant role that input costs play in overall expense, you can understand how reducing or eliminating this could support positive economic outcomes, profitability, and increased interest in regenerative practices (or at least the potential cost savings). Revisiting the 2018 Lundgren & LaCann study mentioned earlier – we can compare the revenue and costs of conventional and regenerative production systems.

Regenerative Corn Fields Generate Two Times the Profit:

The chart shows the comparison: the heights of the bars represent average gross profits across 40 fields on 20 farms. Profit was calculated using direct costs and revenues for each field and excludes any overhead and indirect expenses. Regenerative cornfields implemented three or more practices such as planting a multispecies cover mix, eliminating pesticide use, abandoning tillage, and integrating livestock. Conventional cornfields used fewer than two of these practices. What the study found is that the regenerative systems had 70% higher profit than conventional cornfields. Specific to input costs, you can see that corn seed costs and irrigation costs (represented by orange and green) went down, and fertilizer costs (represented by tan) went down significantly.

The study concluded with two keys to success for this approach to farming:

- By promoting soil biology and organic matter and biodiversity on their farms, regenerative farmers required fewer costly inputs like insecticides and fertilizers and managed their pest populations more effectively.

- Soil organic matter was a more important driver of proximate farm profitability than yields were, in part because the regenerative farms marketed their products differently or had a diversified income stream from a single field.

Market Demand for Regenerative

The second driver of profitability in regenerative agriculture – new markets and access to premiums – comes from the ability to diversify into higher value crops that can be marketed at a premium.

We know consumer awareness of “regenerative” specifically remains low – only 16% of consumers aged 16-44 are aware of regenerative agriculture, according to data from consumer brands carbon management platform Planet FWD; but this number is growing. Consumers today are increasingly seeking to understand where their food comes from and how it was produced. They want their food to also reflect their values – and today that means “good for people and planet” – according to Planet FWD. They explain that:

- 55% of all growth in CPG came from sustainably marketed products from 2015-2019

- Consumers will pay a 39% premium for sustainably marketed products compared to conventionally marketed counterparts

- 69% of consumers have changed the products they use due to concern about climate change

These trends will continue to drive demand and premiums for regeneratively produced goods.

So then, if the agronomic, ecological AND economic outcomes are there, why are there still barriers to farmer adoption?

Barriers to Adoption

Jennifer O’Connor and Guidelight Strategies (funded by Patagonia) conducted a study on this topic in 2020. Among the many barriers that the report identified are:

- Behavior and Cultural Change: Changing away from the predominant paradigm and mindset for farming is difficult. The conventional way of farming is embedded in all the systems that farmers work in – cultural, operational, financial, and more.

- Trusted Technical Assistance: Farmers and ranchers are extraordinarily busy people, managing complex businesses in a risky, low-margin, and ever-changing business environment. This reality makes taking time to learn about and experiment with new management practices a slow and time-consuming process. Without technical assistance, many farmers do not have the resources, time, or energy to learn about, plan, implement, and monitor new practices on their own.

- Regenerative Supply Chains: Success for regenerative producers, in large part relies on premium end markets – if the end markets don’t exist yet or the processing infrastructure to create the end products don’t exist, then the premium could be forfeited and the incentive to transition is also hindered.

- Financial Capital and Incentives: One of the biggest barriers to farmers actually adopting regenerative techniques is the added costs and risks in changing any given practice. Even if regenerative can lead to better economic outcomes – there is still initial risk during the process of the change, when transition costs are highest, and premiums are not yet attainable.

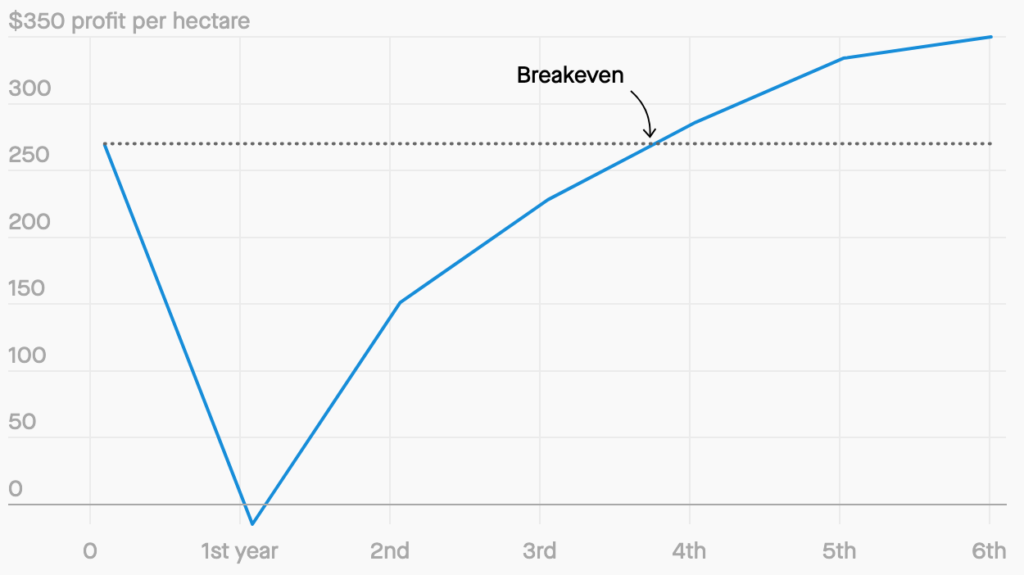

Breakeven Point for Regenerative Farmers:

A recent Bain and Nature United study explains the financial risk of transition well: “While beginning the process of changing farming techniques, initial yields will be lower, leading to less marketable produce and less profit. The study suggests that it will be four years until a farmer would break even and make the same amount they would have before transitioning.” However, other studies have said breakeven could be achieved at 2 or 3 years. The key here, however, is that after breakeven, the farm is better positioned to reach higher profits than if the farm had not made the transition.

So there’s great potential for longer-term resilience and economic success associated with transition to regenerative practices but still risk in the near-term that inhibits adoption. In light of this, where do the solutions lie?

Investment capital offers some key solutions to addressing these barriers.

—

In the Part 2 of this series, we’ll look at investment into agriculture as a whole and how it can address some of the barriers facing farmer transition to regenerative agriculture.

The articles in this series are based on a February 2022 presentation from Sarah Day Levesque on the same topic.

—

Sarah Day Levesque is Managing Director at RFSI & Editor of RFSI News. She can be reached here.