Nearly every week, RFSI News curates the latest news in regenerative agriculture and food systems investing, plus shares some stories of our own along the way, covering the latest strategies, players, challenges and opportunities that exist in the space.

RFSI tracks investments and other capital allocations into regenerative agriculture and food systems initiatives, as well as investments and activities that can enable individuals and operations to transition toward regeneration. While we certainly don’t claim to have tracked all the deals, fund activity, and news happening across the world in this rapidly growing space, we do keep our eyes on a lot of things. We think digging into what we did track can add perspective, and over time, shed light on emerging trends.

Here’s what happened in regenerative agriculture and food systems investment in Q1 (January-March) 2025.

Download the Infographic here!

Investment Highlights

Despite the global market chaos that Q1 2025 has brought, driven in large part by politics in the United States, regenerative agriculture and food systems investment had a strong start to the year, according to RFSI’s deal tracking. RFSI tracked 37 deals, worth more than a combined $1.17 billion*. This quarterly total is higher than any quarterly total in 2024, barely passing the $1.13 billion in commitments tracked in Q1 2024 but significantly higher than Q2 and Q4 2024, in particular. Pushing this latest quarterly total was the January announcement of the acquisition of Simple Mills for $795 million by Flowers Foods, Inc.

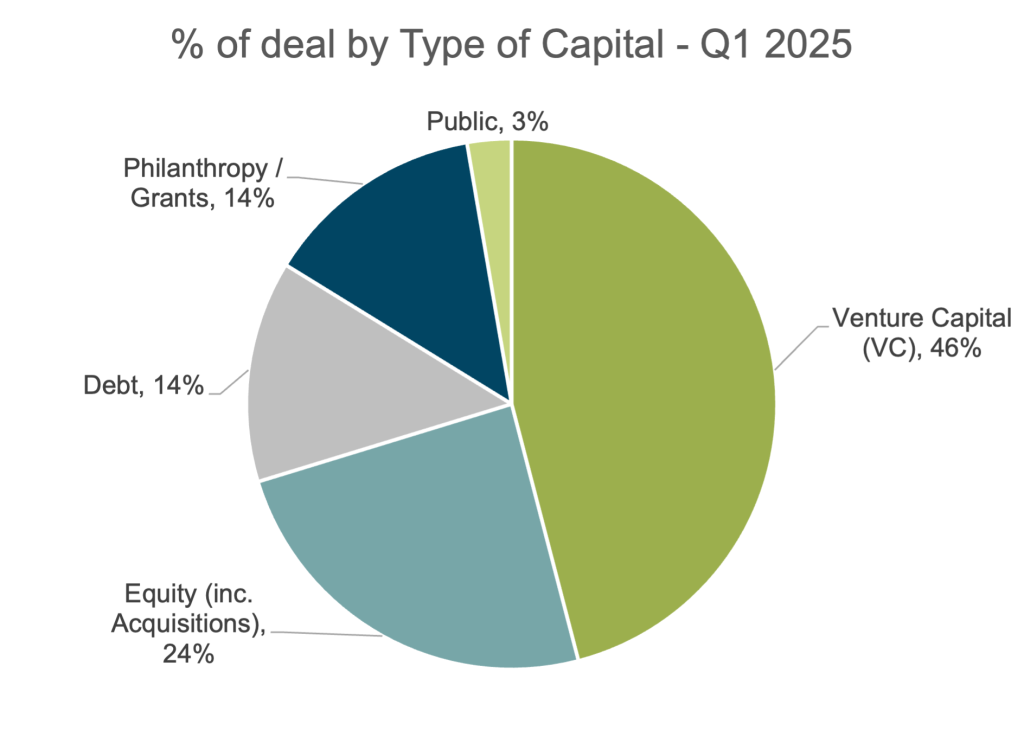

Venture-backed deals maintained their position as the largest proportion of overall deals (by deal count) – which was also the case for all of 2024 – with 46% of deals tracked, representing 17 deals and more than $123 million (noting that some deals did not disclose financials). Equity investments, including acquisitions represented 24% of deals in Q1 but the largest proportion by deal size because of the inclusion of the Simple Mills acquisition. Debt and Philanthropy/Grant funding both represented 14% of deals and there was one public deal recorded.

*Includes investments into companies, programs, projects and individuals from diverse investors and grant makers. Total amount reported is not a claim of actual investment totals as it does not account for undisclosed financials and deals.

Deals by Region: Europe led in deals tracked by region, representing 38% of all deals by count, followed by North America, with 35% of deals. Europe and the U.S. led deal count together in Q4 2024 – it will be interesting to see whether Europe continues to hold the top spot as the year moves on as result of unsteady markets and political and economic chaos in the U.S. We recorded 6 deals for Asia, representing 16% of total, while Africa and Latin America rounded out the group with 8% and 3% of deals, respectively.

Top Investment Theme: Biological based input innovation led the number of deals in Q1 with 27% of deals, just as it did for most of 2024. Investment and funding for farm transition and practice adoption was a secondary theme that is consistent with strong investment in Q4 2024, as well. This theme saw 6 deals recorded from debt, equity and philanthropic funding sources. Investments in supply chain and processing was not far behind and again is consistent with a rising theme we saw in 2024.

Fund Raises and Closes

In addition to the deals tracked above, RFSI tracked more than $650 million in raises and closes for regenerative funds and “regen adjacent funds” – that is, funds that are working beyond simply sustainability toward regenerative outcomes but may not be wholly regenerative or it may not be the fund’s entire focus.

Real asset manager, SLM Partners, which specializes in regenerative agriculture and sustainable forestry, has held the final close of SLM Silva Europe Fund at €30 million, with its most recent investment coming from Dutch-based Wire Thrive Fund. The strategy has a 9 percent net IRR target and has already deployed over €22 million into orchards in the two focus countries, building a diversified portfolio across permanent crops – almonds, walnuts, pistachios and olives – and across microclimates within the Iberian peninsula.

Private equity firm Just Climate has secured its first round of funding from two major global investors to begin investing in solutions aimed at reducing agricultural emissions. The company, founded by Generation Investment Management—an asset management firm co-founded by Al Gore—and led in Brazil by businessman Eduardo Mufarej, raised $175 million (approximately R$1 billion) from Microsoft’s Climate Innovation Fund and the California State Teachers’ Retirement System (CalSTRS).

French private equity investor Eurazeo raised an initial 300 million euros ($314.64 million) for a fund investing in line with the planet’s ecological limits and made its first investment in an agricultural pest-control firm. The money raised at the first close of the Eurazeo Planetary Boundaries Fund, 10 months after its marketing launch, is 40% of the target amount of 750 million euros.

French based Mirova secured commitments approaching €100m from a variety of institutional, public, private, and philanthropic investors for its Sustainable Land Fund 2 in February, and later secured $75 million commitment from the Green Climate Fund.

Toniic members shared in January why they invested in At One Ventures. To date, At One Ventures has invested in 43 companies across two early-stage funds and manages $525M in assets. The At One Ventures portfolio is characterized by “invention catalysts” which are technologies that not only improve upon the domain of the invention itself, but also have the potential to ripple-change entire systems of production and use.

New Funding Vehicles & Platforms Launched

In 2025, we continued to track funding vehicles and platforms dedicated to regenerative agriculture, indicating the increasing recognition of the need to address regenerative through investment and often the need to address it with new financial tools. Here are some of the new platforms launched at the start of 2025:

Mycelium, a new entity on a mission to raise institutional-grade capital to invest in European lands and help farmers rebuild and repopulate soil while generating uncorrelated yet competitive returns to investors, has officially launched and announced its first 1500 hectare project in Italy.

Oxbury, the UK’s only bank dedicated to agriculture, food, and farming, launched a new globally unique facility for farmers to support them in making sustainable changes to their farming practices.

Building on more than a decade of impactful work driving grasslands regeneration around the globe, the Savory Institute quietly launched a foundation in 2022 to address the need for large-scale capital to fund regeneration at scale. The Savory Foundation is now working on its first investable project in Uruguay – a project that offers great potential for holistic ecosystems and community regeneration, as well as opportunity for impact and natural capital investors – and its intentions to build a platform of other investable opportunities around the globe.

Development finance institution British International Investment partnered with Pakistan’s largest bank, HBL, to launch a $75 million finance facility aimed at helping the country’s smallholder farmers and agribusinesses gain easier access to finance. BII seeks to help Pakistan’s agriculture sector adopt sustainable and climate-resilient practices to strengthen the agriculture value chain and boost food security.

Regen Adjacent Investment Vehicles and Platforms

The jury may still be out on these new vehicle launches (and rebrands) but at the outset, they appear to have aligned goals for achieving outcomes that align with a journey to regeneration:

Goldman Sachs Asset Management (GSAM) announced it is launching its first biodiversity-focused bond fund, offering fixed-income investors a way to support nature conservation. The fund aims to reach $300 million to $500 million in assets over the next three to five years, investing in corporate bonds linked to biodiversity impact.

Global investment firm PRPLife launched GreenHarvest, an agribusiness initiative designed to revolutionize farmland investment while addressing global food security. The initiative focuses on acquiring and developing high-yield farmland using precision agriculture, organic farming techniques, and smart irrigation systems. These innovations maximize productivity while minimizing environmental impact.

Conservation Ontario announced its role in delivering the Marginal Lands Initiative, a program funded by a $12 million investment over four years from the governments of Canada and Ontario through the Sustainable Canadian Agricultural Partnership (Sustainable CAP). This program is designed to make it easier for farmers to implement environmental projects on their properties, enhancing the productivity and resilience of their operations while strengthening the province’s food supply chain.

Do you have an investment or funding deal RFSI should know about? Please send them to us here.