There’s a new fund on the block. Terra Regenerative Capital has launched its first fund aimed at closing a major gap in the regenerative agricultural system: the often overlooked and underfunded middle supply chain. The Leaders Fund – aptly named for the systems leaders it aims to invest in – has already invested $2 million in a demonstration portfolio and secured a $10 million anchor investment on its path to a $50 million final close. The specialized fund is led by a powerhouse team with deep sector and investment expertise whose sights are set on addressing a significant need in the domestic agricultural economy: connecting regenerative growers with the buyers and markets that want their products. With a systems-based investment strategy, Terra Regenerative Capital (TRC) is poised for catalytic impact.

Thoughtfully Driving Systems Change

The product of two years of market exploration and research by co-founders Tara Smith Swibel and Calla Rose Ostrander, TRC was founded with a bold mission: to catalyze the transition of our agricultural system to a regenerative model that rebalances the climate, reinforces food security, restores biodiversity, and revitalizes human and planetary health and economic well-being.

“We explored many aspects of the regenerative agriculture investment space,” says Swibel, a Tony award winning Broadway producer and lifelong environmentalist. “We looked at everything from carbon offsets, to farmland REITs, to precision ag tech, to farmer CDFI’s and more. I was even out there talking with the realtors representing some of the largest ranches in the country trying to understand the time and money it would take to regenerate these huge properties. While there are positive aspects to many of these things, at the end of the day what I wanted was a way to catalyze change at scale. I was looking for a way to shift the market.”

For Ostrander, these two years of exploration in the private sector reinforced what she had already seen in her previous decade leading the integration of conservation and climate policies, philanthropy and public education: that farmers will grow what there is a market for. As such, a lack of market access is a significant barrier to the evolution of the agricultural sector.

At the foundation of TRC’s mission is the understanding that the predominant way of doing agriculture today is extractive for farmers and highly degrading to soil health and that to realize regenerative agriculture as a climate change solution requires that we change how agriculture is conducted at large. This transition to regenerative agriculture is a more complex process than one might think. For farmers to transition, several key pieces must fit together – including farmer know how, farmer financing, and market access. These key pieces of the agricultural economy are currently secured, for the sake of national food security and market interests, by Federal funding in the form of agricultural universities, crop insurance, commodity markets, and procurement programs such as SNAP. But this infrastructure and funding is designed to serve farmers and markets that serve a larger scale, commodity cropping systems and supply chains. To bridge the gap while maintaining affordable food prices, requires these key supply chain features be replicated for growers who do not farm monocrops fence line to fence line. This means transition must not only happen on the farm, but also across the food system.

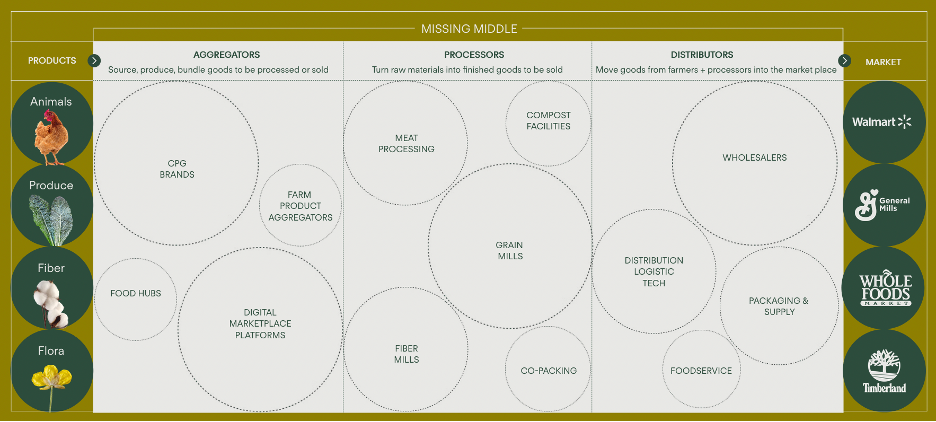

With this in mind, Swibel and Ostrander kept returning to the fact that producers faced significant gaps in the supply chain when seeking new or value-added markets without appropriate supply chain infrastructure that aggregates, processes and distributes regenerative products. Small to large-scale producers lacked access to markets, while commodity growers looking to integrate cover crops such as rye and buckwheat, also faced a lack of off takers for new products. Simultaneously, on the other side of the supply chain, markets – including large buyers and individual consumers – faced challenges accessing regenerative products. With this realization in place, this “missing middle” became the bridge TRC knew they wanted to build to drive the systemic transition.

Source: Terra Regenerative Capital

Series 1

To bring this theory of change to life, Swibel and Ostrander began to invest in what would become their demonstration portfolio. In this process they hired a third partner with experience in law, investing, and start-ups, Amanda Hendy, and brought on financial analyst Mike Gevertz. Now, TRC is launching their first investment vehicle – The Leaders Fund – dedicated to empowering those entrepreneurs at the forefront of building regenerative supply chains and creating new and value-added market access for regenerative producers. TRC is also a public benefit company to ensure mission-alignment between financial returns and impact.

Terra Regenerative Capital leadership team (from left to right):

Calla Rose Ostrander, Tara Swibel, Amanda Hendy

While the entrepreneurs TRC seeks to invest in are tackling infrastructure and market access gaps in agriculture, they also face a dearth of appropriate institutional capital and operational expertise required to move from boutique to mainstream, explains Hendy – something TRC seeks to address through The Leaders Fund. The Fund focuses specifically on pre-seed to Series A stage companies that act as aggregators, processors, and distributors.

“We focus on businesses that are at the heart of the regenerative movement—those involved in food, fiber, flora, soil amendments, and technologies that enhance farmers’ bottom line,” says Ostrander. “We are dedicated to investing in founders who are poised to take their early-stage companies to the next level while also building out that missing middle of regenerative supply chains and expanding market access to regenerative growers. We seek out value-driven leaders with a proven ability to bring their vision to life.”

Specifically, The Leaders Fund looks for companies demonstrating both commercial traction and strong growth potential. Their investment criteria are designed to identify companies with not only the potential for significant financial returns but also a profound impact on the environment, society, and the robustness of North American supply chains. The goal is to drive meaningful change while achieving real returns.

A Growing Portfolio

Equipped with a grounded theory of change and a thoughtful approach to actionize it, the team has already invested in game-changing companies aligned with their thesis and who are creating regenerative supply systems and markets. Select investments include:

- Alec’s Ice Cream: This ROC company sources and aggregates best in class regenerative products; from A2 cows raised on pasture Northern California, to the first regenerative certified sugar producer in the world.

- Cairnspring Mills: A long-time leader in conservation and regenerative agriculture that is now expanding and building a new wheat mill located on the Confederated Tribes of the Umatilla Indian Reservation. The brand plays a key role in supporting farmers transition away from chemical fallow production methods and to rotation cropping methods and other regenerative practices.

- Mad Markets PBC: A first of its kind business in the regenerative space, Mad Markets aims to become a go-to source of regenerative organic ingredients for a wide range of clients, from consumer-packaged goods to wholesale buyers.

- Timeless Seeds Inc.: A renowned lentil and chickpea processing company and a pioneer in the organic agriculture movement recently acquired by Mad Markets.

TRC served as the lead investor and played instrumental roles in the majority of its investments.

However, it’s not just capital that TRC offers its portfolio companies. The ecosystem they’ve built is designed to provide services that can act to de-risk and accelerate the growth of their investments. TRC team members sit on the boards of their portfolio companies, provide strategic planning, offer business and financial modeling, help apply for non-dilutive capital, and much more, all in an effort to ensure success of their companies. The TRC team also leverages their robust relationships with diverse partners in the space – including philanthropic and debt partners, co-investors, technical assistance and policy partners – who can help support portfolio companies.

Kevin Morse of portfolio company Cairnspring Mills confirms, “Terra Regenerative brings more than capital to a venture. They bring skills, networks, values and a philosophy that supports the whole business that has been invaluable as we have prepared to grow Cairnspring and build our second mill. Terra’s collaborative approach and experience with ‘club’ deals has helped us bring other investors to the table and streamline due diligence. It’s refreshing to work with investors that are value aligned, practical and understand the core thesis of the importance of building new ‘Magnificent Middle’ infrastructure needed to advance the regenerative movement at scale and achieve the desired impact for people and planet.”

Mad Markets PBC and Mad Markets Timeless SPV (used for the acquisition of Timeless Seeds) serves as an excellent demonstration of the kind of investment that is catalytic to the transformation of the marketplace. It also shows how TRC aims to go beyond the typical impact investor. For these investments to take shape, TRC worked closely with Mad Markets for nine months to formulate a structure for the Mad Markets platform and investment terms that would benefit all stakeholders. Now, Ostrander has joined the board of directors of Mad Markets and Hendy is a board observer. Together, they will continue to help drive strategy and execution. In addition, TRC worked closely with Builders Vision, the anchor investor in the Timeless Seeds acquisition, and other mission-aligned investors to bring this opportunity to life.

“Terra Regen has been the perfect funding partner for Mad Markets,” says Mad Markets co-founder, Phil Taylor. “They are wholly committed to the regenerative revolution in agriculture. The team has the ability to move seamlessly from vision, ideation, support, sharp diligence and network connections – all of which constructively help and define true partnership. We are excited to grow together and scale regenerative organic agriculture.”

Pioneering Partners Welcome

The newly launched Leaders Fund may be named as such because of the leaders it supports, but it is also a reflection of how TRC is leading the space in learning and demonstrating how to fund this critical missing piece of the system. They are not just uncovering nuanced obstacles along the path to transition, but they are strategically piecing together an approach and portfolio to address them. They hope to attract investors who have this same leadership mentality.

With a target of $50 million, an anchor commitment that has already brought them 20% of the way to their goal, and a strong demonstration portfolio, Terra Regenerative Capital hopes to recruit a suite of investors who not only share their vision for transformative change but are willing to invest in that vision.

“We want our investors to be other individuals and institutions that see themselves as leaders in this space,” explains Swibel. “Together, we can lead the way toward a sustainable and prosperous future.”

Interested in learning more? To contact the Terra Regenerative Capital team, click here.